| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

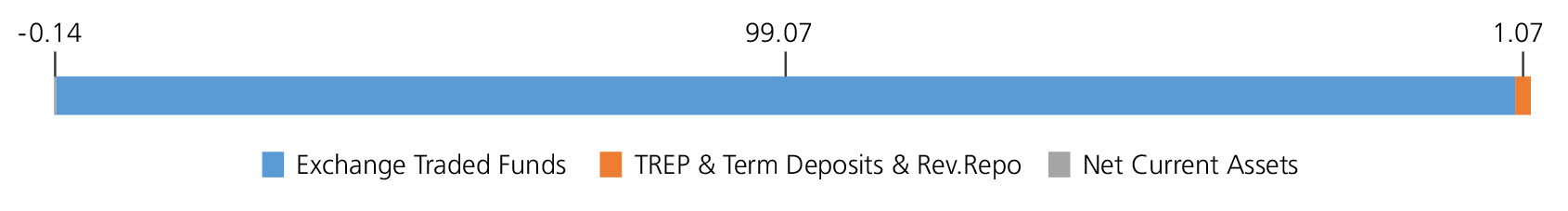

| Kotak Mutual Fund - Kotak Silver ETF | ETF Units | 99.07 |

| Mutual Fund Units - Total | 99.07 | |

| Triparty Repo | 1.07 | |

| Net Current Assets/(Liabilities) | -0.14 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs11.6749 | Rs11.7690 |

A) Regular B) Direct Plan

Options: Growth

| Fund Manager* | Mr. Jeetu Valechha Sonar & Mr. Abhishek Bisen |

| Benchmark | Price of silver (based on LBMA daily spot fixing price) |

| Allotment date | March 31, 2023 |

| AAUM | Rs56.31 crs |

| AUM | Rs56.19 crs |

| Folio count | 3,248 |

Not Applicable since IDCW is not applicable

| Portfolio Turnover: | 46.65% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3 year & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

a) For redemption/switch- out of units on or

before 30 days from the date of allotment:

0.5% of applicable NAV.

b) For redemption/switch- out of units after

30 days from the date of allotment: NIL

| Regular Plan: | 0.60% |

| Direct Plan: | 0.14% |

Folio Count data as on 30th November 2024.

Fund

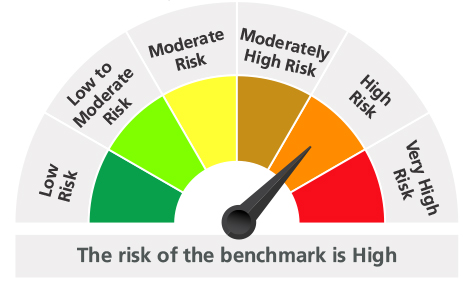

Benchmark : Price of silver (based on LBMA daily spot fixing price)

This product is suitable for investors who are seeking*:

- Long-term capital appreciation

- An open-ended Fund of Funds scheme with the primary objective of generating returns by investing in units of Kotak Silver ETF.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th November, 2024. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

**Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'