An open-ended Sectoral Target Maturity Debt Index Fund investing in constituents of CRISIL-IBX AAA Financial Services Index – Sep 2027. A relatively high interest rate risk and relatively low credit risk.

An open-ended Sectoral Target Maturity Debt Index Fund investing in constituents of CRISIL-IBX AAA Financial Services Index – Sep 2027. A relatively high interest rate risk and relatively low credit risk.

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Public Sector Undertakings | ||

| National Housing Bank | CRISIL AAA | 4.47 |

| REC LTD | ICRA AAA | 2.22 |

| NATIONAL BANK FOR AGRICULTURE & RURAL DEVELOPMENT | FITCH AAA | 1.11 |

| Public Sector Undertakings - Total | 7.80 | |

| Corporate Debt/Financial Institutions | ||

| HDB Financial Services Ltd. | CRISIL AAA | 13.25 |

| AXIS Finance Ltd. | CARE AAA | 12.58 |

| Kotak Mahindra Prime Ltd. | CRISIL AAA | 11.15 |

| LIC HOUSING FINANCE LTD. | CRISIL AAA | 11.15 |

| ADITYA BIRLA HOUSING FINANCE LTD | CRISIL AAA | 10.05 |

| BAJAJ FINANCE LTD. | CRISIL AAA | 8.93 |

| TATA CAPITAL LTD. | CRISIL AAA | 8.90 |

| Mahindra & Mahindra Financial Services Ltd. | CRISIL AAA | 5.55 |

| L & T Finance Ltd. | ICRA AAA | 3.80 |

| TATA CAPITAL HOUSING FINANCE LTD. | CRISIL AAA | 2.22 |

| Corporate Debt/Financial Institutions - Total | 87.58 | |

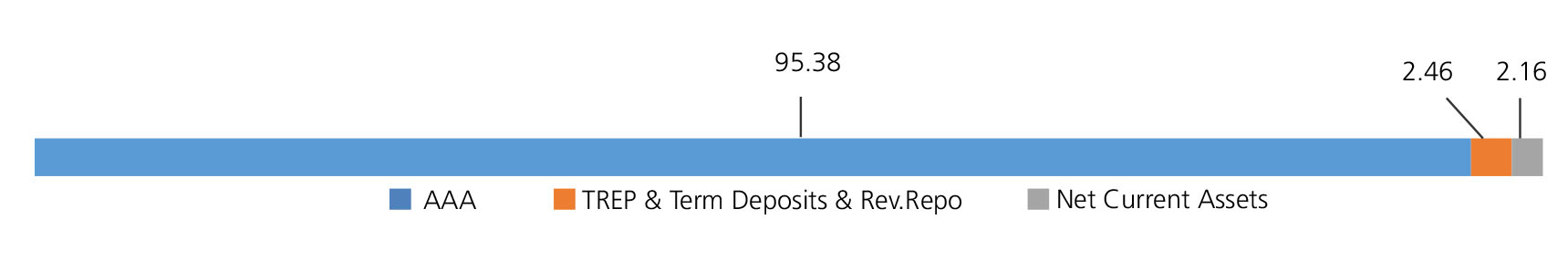

| Triparty Repo | 2.46 | |

| Net Current Assets/(Liabilities) | 2.16 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs10.3115 | Rs10.3199 |

| IDCW | Rs10.3115 | Rs10.3192 |

A) Regular B) Direct Plan

Options: a) Growth

b) Income Distribution cum Capital

Withdrawal (IDCW)

• Payout of Income Distribution cum

Capital Withdrawal Option.

• Reinvestment of Income Distribution

cum Capital Withdrawal Option.

| Fund Manager* | Mr. Abhishek Bisen |

| Benchmark | CRISIL-IBX AAA Financial Services Index - Sep 2027 |

| Allotment date | September 13, 2024 |

| AAUM | Rs437.00 crs |

| AUM | Rs450.20 crs |

| Folio count | 5,362 |

| Average Maturity | 2.40 yrs |

| Modified Duration | 2.01 yrs |

| Macaulay Duration | 2.17 yrs |

| Annualised YTM* | 7.78% |

| Tracking Error | 0.40% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 1 year & above

Entry Load:

Nil. (applicable for all plans)

Exit Load: Nil.

• For redemption / switch-out of units on

or before 30 days from the date of

allotment: 0.25% of applicable NAV.

• For redemption / switch-out of units after

30 days from the date of allotment-Nil.

| Regular Plan: | 0.40% |

| Direct Plan: | 0.20% |

Folio Count data as on 31st December 2024.

Fund

Benchmark : CRISIL-IBX AAA Financial Services Index - Sep 2027

This product is suitable for investors who are seeking*:

- Income over Target Maturity Period

- An open-ended Target Maturity Index Fund tracking CRISIL-IBX AAA Financial Services Index - Sep 2027.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st December, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

The scheme has not completed 6 month since inception

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'