15 Sep 2022

Duniya Gol Ha – everything in this world follows a cycle.

Economies go through cycles as well, and different sectors tend to perform differently in each of these cycles.

What if a fund could navigate through these? Let’s know more about the Kotak Business Cycle Fund.

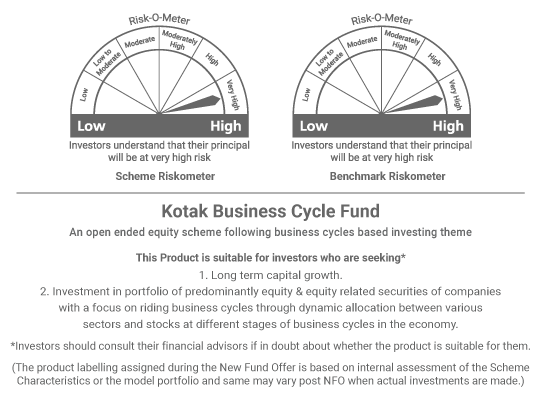

It is an open-ended equity scheme, which aims to dynamically move between various sectors and stocks, by following and navigating business cycles.

It will do this by following a top-down approach to construct a portfolio, where it will first identify stages of a business cycle, and then look into opportunities sector-wise. Once the sector is identified, the fund will follow a bottom-up approach.

Let us take an example and co-relate investing according to business cycles to driving a car on different types of roads.

If you are driving on an expressway, you will be able to drive the car at a top speed, helped by the roads being smooth. You will also be able to use fuel in an efficient manner, while travel time will be relatively lesser.

This is similar to the economy being in the top gear, where interest rates are low, and macro-economic parameters are favourable for growth of businesses.

When the economy is in mid-gear, it is similar to driving on a city highway, where roads are average, and one would take more time to travel, while also using more fuel. One would notice interest rates rising in this scenario, even as macro-economic factors remain stable.

Driving on village roads can be compared to the economy being in the first gear. It is typically characterised by high interest rates and unfavourable macro conditions.

The Kotak Business Cycle Fund also has diversification across sectors, no limit on market capitalisation, and has an investment committee as a sounding board.

The NFO for this fund is open for subscription up to Sep 21, 2022. Invest now or Start an SIP today!

Our Funds

Our Funds  SIP

SIP  Plan Now

Plan Now  Insights

Insights  Services

Services