An open ended fund of fund scheme investing in units of Kotak Gold Exchange Traded Fund

An open ended fund of fund scheme investing in units of Kotak Gold Exchange Traded Fund

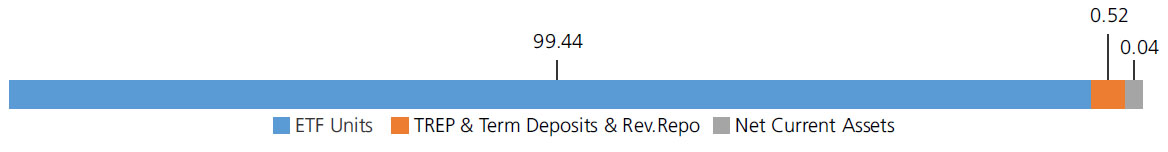

| Issuer/Instrument | Rating | % to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Kotak Mutual Fund - Kotak Gold ETF | ETF Units | 99.44 |

| Mutual Fund Units - Total | 99.44 | |

| Triparty Repo | 0.52 | |

| Net Current Assets/(Liabilities) | 0.04 | |

| Grand Total | 100.00 | |

| Regular | Direct | |

| Growth | Rs32.0790 | Rs33.7423 |

| IDCW | Rs32.0790 | Rs33.7420 |

A)Regular Plan B)Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager* | Mr. Abhishek Bisen & Mr. Jeetu Valechha Sonar |

| Benchmark | Price of Physical Gold |

| Allotment date | March 25, 2011 |

| AAUM | Rs2,402.54 crs |

| AUM | Rs2,520.47 crs |

| Folio count | 96,246 |

Trustee's Discretion

| Portfolio Turnover : | 1.26% |

Initial & Additional Investment

• Rs100 and any amount thereafter

Systematic Investment Plan (SIP)

• Rs 100 and any amount thereafter

• 3 years & above

Entry Load:

Nil. (applicable for all plans)

Exit Load:

a) If redeemed or switched out on or before

completion of 15 days from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 15 days from the date of

allotment of units-NIL

| Regular Plan: | 0.50% |

| Direct Plan: | 0.16% |

Folio Count data as on 31st December 2024.

Fund

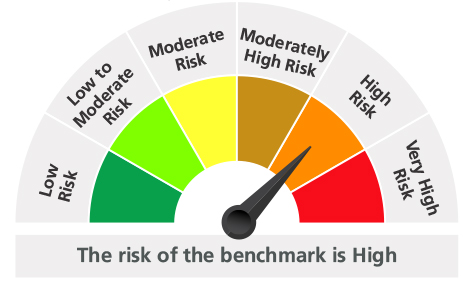

Benchmark : Price of Physical Gold

This product is suitable for investors who are seeking*:

- Returns in line with physical gold over medium to long term, subject to tracking error

- Investment in Kotak Gold ETF

* Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The above risk-o—meter is based on the scheme portfolio as on 31st December, 2024. An addendum may be issued or updated on the website for new riskometer.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'For Regular Plan' & 'For Direct Plan'

For scheme performance, please refer 'For Regular Plan' & 'For Direct Plan'