An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes.

An open ended fund of fund scheme investing in units of Kotak Mahindra Mutual Fund schemes & ETFs / Index schemes (Domestic & Offshore Funds including Gold ETFs schemes.

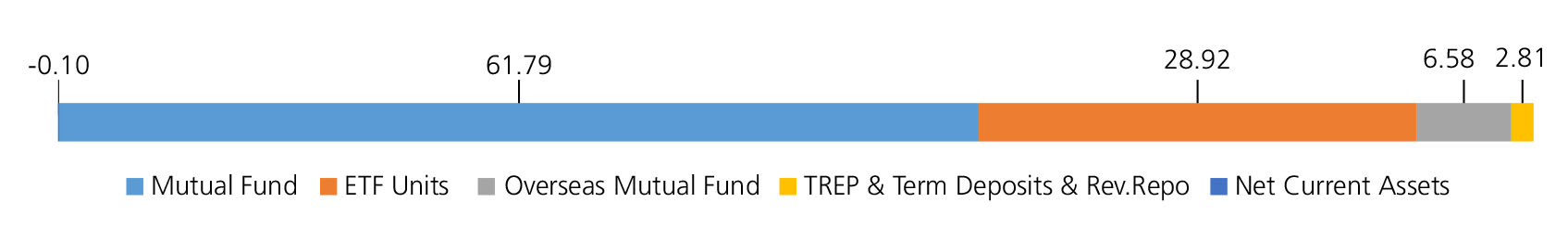

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| KOTAK MUTUAL FUND - KOTAK GOLD ETF | ETF Units | 14.23 |

| Kotak Gilt Fund Direct Growth | Mutual Fund | 12.42 |

| Kotak Bond Direct Plan Growth | Mutual Fund | 10.74 |

| Kotak Consumption Fund Growth | Mutual Fund | 9.59 |

| Kotak Infrastructure & Economic Reform Fund Direct Growth | Mutual Fund | 8.96 |

| KOTAK PSU BANK ETF | ETF Units | 8.74 |

| Ishares Nasdaq 100 UCITS ETF USD | Overseas Mutual Fund | 6.58 |

| Kotak Quant Fund Growth | Mutual Fund | 6.40 |

| Kotak Manufacture In India Fund | Mutual Fund | 4.85 |

| Kotak India EQ Contra Fund Direct Growth | Mutual Fund | 4.67 |

| Kotak Technology Fund Growth | Mutual Fund | 4.16 |

| KOTAK NIFTY IT ETF | ETF Units | 3.55 |

| KOTAK NIFTY BANK ETF | ETF Units | 2.40 |

| Mutual Fund Units - Total | 97.29 | |

| Triparty Repo | 2.81 | |

| Net Current Assets/(Liabilities) | -0.10 | |

| Grand Total | 100.00 | |

| Monthly SIP of Rs 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 24,50,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on December 31, 2024 (₹) | 1,35,57,185 | 29,07,632 | 16,76,275 | 10,03,836 | 4,86,407 | 1,27,389 |

| Scheme Returns (%) | 14.67 | 16.86 | 19.38 | 20.70 | 20.54 | 11.61 |

| 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold + 5% MSCI World Index (%) | NA | 11.72 | 12.21 | 12.27 | 11.96 | 6.82 |

| Alpha* | NA | 5.13 | 7.17 | 8.43 | 8.58 | 4.78 |

| 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold + 5% MSCI World Index(₹)# | NA | 22,08,235 | 12,97,951 | 8,16,371 | 4,30,506 | 1,24,373 |

| Nifty 50 TRI (₹)^ | 1,14,96,382 | 25,60,777 | 14,62,011 | 9,11,976 | 4,45,159 | 1,21,600 |

| Nifty 50 TRI Returns (%) | 13.36 | 14.50 | 15.54 | 16.76 | 14.28 | 2.48 |

# Benchmark; ^ Additional Benchmark. Alpha is difference of scheme return with benchmark return.

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

| Regular | Direct | |

| Growth | Rs221.5060 | Rs237.5060 |

| IDCW | Rs215.6150 | Rs233.2330 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager*^ | Mr. Devender Singhal,

Mr. Abhishek Bisen |

| Benchmark | 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold +5 % MSCI World Index |

| Allotment date | August 9, 2004 |

| AAUM | Rs1,639.96 crs |

| AUM | Rs1,632.21 crs |

| Folio count | 37,153 |

Trustee's Discretion

| Portfolio Turnover | 41.29% |

| $Beta | 1.22 |

| $Sharpe ## | 1.07 |

| $Standard Deviation | 8.64% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: 8% of the units allotted shall

be redeemed without any Exit Load on or

before completion of 1 Year from the date

of allotment of units. Any redemption in

excess of such limit within 1 Year from the

date of allotment shall be subject to the

following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

| Regular Plan: | 1.01% |

| Direct Plan: | 0.33% |

Folio Count data as on 30th November 2024.

Fund

Benchmark : 90% Nifty 50 Hybrid Composite Debt 50:50 Index + 5% price of Physical Gold + 5% MSCI World Index

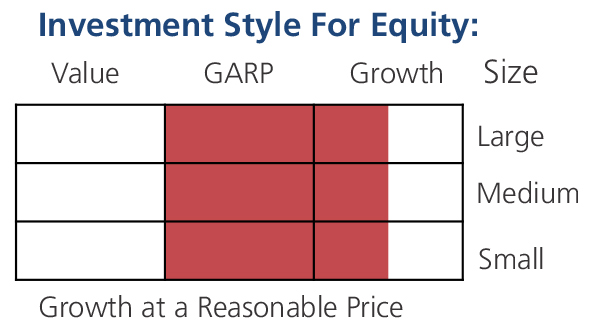

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in Kotak Mahindra Mutual Fund schemes & ETFs/Index schemes (Domestic & Offshore Funds including Gold ETFs)

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

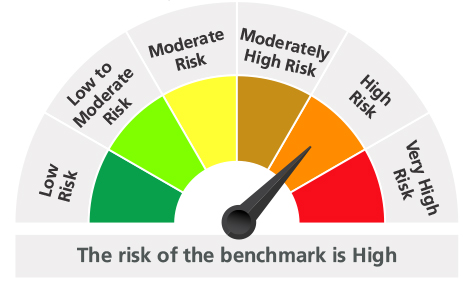

The above risk-o—meter is based on the scheme portfolio as on 30th November, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 7.15% (FBIL Overnight MIBOR rate as on 31st Dec 2024).

**Total Expense Ratio includes applicable B30 fee and GST.

^Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities).

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'