| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

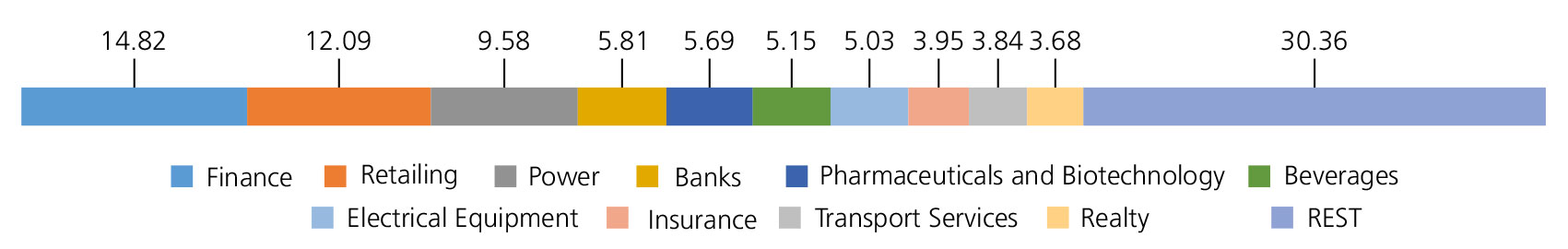

| Finance | 14.82 | |

| JIO FINANCIAL SERVICES LTD | 3.59 | |

| Power Finance Corporation Ltd. | 2.78 | |

| REC LTD | 2.54 | |

| Cholamandalam Investment and Finance Company Ltd. | 2.43 | |

| Bajaj Holdings and Investment Ltd. | 2.26 | |

| INDIAN RAILWAY FINANCE CORPORATION LTD. | 1.22 | |

| Retailing | 12.09 | |

| ZOMATO LTD. | 6.91 | |

| Info Edge (India) Ltd. | 2.73 | |

| AVENUE SUPERMARTS LTD. | 2.45 | |

| Power | 9.58 | |

| Tata Power Co. Ltd. | 2.78 | |

| Adani Power Ltd. | 1.82 | |

| ADANI GREEN ENERGY LTD. | 1.38 | |

| JSW ENERGY LTD. | 1.23 | |

| ADANI ENERGY SOLUTIONS LTD. | 1.22 | |

| NHPC LIMITED | 1.15 | |

| Banks | 5.81 | |

| Bank Of Baroda | 1.80 | |

| PUNJAB NATIONAL BANK | 1.58 | |

| CANARA BANK | 1.42 | |

| UNION BANK OF INDIA | 1.01 | |

| Pharmaceuticals and Biotechnology | 5.69 | |

| Divi s Laboratories Ltd. | 3.20 | |

| Torrent Pharmaceuticals Ltd. | 1.39 | |

| Zydus Lifesciences Limited | 1.10 | |

| Beverages | 5.15 | |

| VARUN BEVERAGES LTD | 3.25 | |

| UNITED SPIRITS LTD. | 1.90 | |

| Electrical Equipment | 5.03 | |

| Siemens Ltd. | 2.43 | |

| ABB India Ltd | 1.39 | |

| Bharat Heavy Electricals Ltd. | 1.21 | |

| Insurance | 3.95 | |

| ICICI Lombard General Insurance Company Ltd | 2.01 | |

| ICICI Prudential Life Insurance Company Ltd | 1.09 | |

| LIFE INSURANCE CORPORATION OF INDIA LTD. | 0.85 | |

| Transport Services | 3.84 | |

| Inter Globe Aviation Ltd | 3.84 | |

| Realty | 3.68 | |

| DLF Ltd. | 2.16 | |

| MACROTECH DEVELOPERS LTD | 1.52 | |

| Aerospace and Defense | 3.38 | |

| HINDUSTAN AERONAUTICS LTD. | 3.38 | |

| Diversified Metals | 3.38 | |

| Vedanta Ltd. | 3.38 | |

| Personal Products | 3.33 | |

| Godrej Consumer Products Ltd. | 1.91 | |

| Dabur India Ltd. | 1.42 | |

| Cement and Cement Products | 3.25 | |

| Shree Cement Ltd. | 1.69 | |

| Ambuja Cements Ltd. | 1.56 | |

| Auto Components | 3.01 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 1.88 | |

| Bosch Ltd. | 1.13 | |

| Gas | 2.97 | |

| GAIL (India) Ltd. | 2.16 | |

| ADANI TOTAL GAS LTD. | 0.81 | |

| Automobiles | 2.61 | |

| TVS Motors Company Ltd | 2.61 | |

| IT - Software | 2.47 | |

| LTIMindtree Limited | 2.47 | |

| Petroleum Products | 2.18 | |

| Indian Oil Corporation Ltd | 2.18 | |

| Chemicals and Petrochemicals | 2.00 | |

| Pidilite Industries Ltd. | 2.00 | |

| Consumer Durables | 1.79 | |

| Havells India Ltd. | 1.79 | |

| Ferrous Metals | 1.36 | |

| Jindal Steel & Power Ltd. | 1.36 | |

| Leisure Services | 1.12 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 1.12 | |

| Equity & Equity related - Total | 102.49 | |

| Triparty Repo | 2.54 | |

| Net Current Assets/(Liabilities) | -5.03 | |

| Grand Total | 100.00 | |

For detailed portfolio log on to:

https://www.kotakmf.com/Products/funds/index-funds/Kotak-Nifty-Next-50-Index-Fund/Reg-G

| Regular | Direct | |

| Growth | Rs17.9539 | Rs18.3199 |

| IDCW | Rs17.9543 | Rs18.3197 |

Regular & Direct Plan

Options: Payout of IDCW, Reinvestment

of IDCW & Growth (applicable for all

plans)

| Fund Manager* | Mr. Devender Singhal & Mr. Satish Dondapati |

| Benchmark | Nifty Next 50 Index TRI |

| Allotment date | March 10, 2021 |

| AAUM | Rs409.28 crs |

| AUM | Rs 423.16 crs |

| Folio count | 37,390 |

Trustee's Discretion

| Portfolio Turnover : | 64.19% |

| Tracking Error : | 0.18% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Trustee's Discretion

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil. (applicable for all plans)

| Regular Plan: | 0.60% |

| Direct Plan: | 0.11% |

Folio Count data as on 31st December 2024.

Fund

Benchmark : Nifty Next 50 Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Returns that are commensurate with the performance of NIFTY Next 50 Index, subject to tracking error

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st December, 2024. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable B30 fee and GST

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'