An open ended equity scheme investing across large cap, mid cap, small cap stocks

An open ended equity scheme investing across large cap, mid cap, small cap stocks

The investment objective of the scheme is

to generate long-term capital appreciation

from a portfolio of equity and equity related

securities across market capitalization

However, there is no assurance that the

objective of the scheme will be realized.

The investment objective of the scheme is

to generate long-term capital appreciation

from a portfolio of equity and equity related

securities across market capitalization

However, there is no assurance that the

objective of the scheme will be realized.

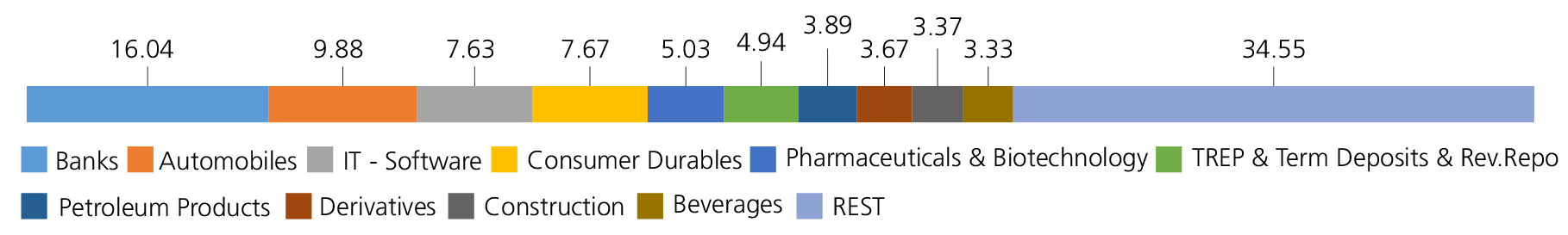

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 16.04 | |

| ICICI Bank Ltd. | 3.60 | |

| State Bank Of India | 3.56 | |

| Federal Bank Ltd. | 2.41 | |

| Indian Bank | 2.27 | |

| City Union Bank Ltd. | 1.80 | |

| Bank Of Baroda | 1.26 | |

| Axis Bank Ltd. | 1.14 | |

| Automobiles | 9.88 | |

| Maruti Suzuki India Limited | 6.08 | |

| Mahindra & Mahindra Ltd. | 2.29 | |

| Tata Motors Ltd - DVR | 1.51 | |

| Consumer Durables | 7.67 | |

| Century Plyboards (India) Ltd. | 2.53 | |

| Pokarna Ltd. | 1.55 | |

| Greenply Industries Ltd. | 1.11 | |

| Bata India Ltd. | 1.06 | |

| Kansai Nerolac Paints Ltd | 1.02 | |

| Amber Enterprises India Ltd. | 0.40 | |

| IT - Software | 7.63 | |

| Persistent Systems Limited | 3.37 | |

| Infosys Ltd. | 1.61 | |

| HCL Technologies Ltd. | 1.47 | |

| Tech Mahindra Ltd. | 1.07 | |

| Tata Consultancy Services Ltd. | 0.11 | |

| Pharmaceuticals & Biotechnology | 5.03 | |

| Sun Pharmaceuticals Industries Ltd. | 1.60 | |

| Alkem Laboratories Ltd. | 1.42 | |

| Eris Lifesciences Ltd. | 1.23 | |

| JB Chemicals & Pharmaceuticals Ltd. | 0.78 | |

| Petroleum Products | 3.89 | |

| Reliance Industries Ltd. | 2.65 | |

| Hindustan Petroleum Corporation Ltd | 1.24 | |

| Construction | 3.37 | |

| Kalpataru Power Transmission Ltd. | 1.34 | |

| KNR Constructions Ltd. | 1.06 | |

| PNC Infratech Ltd | 0.97 | |

| Beverages | 3.33 | |

| United Breweries Ltd. | 1.80 | |

| United Spirits Ltd. | 1.53 | |

| Leisure Services | 3.29 | |

| Jubilant Foodworks Limited | 1.06 | |

| Westlife Development Ltd. | 0.97 | |

| Sapphire Foods India Ltd. | 0.88 | |

| Barbeque Nation Hospitality Ltd. | 0.38 | |

| Diversified FMCG | 3.24 | |

| ITC Ltd. | 3.24 | |

| Finance | 3.20 | |

| Mahindra & Mahindra Financial Services Ltd. | 1.21 | |

| Shriram Transport Finance Co Ltd. | 1.06 | |

| Shriram City Union Finance Ltd. | 0.93 | |

| Auto Components | 3.12 | |

| Rolex Rings Ltd. | 0.95 | |

| Samvardhana Motherson International Limited | 0.92 | |

| Subros Ltd. | 0.70 | |

| Motherson Sumi Wiring India Limited | 0.55 | |

| Healthcare Services | 3.11 | |

| Max Healthcare Institute Ltd. | 2.02 | |

| Fortis Healthcare India Ltd | 1.09 | |

| Power | 2.68 | |

| National Thermal Power Corporation Limited | 2.68 | |

| Telecom - Services | 2.32 | |

| Bharti Airtel Ltd | 2.32 | |

| Aerospace & Defense | 2.27 | |

| Bharat Electronics Ltd. | 2.27 | |

| Industrial Products | 2.24 | |

| Cummins India Ltd. | 1.20 | |

| Carborundum Universal Ltd. | 1.04 | |

| Chemicals & Petrochemicals | 1.84 | |

| Tata Chemicals Ltd | 1.84 | |

| Cement & Cement Products | 1.64 | |

| Ambuja Cements Ltd. | 1.53 | |

| JK Cement Ltd. | 0.11 | |

| IT - Services | 1.51 | |

| Firstsource Solutions Ltd. | 1.51 | |

| Personal Products | 1.47 | |

| Emami Ltd. | 1.47 | |

| Realty | 1.18 | |

| Mahindra Lifespace Developers Ltd | 1.18 | |

| Entertainment | 1.14 | |

| Inox Leisure Ltd. | 1.14 | |

| Printing & Publication | 0.80 | |

| Navneet Education Ltd. | 0.80 | |

| Food Products | 0.70 | |

| Heritage Foods Ltd | 0.70 | |

| Fertilizers & Agrochemicals | 0.69 | |

| Coromandel International Ltd. | 0.47 | |

| Dhanuka Agritech Ltd. | 0.22 | |

| Agricultural Food & other Products | 0.11 | |

| Ruchi Soya Industries Ltd. | 0.11 | |

| Equity & Equity related - Total | 93.39 | |

| Mutual Fund Units | ||

| Kotak Liquid Scheme Direct Plan Growth | 1.53 | |

| Mutual Fund Units - Total | 1.53 | |

| Futures | ||

| Reliance Industries Ltd.-JUL2022 | 2.86 | |

| ICICI Bank Ltd.-JUL2022 | 0.81 | |

| Triparty Repo | 4.94 | |

| Net Current Assets/(Liabilities) | 0.14 | |

| Grand Total | 100.00 | |

| | ||

Equity Derivative Exposuer is 3.67%

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 44.40, 26.43, 26.23, & 2.94.

| Reg-Plan-IDCW | Rs8.8650 |

| Dir-Plan-IDCW | Rs8.9840 |

| Growth option | Rs8.8650 |

| Direct Growth option | Rs8.9840 |

A) Regular Plan B) Direct Plan

Growth and Income Distribution cum

capital withdrawal (IDCW) (Payout and

Reinvestment) (applicable for all plans)

| Fund Manager | Mr. Harsha Upadhyaya,

Mr. Devender Singhal,

Mr. Abhishek Bisen & Mr. Arjun Khanna* (Dedicated fund manager for investments in foreign securities) |

| Benchmark | Nifty 500 Multicap 50:25:25 TRI |

| Allotment date | September 29, 2021 |

| AAUM | Rs3,610.28 crs |

| AUM | Rs3,630.78 crs |

| Folio count | 2,11,058 |

Trustee's Discretion

| Portfolio Turnover | 14.27% |

Initial Investment: Rs5000 and in multiple ofRs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a)For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b)If units redeemed or switched out are

excess of the limit within 1 year from the

date of allotment: 1%

c)If units are redeemed or switched out

or after 1 year from the date of allotment:

NIL

Regular: 1.95%; Direct: 0.22%

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities across market capitalisation.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'