| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

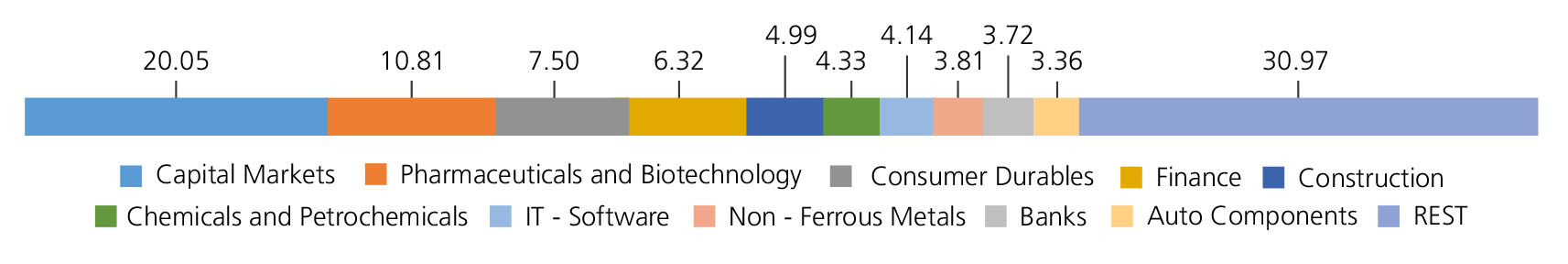

| Capital Markets | 20.05 | |

| Multi Commodity Exchange of India Limited | 4.47 | |

| CENTRAL DEPOSITORY SERVICES (INDIA) LTD. | 4.40 | |

| 360 ONE WAM LTD. | 3.43 | |

| COMPUTER AGE MANAGEMENT SERVICES LIMITED | 3.42 | |

| ANGEL ONE LIMITED | 2.39 | |

| Indian Energy Exchange Ltd | 1.94 | |

| Pharmaceuticals and Biotechnology | 10.81 | |

| Glenmark Pharmaceuticals Ltd | 3.41 | |

| Laurus Labs Ltd. | 3.34 | |

| PIRAMAL PHARMA LTD. | 2.31 | |

| Natco Pharma Ltd | 1.75 | |

| Consumer Durables | 7.50 | |

| BLUE STAR LTD. | 3.91 | |

| Crompton Greaves Consumer Electricals Ltd | 3.59 | |

| Finance | 6.32 | |

| Piramal Enterprises Limited | 1.85 | |

| PNB Housing Finance Ltd. | 1.67 | |

| Manappuram Finance Ltd | 1.45 | |

| IIFL Finance Ltd | 1.35 | |

| Construction | 4.99 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 2.07 | |

| NCC LIMITED | 1.57 | |

| NBCC (India) Ltd | 1.35 | |

| Chemicals and Petrochemicals | 4.33 | |

| Navin Fluorine International Ltd. | 1.59 | |

| Atul Ltd. | 1.56 | |

| Aarti Industries Ltd. | 1.18 | |

| IT - Software | 4.14 | |

| Sonata Software Ltd. | 1.64 | |

| Birlasoft Ltd. | 1.29 | |

| ZENSAR TECHNOLGIES LTD. | 1.21 | |

| Non - Ferrous Metals | 3.81 | |

| National Aluminium Company Ltd | 2.67 | |

| HINDUSTAN COPPER LTD. | 1.14 | |

| Banks | 3.72 | |

| KARUR VYSYA BANK LTD. | 2.40 | |

| RBL Bank Ltd | 1.32 | |

| Auto Components | 3.36 | |

| AMARA RAJA ENERGY MOB LTD. | 2.07 | |

| RAMKRISHNA FORGINGS LTD. | 1.29 | |

| Entertainment | 2.89 | |

| Zee Entertainment Enterprises Ltd | 1.58 | |

| PVR INOX LIMITED | 1.31 | |

| Beverages | 2.86 | |

| Radico Khaitan Ltd. | 2.86 | |

| Gas | 2.50 | |

| Gujarat State Petronet Ltd. | 1.47 | |

| Mahanagar Gas Ltd | 1.03 | |

| Electrical Equipment | 2.45 | |

| Apar Industries Limited | 2.45 | |

| Realty | 2.41 | |

| BRIGADE ENTERPRISES LIMITED | 2.41 | |

| IT - Services | 2.18 | |

| CYIENT LTD. | 2.18 | |

| Paper, Forest and Jute Products | 1.85 | |

| ADITYA BIRLA REAL ESTATE LTD | 1.85 | |

| Cement and Cement Products | 1.72 | |

| The Ramco Cements Ltd | 1.72 | |

| Commercial Services and Supplies | 1.67 | |

| Redington India Ltd | 1.67 | |

| Power | 1.65 | |

| CESC LTD | 1.65 | |

| Telecom - Services | 1.45 | |

| HFCL LTD | 1.45 | |

| Petroleum Products | 1.34 | |

| Castrol (India ) Ltd. | 1.34 | |

| Transport Services | 1.34 | |

| Great Eastern Shipping Company Ltd | 1.34 | |

| Telecom - Equipment and Accessorie | 1.30 | |

| Tejas Networks Ltd | 1.30 | |

| Industrial Products | 1.26 | |

| Finolex Cables Ltd. | 1.26 | |

| Healthcare Services | 1.22 | |

| Narayana Hrudayalaya Ltd. | 1.22 | |

| Retailing | 0.96 | |

| INDIAMART INTERMESH LTD. | 0.96 | |

| Equity & Equity related - Total | 100.08 | |

| Triparty Repo | 0.84 | |

| Net Current Assets/(Liabilities) | -0.92 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs20.6330 | Rs20.8620 |

| IDCW | Rs20.6320 | Rs20.8730 |

A) Regular Plan B) Direct Plan

Options: Growth, Payout of Income

Distribution cum capital withdrawal

(IDCW) & Reinvestment of Income

Distribution cum capital withdrawal

(IDCW)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen |

| Benchmark | Nifty Smallcap 50 Index TRI |

| Allotment date | April 10, 2023 |

| AAUM | Rs118.54 crs |

| AUM | Rs118.35 crs |

| Folio count | 22,441 |

| Portfolio Turnover | 78.28% |

| Tracking Error | 0.44% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

Trustee's Discretion

Entry Load:

Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

| Regular Plan: | 0.89% |

| Direct Plan: | 0.25% |

Folio Count data as on 30th November 2024.

Fund

Benchmark : Nifty Smallcap 50 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital appreciation

- Investment stocks comprising the underlying index and endeavours to track the benchmark index, subject to tracking errors

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th November, 2024. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'