| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|

|---|---|---|---|

| Equity & Equity related |

|||

| Banks | 6.85 | ||

| ICICI Bank Ltd. | 1.86 | ||

| State Bank Of India | 1.83 | ||

| HDFC Bank Ltd. | 1.67 | ||

| Kotak Mahindra Bank Ltd. | 0.86 | ||

| Axis Bank Ltd. | 0.63 | ||

| Consumer Non Durables | 2.98 | ||

| ITC Ltd. | 1.45 | ||

| Emami Ltd. | 0.60 | ||

| United Spirits Ltd. | 0.47 | ||

| United Breweries Ltd. | 0.37 | ||

| Prataap Snacks Ltd | 0.09 | ||

| Petroleum Products | 2.13 | ||

| Reliance Industries Ltd - Partly Paid Shares | 0.92 | ||

| Reliance Industries Ltd. | 0.82 | ||

| Bharat Petroleum Corporation Ltd. | 0.25 | ||

| Hindustan Petroleum Corporation Ltd | 0.14 | ||

| Consumer Durables | 1.76 | ||

| Pokarna Ltd. | 0.72 | ||

| Century Plyboards (India) Ltd. | 0.50 | ||

| Greenply Industries Ltd. | 0.45 | ||

| Dixon Technologies India Ltd. | 0.09 | ||

| Software | 1.59 | ||

| Persistent Systems Limited | 0.87 | ||

| Firstsource Solutions Ltd. | 0.54 | ||

| Infosys Ltd. | 0.18 | ||

| Auto | 1.35 | ||

| Maruti Suzuki India Limited | 1.04 | ||

| Mahindra & Mahindra Ltd. | 0.22 | ||

| Tata Motors Ltd. | 0.09 | ||

| Telecom - Services | 1.18 | ||

| Bharti Airtel Ltd | 1.16 | ||

| Bharti Airtel Ltd - Rights | 0.02 | ||

| Pharmaceuticals | 1.03 | ||

| Ami Organics Ltd | 0.31 | ||

| Gland Pharma Limited | 0.24 | ||

| Solara Active Pharma Sciences Ltd. | 0.24 | ||

| Eris Lifesciences Ltd. | 0.13 | ||

| Cadila Healthcare Ltd | 0.11 | ||

| Construction | 0.87 | ||

| PNC Infratech Ltd | 0.38 | ||

| KNR Constructions Ltd. | 0.25 | ||

| Mahindra Lifespace Developers Ltd | 0.24 | ||

| Power | 0.83 | ||

| National Thermal Power Corporation Limited | 0.83 | ||

| Auto Ancillaries | 0.58 | ||

| Subros Ltd. | 0.41 | ||

| Varroc Engineering Ltd. | 0.17 | ||

| Entertainment | 0.51 | ||

| Zee Entertainment Enterprises Ltd | 0.51 | ||

| Cement & Cement Products | 0.45 | ||

| The Ramco Cements Ltd | 0.19 | ||

| Ultratech Cement Ltd. | 0.14 | ||

| JK Cement Ltd. | 0.12 | ||

| Leisure Services | 0.38 | ||

| Barbeque Nation Hospitality Ltd. | 0.38 | ||

| Retailing | 0.37 | ||

| Zomato Ltd. | 0.20 | ||

| Indiamart intermesh ltd. | 0.17 | ||

| Industrial Products | 0.29 | ||

| Ksb Ltd | 0.29 | ||

| Insurance | 0.28 | ||

| HDFC Life Insurance Company Ltd. | 0.28 | ||

| Construction Project | 0.26 | ||

| Techno Electric & Engineering Company Limited | 0.16 | ||

| Larsen And Toubro Ltd. | 0.10 | ||

| Chemicals | 0.25 | ||

| Clean Science and Technology Ltd | 0.25 | ||

| Ferrous Metals | 0.23 | ||

| Jindal Steel & Power Ltd. | 0.15 | ||

| Shyam Metalics and Energy Ltd | 0.08 | ||

| Aerospace & Defense | 0.19 | ||

| Bharat Electronics Ltd. | 0.19 | ||

| Finance | 0.07 | ||

| Mahindra & Mahindra Financial Services Ltd. | 0.07 | ||

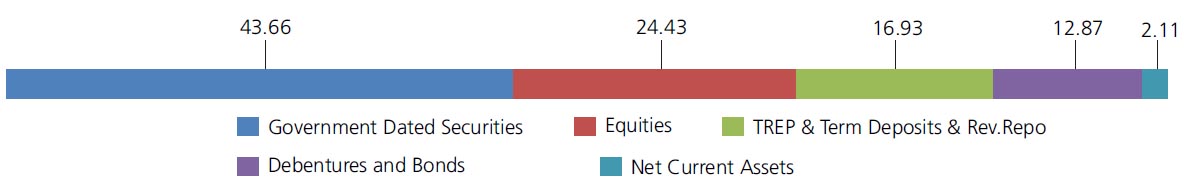

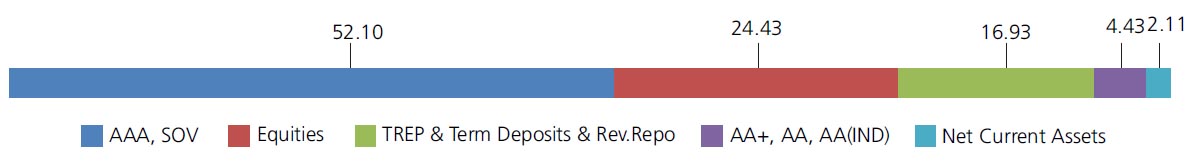

| Equity & Equity Related - Total | 24.43 | ||

| Debt Instruments | |||

| Debentures and Bonds | |||

| Government Dated Securities | |||

| 4.62% Central Government | SOV | 18.34 | |

| 6.64% Central Government | SOV | 9.45 | |

| 4.59% Central Government | SOV | 2.41 | |

| 6.82% State Government-Maharashtra | SOV | 1.97 | |

| GS CG 22 Aug 2028 - (STRIPS) | SOV | 1.53 | |

| 6.72% State Government-Kerala | SOV | 1.22 | |

| 6.75% State Government-Bihar | SOV | 0.98 | |

| 6.67% Central Government | SOV | 0.95 | |

| GS CG 17 Jun 2027 - (STRIPS) | SOV | 0.59 | |

| 8.27% State Government-Rajasthan | SOV | 0.50 | |

| 8.42% State Government-Tamil Nadu | SOV | 0.35 | |

| GS 6.76% CG 22/02/2061 - (STRIPS) | SOV | 0.29 | |

| GS CG 22 Aug 2029 - (STRIPS) | SOV | 0.27 | |

| GS CG 22 Feb 2030 - (STRIPS) | SOV | 0.26 | |

| GS CG 22 Aug 2030 - (STRIPS) | SOV | 0.26 | |

| GS CG 22 Feb 2036 - (STRIPS) | SOV | 0.17 | |

| GS CG 22 Feb 2037 - (STRIPS) | SOV | 0.16 | |

| GS CG 22 Feb 2022 - (STRIPS) | SOV | 0.16 | |

| GS CG 22 Aug 2036 - (STRIPS) | SOV | 0.16 | |

| GS CG 22 Aug 2022 - (STRIPS) | SOV | 0.16 | |

| GS CG 22 Feb 2023 - (STRIPS) | SOV | 0.15 | |

| GS CG 22 Aug 2023 - (STRIPS) | SOV | 0.15 | |

| GS CG 22 Feb 2025 - (STRIPS) | SOV | 0.14 | |

| GS CG 22 Feb 2024 - (STRIPS) | SOV | 0.14 | |

| GS CG 22 Aug 2024 - (STRIPS) | SOV | 0.14 | |

| GS CG 22/02/2026 - (STRIPS) | SOV | 0.13 | |

| GS CG 22 Aug 2025 - (STRIPS) | SOV | 0.13 | |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.12 | |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.12 | |

| GS CG 22 Feb 2028 - (STRIPS) | SOV | 0.11 | |

| GS CG 22 Aug 2027 - (STRIPS) | SOV | 0.11 | |

| GS CG 22 Feb 2029 - (STRIPS) | SOV | 0.10 | |

| GS CG 22 Feb 2031 - (STRIPS) | SOV | 0.09 | |

| GS CG 22 Aug 2031 - (STRIPS) | SOV | 0.09 | |

| GS CG 22 Feb 2033 - (STRIPS) | SOV | 0.08 | |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.08 | |

| GS CG 22 Feb 2032 - (STRIPS) | SOV | 0.08 | |

| GS CG 22 Aug 2032 - (STRIPS) | SOV | 0.08 | |

| GS CG 22 Feb 2034 - (STRIPS) | SOV | 0.07 | |

| GS CG 22 Aug 2034 - (STRIPS) | SOV | 0.07 | |

| GS CG 22 Aug 2033 - (STRIPS) | SOV | 0.07 | |

| GS CG 22 Feb 2035 - (STRIPS) | SOV | 0.06 | |

| GS CG 22 Aug 2035 - (STRIPS) | SOV | 0.06 | |

| GS CG 22 Feb 2038 - (STRIPS) | SOV | 0.05 | |

| GS CG 22 Feb 2039 - (STRIPS) | SOV | 0.05 | |

| GS CG 22 Aug 2039 - (STRIPS) | SOV | 0.05 | |

| GS CG 22 Aug 2038 - (STRIPS) | SOV | 0.05 | |

| GS CG 22 Aug 2037 - (STRIPS) | SOV | 0.05 | |

| GS CG 22 Feb 2043 - (STRIPS) | SOV | 0.04 | |

| GS CG 22 Feb 2042 - (STRIPS) | SOV | 0.04 | |

| GS CG 22 Aug 2042 - (STRIPS) | SOV | 0.04 | |

| GS CG 22 Aug 2040 - (STRIPS) | SOV | 0.04 | |

| GS CG 22 Feb 2045 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Feb 2048 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Feb 2047 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Feb 2046 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Feb 2044 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Aug 2047 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Aug 2046 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Aug 2045 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Aug 2044 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Aug 2043 - (STRIPS) | SOV | 0.03 | |

| GS CG 22 Feb 2050 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2055 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2052 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2053 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2052 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2051 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2049 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2054 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2053 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2051 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2050 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2049 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Aug 2048 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2054 - (STRIPS) | SOV | 0.02 | |

| GS CG 22 Feb 2061 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Feb 2059 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Feb 2058 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Feb 2057 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Aug 2060 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Aug 2059 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Aug 2058 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Aug 2057 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Aug 2056 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Aug 2055 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Feb 2060 - (STRIPS) | SOV | 0.01 | |

| GS CG 22 Feb 2056 - (STRIPS) | SOV | 0.01 | |

| Government Dated Securities - Total | 43.66 | ||

| Public Sector Undertakings | |||

| THDC India Ltd. (THDCIL) | FITCH AA(IND) | 3.84 | |

| Power Finance Corporation Ltd. | CRISIL AAA | 2.81 | |

| Power Finance Corporation Ltd. | CRISIL AAA | 0.66 | |

| Canara Bank (Basel III TIER I Bonds) | CRISIL AA | 0.43 | |

| Indian Railway Finance Corporation Ltd. | CRISIL AAA | 0.42 | |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 0.20 | |

| Punjab National Bank(Basel III TIER I Bonds) | FITCH AA(IND) | 0.09 | |

| NHPC Ltd. | ICRA AAA | 0.07 | |

| Public Sector Undertakings - Total | 8.52 | ||

| Corporate Debt/Financial Institutions | |||

| HDFC Bank Ltd. | CRISIL AAA | 3.33 | |

| ICICI Bank Ltd. | ICRA AAA | 0.95 | |

| Hindalco Industries Ltd. | CRISIL AA+ | 0.07 | |

| Corporate Debt/Financial Institutions - Total | 4.35 | ||

| Triparty Repo | 16.93 | ||

| Net Current Assets/(Liabilities) | 2.11 | ||

| Grand Total | 100.00 | ||

| | |||

| Monthly SIP of Rs 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 21,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Sep 30, 2021 (Rs) | 51,98,422 | 20,91,821 | 12,39,108 | 8,09,921 | 4,55,833 | 1,32,876 |

| Scheme Returns (%) | 9.18 | 10.71 | 10.92 | 11.96 | 15.96 | 20.57 |

| CRISIL Hybrid 85+15 - Conservative Index Returns (%) | 9.24 | 10.12 | 10.09 | 10.48 | 11.97 | 11.76 |

| Alpha* | -0.06 | 0.59 | 0.83 | 1.48 | 3.99 | 8.81 |

| CRISIL Hybrid 85+15 - Conservative Index (Rs)# | 52,29,264 | 20,27,028 | 12,03,078 | 7,80,703 | 4,30,462 | 1,27,451 |

| CRISIL 10 Year Gilt Index (Rs)^ | 40,50,369 | 17,35,596 | 10,71,753 | 7,07,211 | 3,95,782 | 1,21,914 |

| CRISIL 10 Year Gilt Index Returns (%) | 6.72 | 7.17 | 6.85 | 6.52 | 6.26 | 2.98 |

Alpha is difference of scheme return with benchmark return.

| Growth option | Rs42.5574 |

| Direct Growth option | Rs46.7730 |

| Monthly-Reg-Plan-IDCW | Rs13.2615 |

| Monthly-Dir-Plan-IDCW | Rs14.0472 |

| Quarterly-Reg-Plan-IDCW | Rs15.1778 |

| Quarterly-Dir-Plan-IDCW | Rs16.2318 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Devender Singhal & Mr. Abhishek Bisen* |

| Benchmark | CRISIL Hybrid 85+15 - Conservative Index |

| Allotment date | December 02, 2003 |

| AAUM | Rs994.39 crs |

| AUM | Rs1,050.02 crs |

| Folio count | 15,560 |

Monthly (12th of every Month)

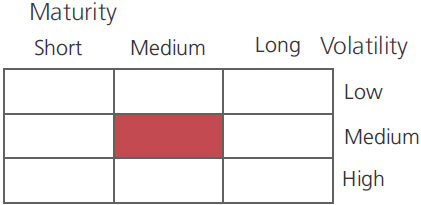

| Portfolio Average Maturity | 7.93 yrs |

| IRS Average Maturity* | - |

| Net Average Maturity | 7.93 yrs |

| Portfolio Modified Duration | 3.44 yrs |

| IRS Modified Duration* | - |

| Net Modified Duration | 3.44 yrs |

| Portfolio Macaulay Duration | 3.58 yrs |

| IRS Macaulay Duration* | - |

| Net Macaulay Duration | 3.58 yrs |

| YTM | 5.22% |

| $Standard Deviation | 3.61% |

Source: $ICRAMFI Explorer.

Standard Deviation is calculated on Annualised basis using 3 years history of monthly returns.

Initial Investment:

(i) Reinvestment of IDCW & Growth and Payout of IDCW (Quarterly) - Rs5000 & above

(ii) Payout of IDCW (Monthly) - Rs50,000 & above

Additional Investment: Rs1000 & in multiples of Rs1

Ideal Investments Horizon - 3 year & above

Entry Load: Nil. (applicable for all plans)

Exit Load: a) For redemption / switch out of upto 8%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%.

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

Nil.

Regular: 1.95%; Direct: 0.54%

Fund

Benchmark

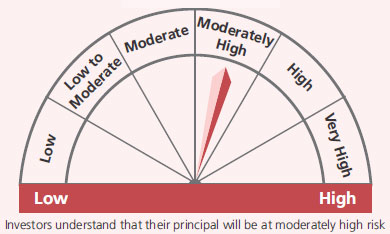

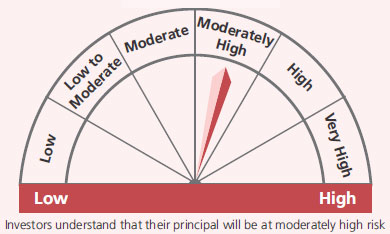

This product is suitable for investors who are seeking*:

- Income & capital growth over a long term horizon

- Investment in a portfolio of debt instruments with a moderate exposure in equity & equity related instruments

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'