Investment Objective

The investment objective of the scheme is

to replicate the composition of the NIFTY

Midcap 50 Index and to generate returns

that are commensurate with the

performance of the NIFTY Midcap 50 Index,

subject to tracking errors. However, there is

no assurance or guarantee that the

investment objective of the scheme will be

achieved.

The investment objective of the scheme is

to replicate the composition of the NIFTY

Midcap 50 Index and to generate returns

that are commensurate with the

performance of the NIFTY Midcap 50 Index,

subject to tracking errors. However, there is

no assurance or guarantee that the

investment objective of the scheme will be

achieved.

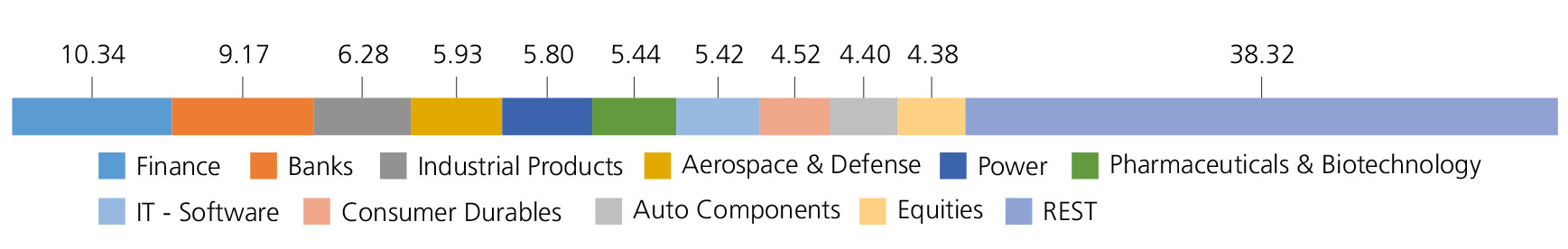

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Finance | 10.34 | |

| Shriram Transport Finance Co Ltd. | 3.56 | |

| Power Finance Corporation Ltd. | 1.68 | |

| Rural Electrification Corporation Ltd | 1.59 | |

| Mahindra & Mahindra Financial Services Ltd. | 1.44 | |

| LIC Housing Finance Ltd. | 1.37 | |

| L&T Finance Holdings Ltd | 0.70 | |

| Banks | 9.17 | |

| AU Small Finance Bank Ltd. | 3.62 | |

| Federal Bank Ltd. | 2.50 | |

| Canara Bank | 1.69 | |

| IDFC First Bank Limited | 1.36 | |

| Industrial Products | 6.28 | |

| Bharat Forge Ltd. | 2.32 | |

| Astral Ltd. | 2.03 | |

| Cummins India Ltd. | 1.93 | |

| Aerospace & Defense | 5.93 | |

| Bharat Electronics Ltd. | 3.88 | |

| Hindustan Aeronautics Ltd. | 2.05 | |

| Power | 5.80 | |

| Tata Power Co. Ltd. | 4.75 | |

| Torrent Power Ltd | 1.05 | |

| Pharmaceuticals & Biotechnology | 5.44 | |

| Alkem Laboratories Ltd. | 2.04 | |

| Aurobindo Pharma Ltd. | 2 | |

| Abbott India Ltd. | 1.40 | |

| IT - Software | 5.42 | |

| Mphasis Ltd | 2.63 | |

| Coforge Limited | 1.79 | |

| Oracle Financial Services Software Ltd | 1.00 | |

| Consumer Durables | 4.52 | |

| Voltas Ltd. | 3.12 | |

| Bata India Ltd. | 1.40 | |

| Auto Components | 4.40 | |

| Balkrishna Industries Ltd. | 2.42 | |

| MRF Limited | 1.98 | |

| Agricultural, Commercial & Construction Vehicles | 4.38 | |

| Ashok Leyland Ltd. | 2.95 | |

| Escorts Ltd. | 1.43 | |

| Retailing | 3.34 | |

| Trent Ltd | 3.34 | |

| Entertainment | 3.30 | |

| Zee Entertainment Enterprises Ltd | 2.74 | |

| Sun TV Network Ltd. | 0.56 | |

| Textiles & Apparels | 3.27 | |

| Page Industries Ltd | 3.27 | |

| Gas | 3.26 | |

| Petronet LNG Ltd. | 2.26 | |

| Gujarat Gas Ltd. | 1.00 | |

| Automobiles | 2.72 | |

| TVS Motors Company Ltd | 2.72 | |

| Electrical Equipment | 2.49 | |

| ABB India Ltd | 1.69 | |

| Bharat Heavy Electricals Ltd. | 0.80 | |

| Telecom - Services | 2.42 | |

| Tata Communications Ltd. | 1.48 | |

| Vodafone Idea Ltd | 0.94 | |

| Insurance | 2.36 | |

| Max Financial Services Ltd. | 2.36 | |

| Transport Services | 2.26 | |

| Container Corporation of India Ltd. | 2.26 | |

| Leisure Services | 2.11 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 2.11 | |

| Petroleum Products | 1.92 | |

| Hindustan Petroleum Corporation Ltd | 1.92 | |

| Realty | 1.92 | |

| Godrej Properties Limited | 1.92 | |

| Ferrous Metals | 1.86 | |

| Jindal Steel & Power Ltd. | 1.86 | |

| Beverages | 1.44 | |

| United Breweries Ltd. | 1.44 | |

| IT - Services | 1.16 | |

| L&T Technology Services Ltd | 1.16 | |

| Cement & Cement Products | 1.13 | |

| The Ramco Cements Ltd | 1.13 | |

| Industrial Manufacturing | 1.02 | |

| Honeywell Automation India Ltd. | 1.02 | |

| Equity & Equity Related - Total | 99.66 | |

| Net Current Assets/(Liabilities) | 0.34 | |

| Grand Total | 100.00 | |

NAV

| Reg-Plan-IDCW | Rs73.3530 |

Available Plans/Options

A) Regular Plan

| Fund Manager | Mr. Devender Singhal Mr. Satish Dondapati Mr. Abhishek Bisen* |

| Benchmark | Nifty Midcap 50 (Total Return Index) |

| Allotment date | January 28, 2022 |

| AAUM | Rs4.32 crs |

| AUM | Rs4.30 crs |

| Folio count | 1,753 |

Ratios

| Portfolio Turnover : | 241.96% |

Minimum Investment Amount

Through Exchange:1 Unit,

Through AMC: 35000 Units and multiple thereof,

Ideal Investment Horizon: 5 years and above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.15%

Data as on June 30, 2022

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in stocks Comprising the underlying index and endeavours to track the benchmark index

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

Total Expense Ratio includes applicable B30 fee and GST

Scheme has not completed 6 months since inception