Key Events for the Month of March 2022:

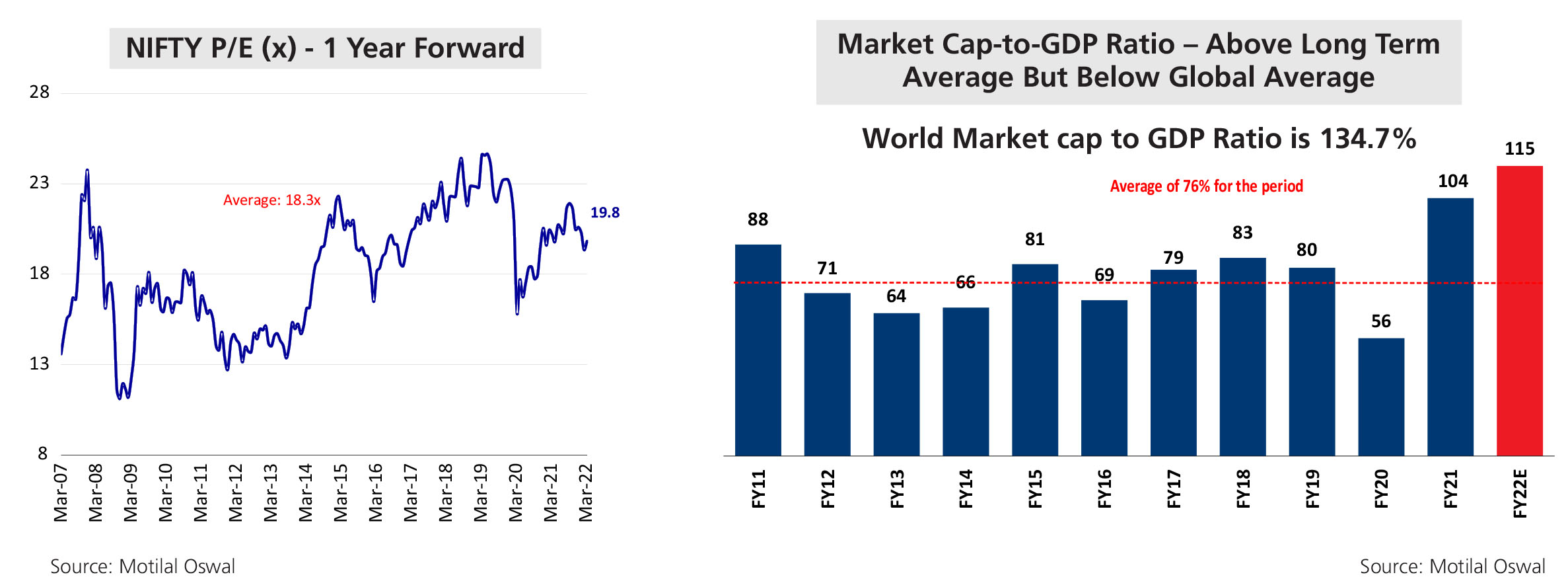

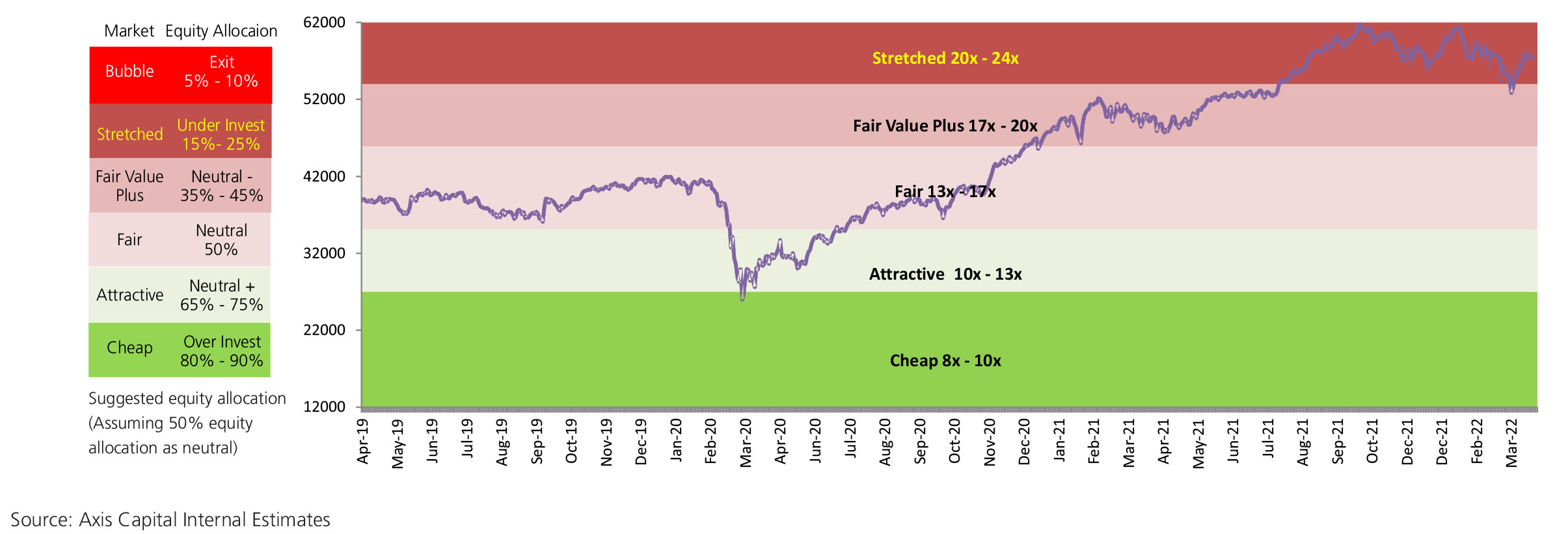

• Nifty (+4%) moved up, as the markets got enthused by BJP winning 4 of the 5 state elections. For FY22 Nifty was up 18.9%.

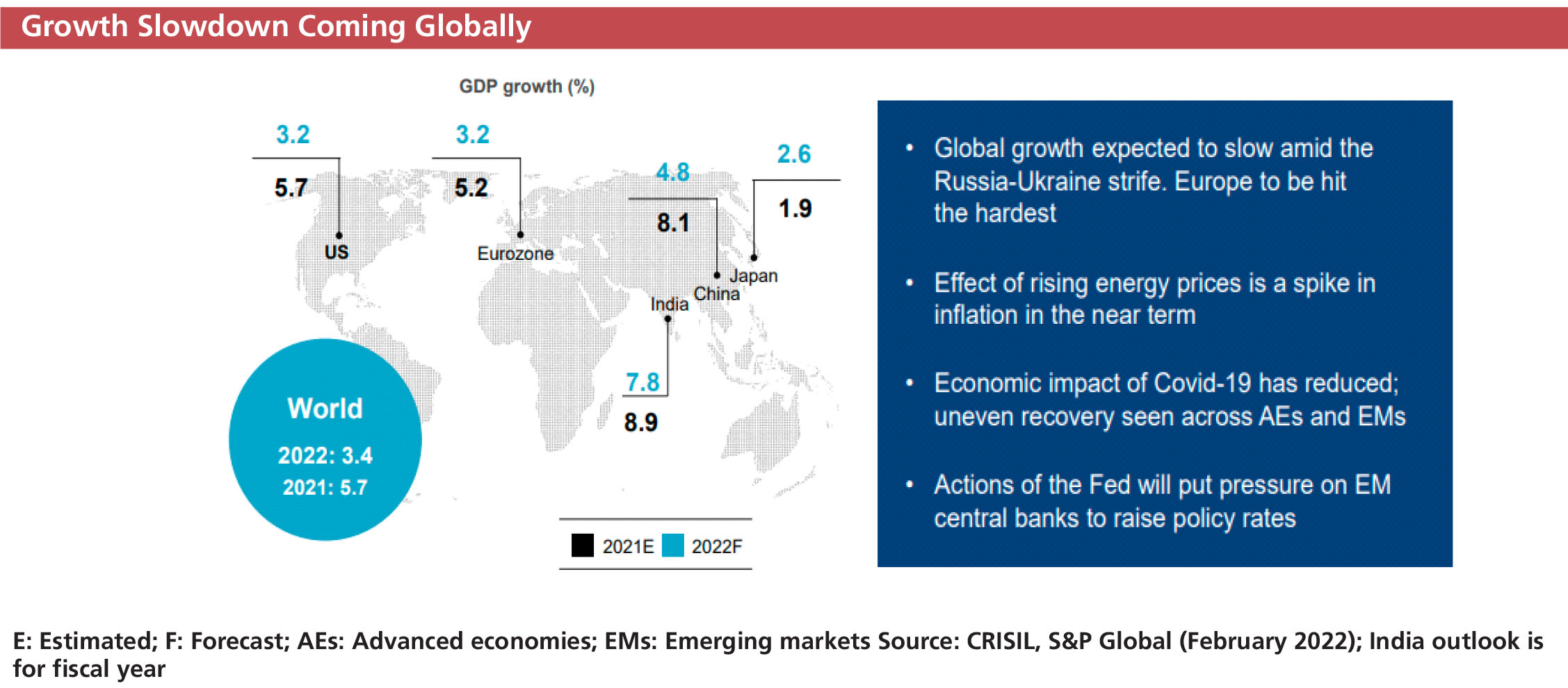

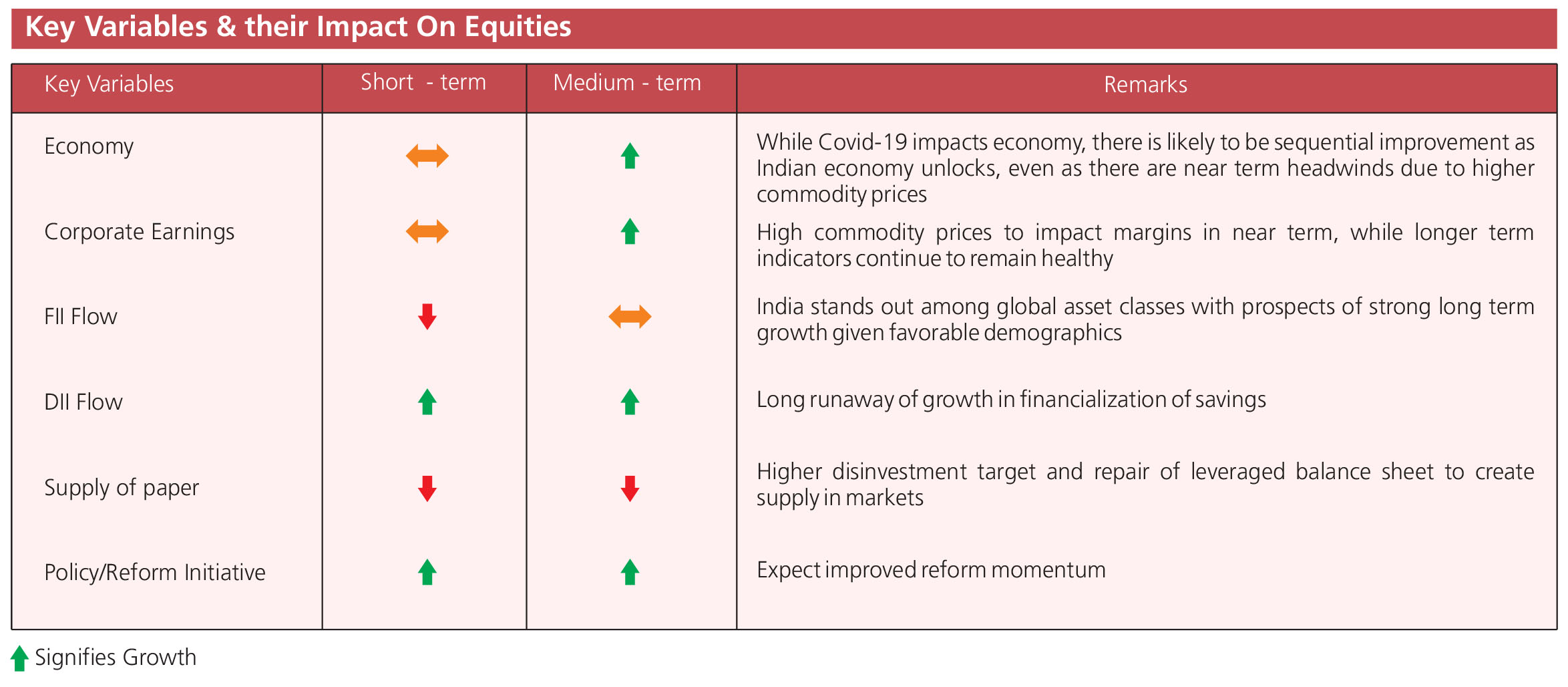

• India’s GDP growth is expected to come in at 7.8% in FY23 according to CRISIL. ICRA has lowered the same figure to 7.2% from 8% due to

elevated commodity prices and fresh supply side issues from the conflict.

• The retail inflation rate in India – measured by the CPI came in at 6.07% in February 2022. The Wholesale Price Index (WPI) based inflation of India

moved up to 13.11% year on year in February from 12.96% in January

• CAD widened to $23bn, 2.7% of GDP, in the 3rd quarter ending Dec 2021, highest in 9 years.

• The Fed finally hiked the interest rates by 0.25% in more than three years.

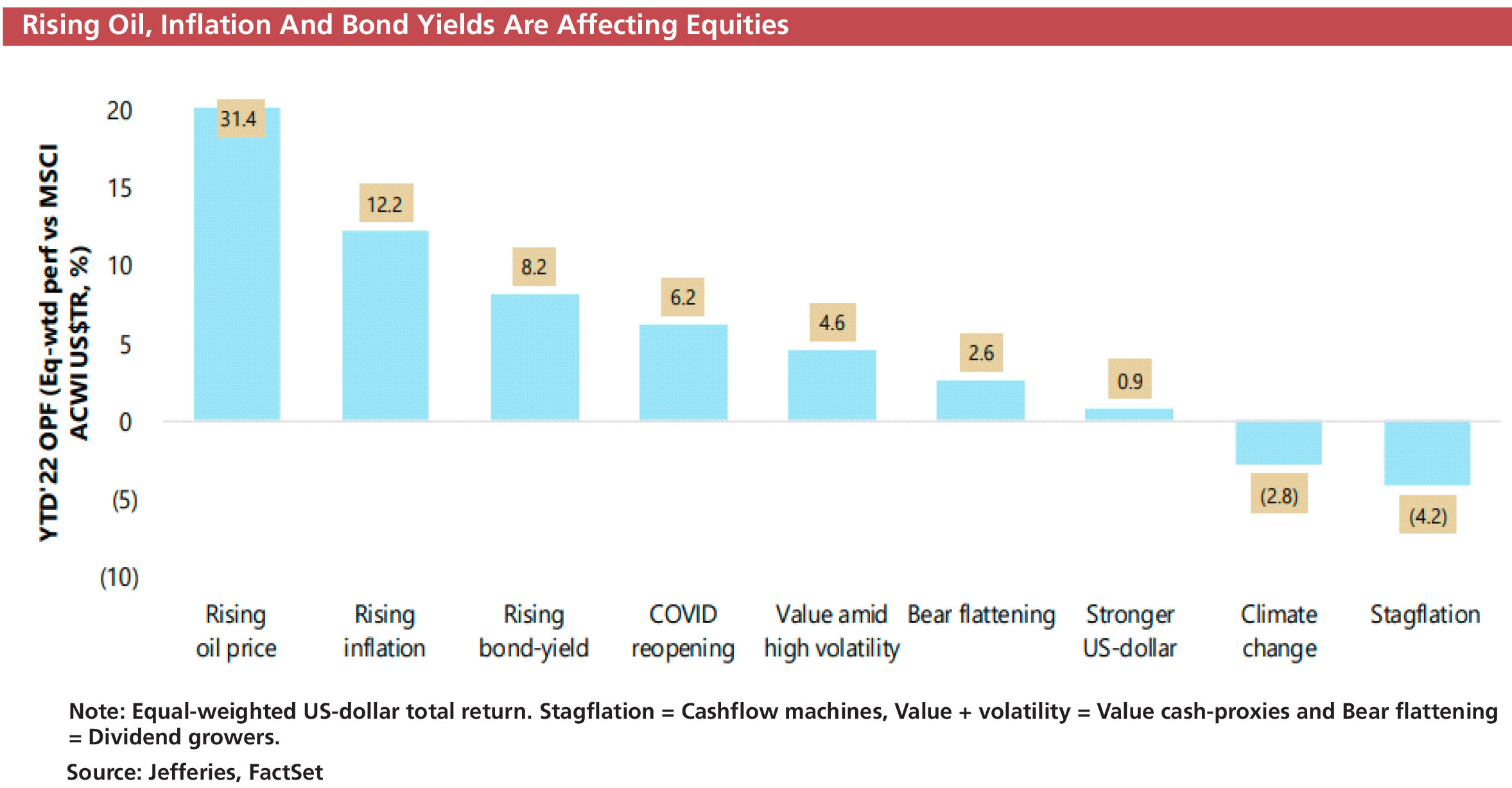

• The US 10 Yr treasury jumped by ~50 bps, while the Indian 10 Yr bond yield moved up by ~5bps with energy and metal stocks continue to do well

amid the geopolitical conflict between Russia-Ukraine.

• FIIs continued being net sellers in the month of March 2022 and were net sellers to the tune of -$4.4bn even as DII buying continued +$5.1bn.

MFs had put in +3.1bn till 29th March 2022