Key Events for the Month of September 2021:

• Nifty (+2.8%) outperformed both EM / DM markets in September as insulation from a potential China slowdown (sparked by Evergrande

Default) and steady trends on pandemic front (daily cases sub-30k) placed India in a relatively better position than other economies. Global

markets remained under pressure likely as September FOMC turned out to be more hawkish than street expectations which led to a rally in yields.

• OECD cut India's FY22 growth estimate to 9.7% but remained the fastest growing large economy in the revised list. Weekly activity

indicators suggested some stalling in activity improvement in September

• Aug CPI inflation at 5.3% was another soft print, driven by subdued vegetable prices. Sequential price momentum in core goods moderated

due to some normalization of global supply chains and easing of commodity prices.

• India's fiscal deficit stood at Rs4.6trn or 31.1% of the budget estimate at the end of August. Total receipts stood at 40.9% of FY22E budget

estimate while the expenditure reached 36.7% of full year estimate by August.

• With over 890mn+ doses administered till date, India's vaccination roll-out became the largest globally. ~70% of adult population received at

least one dose and ~25% both doses as pace ramped up to ~8mn/day

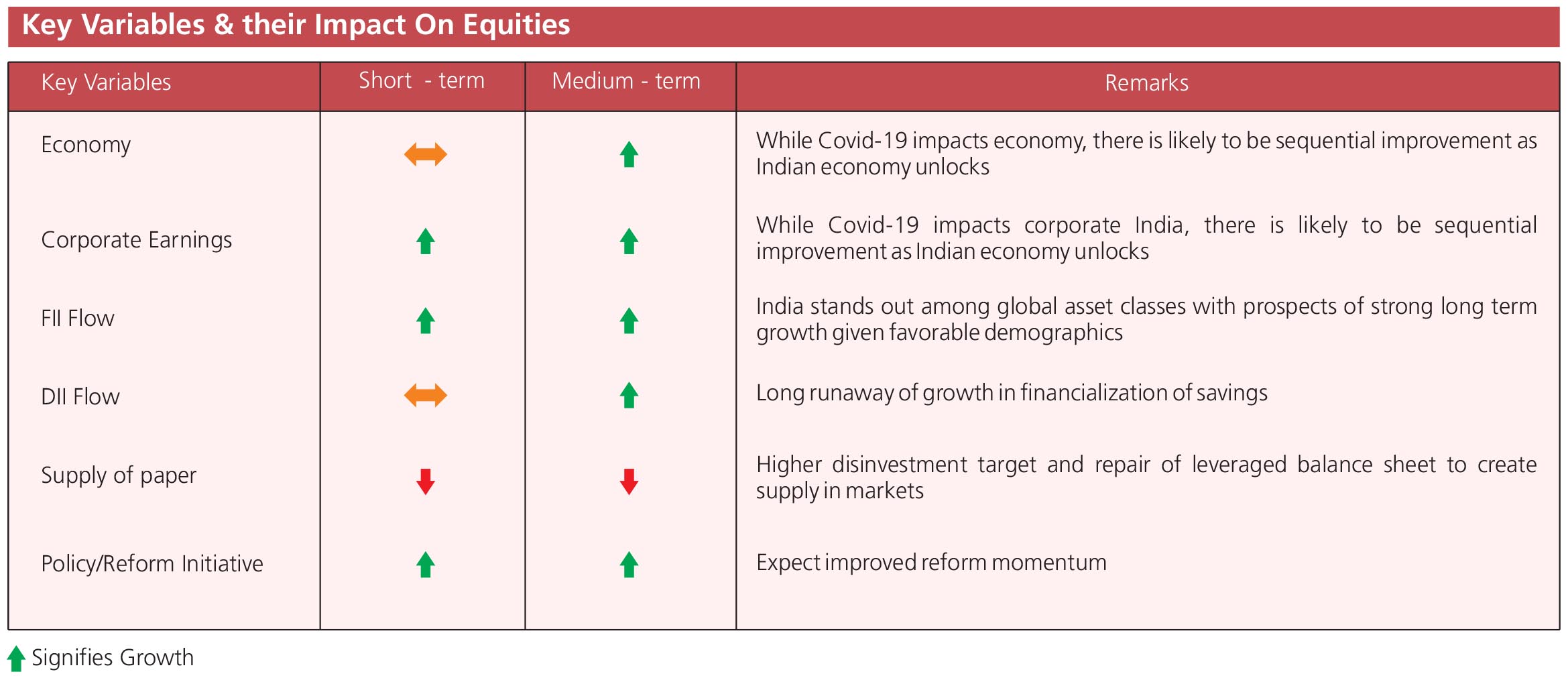

• FIIs were net buyers to the tune of +$1.1bn in September (YTD +$8.5bn) vs +$1bn in August while DII buying was +$0.8bn (YTD +$3.7bn) vs

+$0.9bn in August. DII buying was largely driven by Domestic MFs who bought +$0.9bn (YTD +$3.7bn).