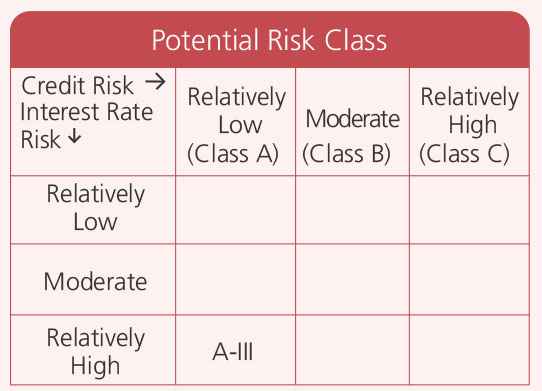

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Apr 2032 Top 12 Equal Weight Index. A relatively high interest rate risk and relatively low credit risk.

An open-ended Target Maturity Index Fund investing in constituents of Nifty SDL Apr 2032 Top 12 Equal Weight Index. A relatively high interest rate risk and relatively low credit risk.

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Government Dated Securities | ||

| Government Dated Securities | ||

| 7.70% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 18.03 |

| 7.73% Maharashtra State Govt-Maharashtra | SOV | 15.45 |

| 7.72% Maharashtra State Govt-Maharashtra | SOV | 12.40 |

| 7.63% Gujarat State Govt-Gujarat | SOV | 11.63 |

| 7.73% Haryana State Govt-Haryana | SOV | 10.80 |

| 7.14% Karnataka State Govt-Karnataka | SOV | 5.84 |

| 7.74% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 5.14 |

| 7.57% Gujarat State Govt-Gujarat | SOV | 3.68 |

| 7.28% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 2.94 |

| 7.30% Tamil Nadu State Govt-Tamil Nadu | SOV | 2.81 |

| 7.17% Rajasthan State Govt-Rajasthan | SOV | 1.38 |

| 7.15% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 1.20 |

| 7.88% Rajasthan State Govt-Rajasthan | SOV | 1.08 |

| 7.21% Karnataka State Govt-Karnataka | SOV | 0.86 |

| 7.09% Rajasthan State Govt-Rajasthan | SOV | 0.86 |

| 7.70% Haryana State Govt-Haryana | SOV | 0.71 |

| 7.7% Maharashtra State Govt-Maharashtra | SOV | 0.42 |

| 6.89% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 0.41 |

| 6.87% Rajasthan State Govt-Rajasthan | SOV | 0.22 |

| 7.25% Haryana State Govt-Haryana | SOV | 0.19 |

| 7.36% West Bengal State Govt-West Bengal | SOV | 0.19 |

| 7.68% Karnataka State Govt-Karnataka | SOV | 0.18 |

| 7.17% West Bengal State Govt-West Bengal | SOV | 0.18 |

| 7.14% Punjab State Govt-Punjab | SOV | 0.14 |

| 6.62% Uttar Pradesh State Govt-Uttar Pradesh | SOV | 0.13 |

| 6.91% Rajasthan State Govt-Rajasthan | SOV | 0.12 |

| 7.17% Kerala State Govt-Kerala | SOV | 0.10 |

| 6.98% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.10 |

| 6.48% Karnataka State Govt-Karnataka | SOV | 0.07 |

| 6.95% Maharashtra State Govt-Maharashtra | SOV | 0.07 |

| 6.85% Madhya Pradesh State Govt-Madhya Pradesh | SOV | 0.07 |

| 7.30% Karnataka State Govt-Karnataka | SOV | 0.07 |

| 7.13% Haryana State Govt-Haryana | SOV | 0.06 |

| 6.57% Gujarat State Govt-Gujarat | SOV | 0.06 |

| 6.53% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.04 |

| 6.97% Karnataka State Govt-Karnataka | SOV | 0.03 |

| 8.39% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.03 |

| 6.98% Gujarat State Govt-Gujarat | SOV | 0.01 |

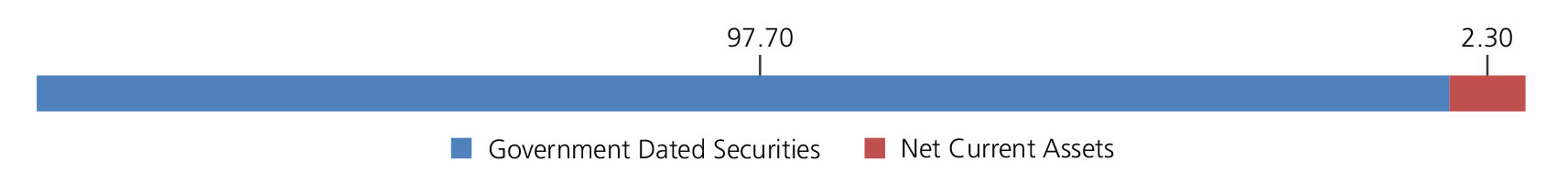

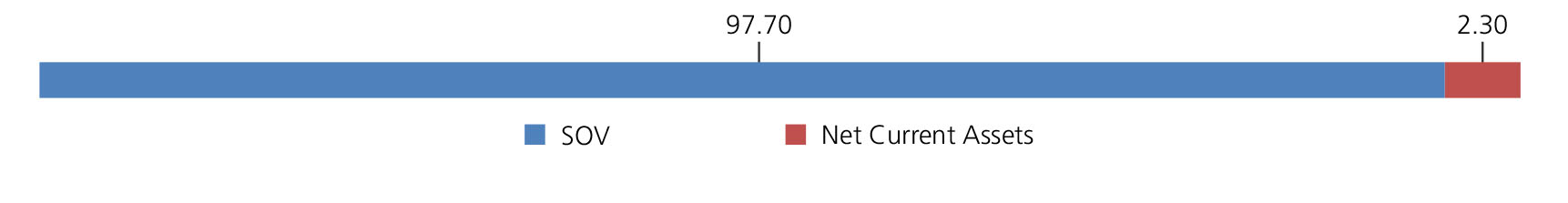

| Government Dated Securities - Total | 97.70 | |

| Net Current Assets/(Liabilities) | 2.30 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs12.1245 | Rs12.1850 |

| IDCW | Rs12.1282 | Rs12.1839 |

Regular & Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | Nifty SDL Apr 2032 Top 12 Equal Weight Index |

| Allotment date | February 11, 2022 |

| AAUM | Rs2,918.44 crs |

| AUM | Rs2,916.60 crs |

| Folio count | 2,497 |

| Average Maturity | 7.00 yrs |

| Modified Duration | 5.23 yrs |

| Macaulay Duration | 5.42 yrs |

| Annualised YTM* | 7.24% |

| Tracking Error | 1.45% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 1 year & above

Trustee's Discretion

Entry Load: Nil. (applicable for all plans)

Exit Load: For redemption / switch-out of

units on or before 30 days from the date of

allotment: 0.15% of applicable NAV. For

redemption / switch-out of units after 30

days from the date of allotment – Nil

Redemption of units would be done on

First in First out Basis (FIFO). Any exit load

charged (net off Goods & Service Tax, if

any) shall be credited back to the

respective Scheme. Units issued on

reinvestment of IDCW shall not be subject

to entry and exit load.

| Regular Plan: | 0.36% |

| Direct Plan: | 0.20% |

Folio Count data as on 30th November 2024.

Fund

Benchmark : Nifty SDL Apr 2032 Top 12 Equal Weight Index

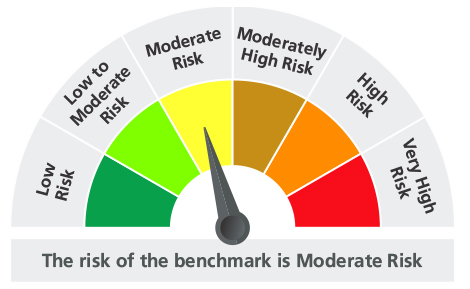

This product is suitable for investors who are seeking*:

- Income over Target Maturity Periods

- Target Maturity Index Fund tracking Nifty SDL Apr 2032 Top 12 Equal weight Index

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 30th November, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'