| Issuer/Instrument | |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

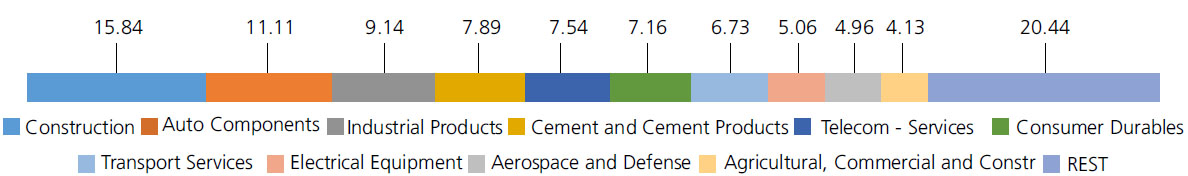

| Construction | 15.84 | |

| Larsen And Toubro Ltd. | 4.91 | |

| KALPATARU PROJECTS INTERNATIONAL LIMITED | 3.01 | |

| Ashoka Buildcon Limited | 2.86 | |

| G R Infraprojects Limited | 2.05 | |

| CEIGALL INDIA LIMITED | 1.12 | |

| H G Infra Engineering Ltd. | 1.12 | |

| PNC Infratech Ltd | 0.77 | |

| Auto Components | 11.11 | |

| Bosch Ltd. | 2.23 | |

| Exide Industries Ltd | 1.58 | |

| Apollo Tyres Ltd. | 1.57 | |

| SAMVARDHANA MOTHERSON INTERNATIONAL LIMITED | 1.47 | |

| Schaeffler India Ltd | 1.29 | |

| Bharat Forge Ltd. | 1.21 | |

| Sansera Engineering Ltd. | 1.08 | |

| Rolex Rings Ltd. | 0.68 | |

| Industrial Products | 9.14 | |

| Cummins India Ltd. | 2.07 | |

| Ratnamani Metals & Tubes Ltd. | 1.90 | |

| AIA Engineering Limited. | 1.86 | |

| WPIL LTD | 1.30 | |

| SUPREME INDUSTRIES LIMITED | 0.75 | |

| Carborundum Universal Ltd. | 0.69 | |

| SKF India Ltd | 0.57 | |

| Cement and Cement Products | 7.89 | |

| Shree Cement Ltd. | 4.32 | |

| Ultratech Cement Ltd. | 3.57 | |

| Telecom - Services | 7.54 | |

| Bharti Airtel Ltd | 5.85 | |

| BHARTI HEXACOM LTD. | 1.69 | |

| Consumer Durables | 7.16 | |

| GREENPANEL INDUSTRIES LTD | 3.06 | |

| Kajaria Ceramics Ltd. | 2.64 | |

| V-Guard Industries Ltd. | 1.46 | |

| Transport Services | 6.73 | |

| MAHINDRA LOGISTICS LTD | 2.37 | |

| Inter Globe Aviation Ltd | 2.21 | |

| Container Corporation of India Ltd. | 2.15 | |

| Electrical Equipment | 5.06 | |

| AZAD ENGINEERING LTD | 1.61 | |

| ABB India Ltd | 1.32 | |

| PREMIER ENERGIES LIMITED | 1.27 | |

| Thermax Ltd. | 0.86 | |

| Aerospace and Defense | 4.96 | |

| ZEN TECHNOLOGIES LTD | 2.67 | |

| Bharat Electronics Ltd. | 1.30 | |

| ASTRA MICROWAVE PRODUCTS LTD. | 0.99 | |

| Agricultural, Commercial and Construction Vehicles | 4.13 | |

| V.S.T Tillers Tractors Ltd | 2.69 | |

| Ashok Leyland Ltd. | 1.44 | |

| Industrial Manufacturing | 3.94 | |

| JYOTI CNC AUTOMATION LTD | 2.15 | |

| Tega Industries Ltd. | 1.16 | |

| JNK INDIA LIMITED | 0.63 | |

| Chemicals and Petrochemicals | 3.26 | |

| SOLAR INDUSTRIES INDIA LIMITED | 3.26 | |

| Power | 3.01 | |

| NTPC GREEN ENERGY LIMITED | 2.36 | |

| NTPC LTD | 0.65 | |

| Finance | 2.35 | |

| Power Finance Corporation Ltd. | 2.35 | |

| Realty | 2.04 | |

| Mahindra Lifespace Developers Ltd | 1.15 | |

| BRIGADE ENTERPRISES LIMITED | 0.89 | |

| Petroleum Products | 1.71 | |

| Indian Oil Corporation Ltd | 1.71 | |

| Gas | 1.54 | |

| Gujarat State Petronet Ltd. | 1.54 | |

| Other Utilities | 1.01 | |

| CONCORD ENVIRO SYSTEMS LIMITED | 1.01 | |

| Equity & Equity related - Total | 98.42 | |

| Triparty Repo | 1.75 | |

| Net Current Assets/(Liabilities) | -0.17 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (₹) | 20,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Jan 31, 2025 (₹) | 97,70,877 | 32,87,435 | 19,66,804 | 12,15,281 | 5,09,542 | 1,15,194 |

| Scheme Returns (%) | 16.44 | 19.13 | 23.87 | 28.64 | 23.87 | -7.32 |

| Nifty Infrastructure (TRI) Returns (%) | 11.31 | 16.72 | 20.66 | 23.55 | 21.56 | -8.50 |

| Alpha* | 5.13 | 2.41 | 3.21 | 5.09 | 2.31 | 1.18 |

| Nifty Infrastructure (TRI) (₹)# | 58,35,357 | 28,86,466 | 17,54,838 | 10,75,882 | 4,93,549 | 1,14,409 |

| Nifty 50 (TRI) (₹)^ | 70,79,851 | 25,27,121 | 14,40,370 | 8,96,726 | 4,39,534 | 1,20,014 |

| Nifty 50 (TRI) Returns (%) | 13.26 | 14.24 | 15.12 | 16.06 | 13.37 | 0.02 |

| Regular | Direct | |

| Growth | Rs62.3217 | Rs73.0947 |

| IDCW | Rs49.8431 | Rs72.2587 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Nalin Rasik Bhatt |

| Benchmark | Nifty Infrastructure TRI (Tier 1) |

| Allotment date | February 25, 2008 |

| AAUM | Rs2,299.33 crs |

| AUM | Rs2,251.13 crs |

| Folio count | 1,48,876 |

Trustee's Discretion

| Portfolio Turnover | 22.27% |

| $Beta | 0.76 |

| $Sharpe ## | 1.11 |

| $Standard Deviation | 14.68% |

| ^^(P/E) | 28.54 |

| ^^P/BV | 4.53 |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 5 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

• For redemption / switch out within 90

days from the date of allotment: 0.5%

• If units are redeemed or switched out on

or after 90 days from the date of allotment -

Nil.

| Regular Plan: | 2.00% |

| Direct Plan: | 0.67% |

Folio Count data as on 31st December 2024.

Benchmark - Tier 1 : Nifty Infrastructure TRI

This product is suitable for investors who are seeking*:

- Long term capital growth

- Long term capital appreciation by investing in equity and equity related instruments of companies contributing to infrastructure and economic development of India.

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st December, 2024. An addendum may be issued or updated on the website for new riskometer.

## Risk rate assumed to be 6.65% (FBIL Overnight MIBOR rate as on 31st Jan 2024).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'