An open-ended fund of fund scheme investing in specified open-ended equity, and debt schemes of Kotak Mahindra Mutual Fund

An open-ended fund of fund scheme investing in specified open-ended equity, and debt schemes of Kotak Mahindra Mutual Fund

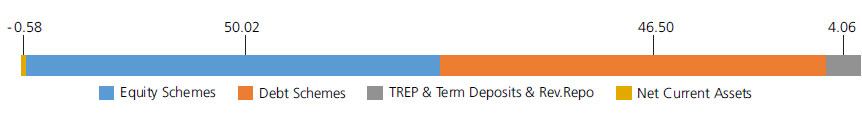

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related Mutual Fund Units |

||

| Kotak Bond Direct Plan Growth | Debt Schemes | 44.72 |

| Kotak Bluechip Fund | Equity Schemes | 15.13 |

| Kotak Small Cap Fund Direct Growth | Equity Schemes | 13.16 |

| Kotak Emerging Equity Scheme Direct Growth | Equity Schemes | 12.22 |

| Kotak Infrastructure & Economic Reform Fund Direct Growth | Equity Schemes | 8.52 |

| Kotak Dynamic Bond Dir Plan Growth | Debt Schemes | 1.78 |

| Kotak Equity Opportunities Fund Direct Growth | Equity Schemes | 0.99 |

| Mutual Fund Units - Total | 96.52 | |

| Triparty Repo | 4.06 | |

| Net Current Assets/(Liabilities) | -0.58 | |

| Grand Total | 100.00 | |

| Reg-Plan-IDCW | Rs130.4610 |

| Dir-Plan-IDCW | Rs137.6200 |

| Growth Option | Rs134.0260 |

| Direct Growth Option | Rs140.1420 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Devender Singhal & Mr. Arjun Khanna* |

| Benchmark | NIFTY 50 Hybrid Composite Debt 50:50 Index |

| Allotment date | August 9, 2004 |

| AAUM | Rs440.19 crs |

| AUM | Rs459.54 crs |

| Folio count | 18,820 |

Trustee's Discretion

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investment Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load: 8% of the units allotted shall be redeemed

without any Exit Load on or before

completion of 1 Year from the date of

allotment of units.

Any redemption in excess of such limit

within 1 Year from the date of allotment

shall be subject to the following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

Regular:1.08%; Direct: 0.20%

Fund

Benchmark

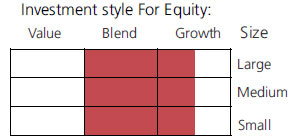

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in open-ended diversified equity schemes and debt schemes of Kotak Mahindra Mutual Fund

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'