An open-ended hybrid scheme investing predominantly in equity and equity related instruments

An open-ended hybrid scheme investing predominantly in equity and equity related instruments

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

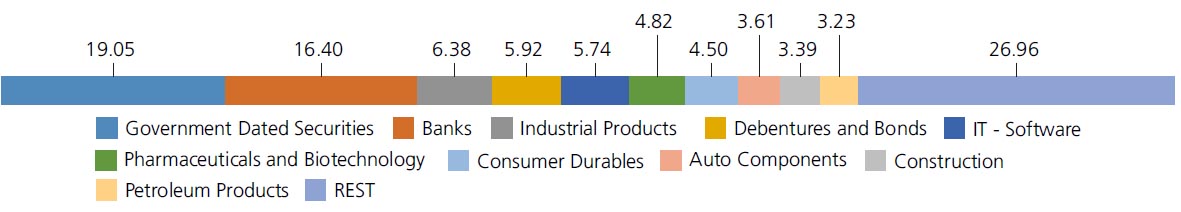

| Banks | 16.40 | |

| ICICI Bank Ltd. | 4.86 | |

| HDFC Bank Ltd. | 4.00 | |

| State Bank Of India | 2.90 | |

| Axis Bank Ltd. | 2.10 | |

| Kotak Mahindra Bank Ltd. | 1.73 | |

| AU Small Finance Bank Ltd. | 0.81 | |

| Industrial Products | 6.38 | |

| Carborundum Universal Ltd. | 2.37 | |

| Bharat Forge Ltd. | 1.46 | |

| Cummins India Ltd. | 1.37 | |

| Supreme Industries Limited | 1.18 | |

| IT - Software | 5.74 | |

| Infosys Ltd. | 3.04 | |

| Tata Consultancy Services Ltd. | 1.20 | |

| Tech Mahindra Ltd. | 0.86 | |

| Oracle Financial Services Software Ltd | 0.64 | |

| Pharmaceuticals and Biotechnology | 4.82 | |

| Dr Reddys Laboratories Ltd. | 1.24 | |

| Sun Pharmaceuticals Industries Ltd. | 1.14 | |

| Torrent Pharmaceuticals Ltd. | 0.85 | |

| Cipla Ltd. | 0.64 | |

| Ipca Laboratories Ltd. | 0.49 | |

| Zydus Lifesciences Limited | 0.46 | |

| Consumer Durables | 4.50 | |

| Century Plyboards (India) Ltd. | 1.95 | |

| Whirlpool of India Ltd. | 1.05 | |

| Sheela Foam Ltd | 0.96 | |

| Kajaria Ceramics Ltd. | 0.54 | |

| Auto Components | 3.61 | |

| Bosch Ltd. | 1.92 | |

| Schaeffler India Ltd | 1.16 | |

| Samvardhana Motherson International Limited | 0.53 | |

| Construction | 3.39 | |

| Larsen And Toubro Ltd. | 2.16 | |

| Techno Electric & Engineering Company Limited | 0.86 | |

| Kalpataru Power Transmission Ltd. | 0.37 | |

| Petroleum Products | 3.23 | |

| Reliance Industries Ltd. | 2.17 | |

| Bharat Petroleum Corporation Ltd. | 0.54 | |

| Indian Oil Corporation Ltd | 0.52 | |

| Cement and Cement Products | 2.95 | |

| JK Cement Ltd. | 1.19 | |

| Shree Cement Ltd. | 1.03 | |

| The Ramco Cements Ltd | 0.73 | |

| Chemicals and Petrochemicals | 2.69 | |

| Solar Industries India Limited | 1.50 | |

| Galaxy Surfactants Ltd. | 1.19 | |

| Diversified FMCG | 2.62 | |

| ITC Ltd. | 1.83 | |

| Hindustan Unilever Ltd. | 0.79 | |

| Finance | 2.49 | |

| HDFC Ltd. | 1.47 | |

| LIC Housing Finance Ltd. | 1.02 | |

| Realty | 1.88 | |

| Mahindra Lifespace Developers Ltd | 1.28 | |

| Oberoi Realty Ltd | 0.60 | |

| Automobiles | 1.84 | |

| Maruti Suzuki India Limited | 0.97 | |

| Mahindra & Mahindra Ltd. | 0.87 | |

| Electrical Equipment | 1.62 | |

| Thermax Ltd. | 1.62 | |

| Beverages | 1.46 | |

| United Spirits Ltd. | 1.46 | |

| Power | 1.41 | |

| National Thermal Power Corporation Limited | 1.41 | |

| Transport Services | 1.03 | |

| Blue Dart Express Ltd. | 1.03 | |

| Fertilizers and Agrochemicals | 0.98 | |

| Coromandel International Ltd. | 0.62 | |

| P I Industries Ltd | 0.36 | |

| Gas | 0.88 | |

| Petronet LNG Ltd. | 0.59 | |

| Gujarat Gas Ltd. | 0.29 | |

| Insurance | 0.57 | |

| ICICI Lombard General Insurance Company Ltd | 0.57 | |

| Agricultural, Commercial & Construction Vehicles | 0.41 | |

| V.S.T Tillers Tractors Ltd | 0.41 | |

| Personal Products | 0.39 | |

| Emami Ltd. | 0.39 | |

| Non - Ferrous Metals | 0.32 | |

| Hindalco Industries Ltd | 0.32 | |

| Ferrous Metals | 0.26 | |

| Shyam Metalics and Energy Ltd | 0.26 | |

| Capital Markets | 0.23 | |

| Prudent Corporate Advisory Services Ltd. | 0.23 | |

| Equity & Equity related - Total | 72.10 | |

| Mutual Fund Units | ||

| Brookfield India Real Estate Trust | Realty | 0.17 |

| Mutual Fund Units - Total | 0.17 | |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

| HDFC Ltd. | CRISIL AAA | 1.10 |

| Bharti Telecom Ltd. | CRISIL AA+ | 0.69 |

| Corporate Debt/Financial Institutions - Total | 1.79 | |

| Public Sector Undertakings | ||

| National Bank for Agriculture & Rural Development | CRISIL AAA | 1.11 |

| Power Finance Corporation Ltd. | CRISIL AAA | 0.97 |

| State Bank of India.(Basel III TIER II Bonds) | CRISIL AAA | 0.69 |

| Small Industries Development Bank Of India | ICRA AAA | 0.41 |

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 0.40 |

| National Bank for Agriculture & Rural Development | CRISIL AAA | 0.37 |

| Power Finance Corporation Ltd. | CRISIL AAA | 0.18 |

| Public Sector Undertakings - Total | 4.13 | |

| Government Dated Securities | ||

| 7.26% Central Government | SOV | 5.53 |

| 8.51% Central Government(^) | SOV | 3.41 |

| 7.38% Central Government | SOV | 3.35 |

| 7.17% Central Government | SOV | 1.94 |

| 7.1% Central Government | SOV | 0.97 |

| 7.69% Central Government(^) | SOV | 0.69 |

| 7.93% Central Government | SOV | 0.54 |

| GS CG 19/03/2028 - (STRIPS) | SOV | 0.50 |

| GS CG 19/09/2028 - (STRIPS) | SOV | 0.38 |

| GS CG 22 Aug 2028 - (STRIPS) | SOV | 0.37 |

| 8.15% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.28 |

| GS CG 17 Jun 2027 - (STRIPS) | SOV | 0.15 |

| 7.62 % Haryana State Govt-Haryana | SOV | 0.14 |

| 7.67 % Punjab State Govt-Punjab | SOV | 0.14 |

| 8% Kerala State Govt-Kerala | SOV | 0.14 |

| 8.01% Tamil Nadu State Govt-Tamil Nadu | SOV | 0.14 |

| GS CG 26/04/2031 - (STRIPS) | SOV | 0.08 |

| GS CG 22 Aug 2030 - (STRIPS) | SOV | 0.07 |

| 7.71% Gujarat State Govt-Gujarat | SOV | 0.06 |

| 7.71% Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.04 |

| 6.91% Rajasthan State Govt-Rajasthan | SOV | 0.03 |

| GS CG 22 Aug 2026 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2028 - (STRIPS) | SOV | 0.02 |

| GS CG 22 Feb 2029 - (STRIPS) | SOV | 0.02 |

| GS CG 23/12/2025 - (STRIPS) | SOV | 0.02 |

| 7.79 Andhra Pradesh State Govt-Andhra Pradesh | SOV | 0.01 |

| GS CG 22 Feb 2027 - (STRIPS) | SOV | 0.01 |

| Government Dated Securities - Total | 19.05 | |

| Triparty Repo | 1.71 | |

| Net Current Assets/(Liabilities) | 1.05 | |

| Grand Total | 100.00 | |

| | ||

| Monthly SIP of (₹) 10000 | Since Inception | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 10,30,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on May 31, 2023 (₹) | 17,85,597 | 13,37,421 | 8,74,431 | 4,45,024 | 1,27,110 |

| Scheme Returns (%) | 12.45 | 13.07 | 15.07 | 14.30 | 11.22 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index Returns (%) | 11.64 | 11.99 | 12.46 | 11.47 | 11.84 |

| Alpha | 0.81 | 1.08 | 2.61 | 2.82 | -0.61 |

| NIFTY 50 Hybrid Composite Debt 65:35 Index (₹)# | 17,21,708 | 12,86,912 | 8,19,995 | 4,27,271 | 1,27,492 |

| Nifty 50 (TRI) (₹)^ | 18,59,341 | 13,83,622 | 8,71,404 | 4,47,568 | 1,28,147 |

| Nifty 50 (TRI) Returns (%) | 13.35 | 14.02 | 14.93 | 14.70 | 12.89 |

Alpha is difference of scheme return with benchmark return. *All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Source: ICRA MFI Explorer.

| Reg-Plan-IDCW | Rs25.341 |

| Dir-Plan-IDCW | Rs30.173 |

| Growth Option | Rs43.12 |

| Direct Growth Option | Rs49.221 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Pankaj Tibrewal, Mr. Abhishek Bisen & Mr. Arjun Khanna (Dedicated fund manager for investments in foreign securities) |

| Benchmark | NIFTY 50 Hybrid Composite Debt 65:35 Index |

| Allotment date | November 25, 1999 |

| AAUM | Rs3,552.00 crs |

| AUM | Rs3,642.93 crs |

| Folio count | 93,545 |

Half Yearly (25th of Mar/Sep)

| Portfolio Turnover | 42.16% |

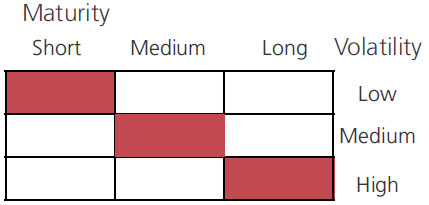

| Portfolio Average Maturity | 6.53 yrs |

| IRS Average Maturity* | 0.12 yrs |

| Net Average Maturity | 6.66 yrs |

| Portfolio Modified Duration | 3.68 yrs |

| IRS Modified Duration* | 0.11 yrs |

| Net Modified Duration | 3.79 yrs |

| Portfolio Macaulay Duration | 3.84 yrs |

| IRS Macaulay Duration* | 0.11 yrs |

| Net Macaulay Duration | 3.95 yrs |

| Annualised YTM* | 7.37% |

| $Beta | 0.96 |

| $Sharpe## | 1.61 |

| $Standard Deviation | 10.35% |

Initial Investment: Rs5000 and in multiples of

Rs1 for purchases and for Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 8%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.87%; Direct: 0.51%

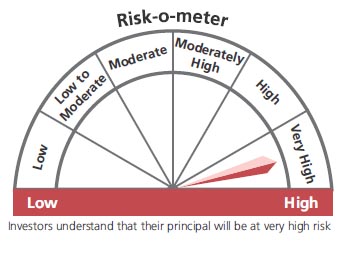

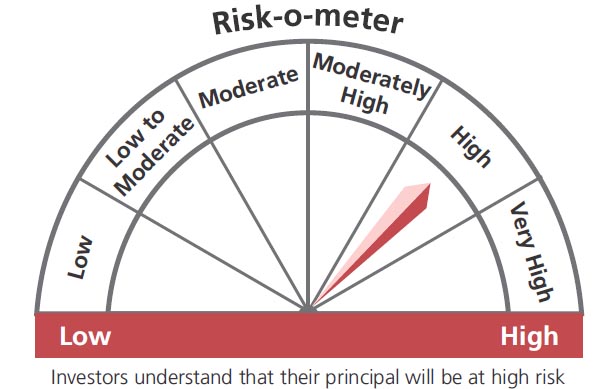

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities balanced with income generation by investing in debt & money.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st May, 2023. An addendum may be issued or updated on the website for new riskometer.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 31 May 2023 is 2.77% of the net assets.

## Risk rate assumed to be 6.40% (FBIL Overnight MIBOR rate as on 31st May 2023).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'