Investment Objective

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total returns of the securities as represented by the

underlying index, subject to tracking errors. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

The investment objective of the scheme is to provide returns that, before expenses, corresponding to the total returns of the securities as represented by the

underlying index, subject to tracking errors. However, there is no guarantee or assurance that the investment objective of the scheme will be achieved.

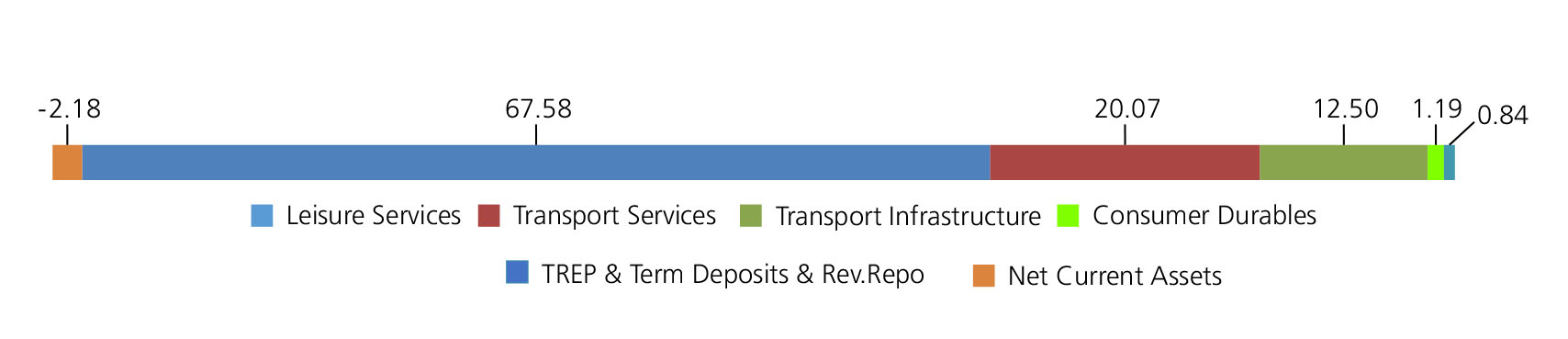

| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity Related | ||

| Leisure Services | 67.58 | |

| INDIAN HOTELS COMPANY LTD. | 19.31 | |

| Jubilant Foodworks Limited | 12.89 | |

| Indian Railway Catering And Tourism Corporation Ltd. | 11.90 | |

| EIH Ltd. | 3.80 | |

| SAPPHIRE FOODS INDIA LTD. | 3.27 | |

| DEVYANI INTERNATIONAL LIMITED | 3.25 | |

| LEMON TREE HOTELS LTD | 3.22 | |

| CHALET HOTELS LTD. | 2.63 | |

| BLS INTERNATIONAL SERVICES LTD. | 2.53 | |

| Westlife Development Ltd. | 2.36 | |

| TBO TEK LIMITED | 1.28 | |

| EASY TRIP PLANNERS LTD | 1.14 | |

| Transport Services | 20.07 | |

| Inter Globe Aviation Ltd | 20.07 | |

| Transport Infrastructure | 12.50 | |

| GMR AIRPORTS LIMITED | 12.50 | |

| Consumer Durables | 1.19 | |

| VIP Industries Ltd. | 1.19 | |

| Equity & Equity related - Total | 101.34 | |

| Triparty Repo | 0.84 | |

| Net Current Assets/(Liabilities) | -2.18 | |

| Grand Total | 100.00 | |

Net Asset Value (NAV)

| Regular | Direct | |

| Growth | Rs9.1413 | Rs9.1620 |

| IDCW | Rs9.1413 | Rs9.1620 |

Available Plans/Options

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Devender Singhal, Mr. Satish Dondapati, Mr. Abhishek Bisen |

| Benchmark | Nifty India Tourism Index TRI |

| AAUM | Rs24.01 crs |

| AUM | Rs23.88 crs |

| Allotment date | September 23, 2024 |

| Folio count | 13,441 |

IDCW Frequency

Trustee's Discretion

Ratios

| Portfolio Turnover : | 13.56% |

| Tracking Error: | 0.15% |

Minimum Investment Amount

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

Ideal Investments Horizon

• 5 years & above

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load:

Nil.

Total Expense Ratio**

| Regular Plan: | 0.96% |

| Direct Plan: | 0.33% |

Data as on 31st January, 2025 unless

otherwise specified.

Folio Count data as on 31st December 2024.

Folio Count data as on 31st December 2024.

Fund

Benchmark : Nifty India Tourism Index TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Return that corresponds to the performance of Nifty India Tourism Index subject to tracking error.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st December, 2024. An addendum may be issued or updated on the website for new riskometer.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

Total Expense Ratio includes applicable B30 fee and GST

The scheme has not completed 6 month since inception