Investment Objective

The investment objective of the scheme is

to replicate the composition of the NIFTY

Midcap 50 Index and to generate returns

that are commensurate with the

performance of the NIFTY Midcap 50 Index,

subject to tracking errors. However, there is

no assurance or guarantee that the

investment objective of the scheme will be

achieved.

The investment objective of the scheme is

to replicate the composition of the NIFTY

Midcap 50 Index and to generate returns

that are commensurate with the

performance of the NIFTY Midcap 50 Index,

subject to tracking errors. However, there is

no assurance or guarantee that the

investment objective of the scheme will be

achieved.

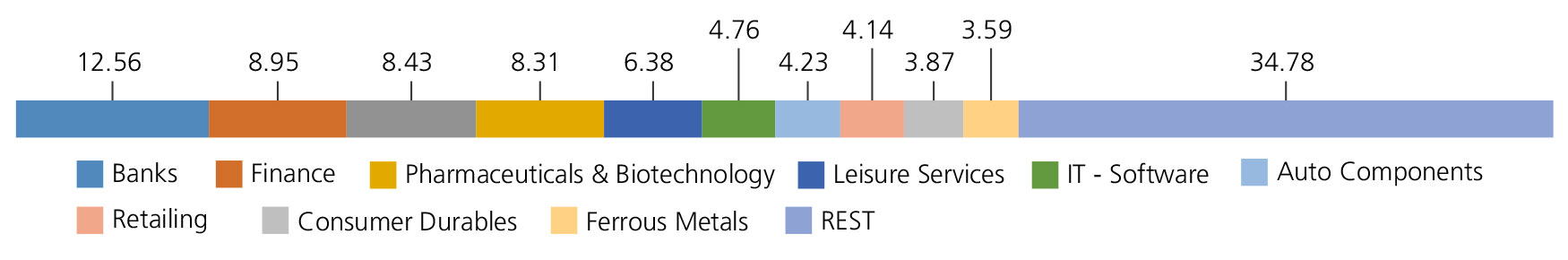

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Banks | 12.56 | |

| AU Small Finance Bank Ltd. | 3.37 | |

| Federal Bank Ltd. | 3.19 | |

| Canara Bank | 2.36 | |

| IDFC First Bank Limited | 2.11 | |

| Punjab National Bank | 1.53 | |

| Finance | 8.95 | |

| Shriram Transport Finance Co Ltd. | 2.86 | |

| Power Finance Corporation Ltd. | 1.62 | |

| Rural Electrification Corporation Ltd | 1.54 | |

| LIC Housing Finance Ltd. | 1.48 | |

| Mahindra & Mahindra Financial Services Ltd. | 1.45 | |

| Industrial Products | 8.43 | |

| Bharat Forge Ltd. | 2.58 | |

| Cummins India Ltd. | 2.22 | |

| Astral Ltd. | 2.17 | |

| Polycab India Ltd. | 1.46 | |

| Pharmaceuticals & Biotechnology | 8.31 | |

| Lupin Ltd. | 2.04 | |

| Alkem Laboratories Ltd. | 1.87 | |

| Aurobindo Pharma Ltd. | 1.83 | |

| Zydus Lifesciences Limited | 1.33 | |

| Abbott India Ltd. | 1.24 | |

| Leisure Services | 6.38 | |

| The Indian Hotels Company Ltd. | 3.56 | |

| Jubilant Foodworks Limited | 2.82 | |

| IT - Software | 4.76 | |

| Persistent Systems Limited | 2.25 | |

| Coforge Limited | 1.69 | |

| Oracle Financial Services Software Ltd | 0.82 | |

| Auto Components | 4.23 | |

| MRF Limited | 2.30 | |

| Balkrishna Industries Ltd. | 1.93 | |

| Retailing | 4.14 | |

| Trent Ltd | 4.14 | |

| Consumer Durables | 3.87 | |

| Voltas Ltd. | 2.45 | |

| Bata India Ltd. | 1.42 | |

| Ferrous Metals | 3.59 | |

| Jindal Steel & Power Ltd. | 2.21 | |

| Steel Authority of India Ltd. | 1.38 | |

| Textiles & Apparels | 3.59 | |

| Page Industries Ltd | 3.59 | |

| Agricultural, Commercial & Construction Vehicles | 3.48 | |

| Ashok Leyland Ltd. | 2.67 | |

| Escorts Ltd. | 0.81 | |

| Automobiles | 3.23 | |

| TVS Motors Company Ltd | 3.23 | |

| Realty | 3.09 | |

| Godrej Properties Limited | 1.79 | |

| Oberoi Realty Ltd | 1.30 | |

| Gas | 2.95 | |

| Petronet LNG Ltd. | 1.87 | |

| Gujarat Gas Ltd. | 1.08 | |

| Entertainment | 2.93 | |

| Zee Entertainment Enterprises Ltd | 2.93 | |

| Transport Services | 2.65 | |

| Container Corporation of India Ltd. | 2.65 | |

| Telecom - Services | 2.61 | |

| Tata Communications Ltd. | 1.78 | |

| Vodafone Idea Ltd | 0.83 | |

| Electrical Equipment | 1.96 | |

| ABB India Ltd | 1.96 | |

| Insurance | 1.86 | |

| Max Financial Services Ltd. | 1.86 | |

| Petroleum Products | 1.65 | |

| Hindustan Petroleum Corporation Ltd | 1.65 | |

| Beverages | 1.43 | |

| United Breweries Ltd. | 1.43 | |

| IT - Services | 1.17 | |

| L&T Technology Services Ltd | 1.17 | |

| Industrial Manufacturing | 1.07 | |

| Honeywell Automation India Ltd. | 1.07 | |

| Power | 1.03 | |

| Torrent Power Ltd | 1.03 | |

| Equity & Equity related - Total | 99.92 | |

| Net Current Assets/(Liabilities) | 0.08 | |

| Grand Total | 100.00 | |

NAV

| Reg-Plan-IDCW | Rs87.4834 |

Available Plans/Options

A) Regular Plan

| Fund Manager* | Mr. Devender Singhal Mr. Satish Dondapati Mr. Abhishek Bisen |

| Benchmark | Nifty Midcap 50 (Total Return Index) |

| Allotment date | January 28, 2022 |

| AAUM | Rs5.00 crs |

| AUM | Rs5.13 crs |

| Folio count | 1,681 |

Ratios

| Portfolio Turnover : | 276.61% |

Minimum Investment Amount

Through Exchange:1 Unit,

Through AMC: 35000 Units and multiple thereof,

Ideal Investment Horizon: 5 years and above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.15%

Data as on October 31, 2022

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks Comprising the underlying index and endeavours to track the benchmark index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'Scheme Performances'