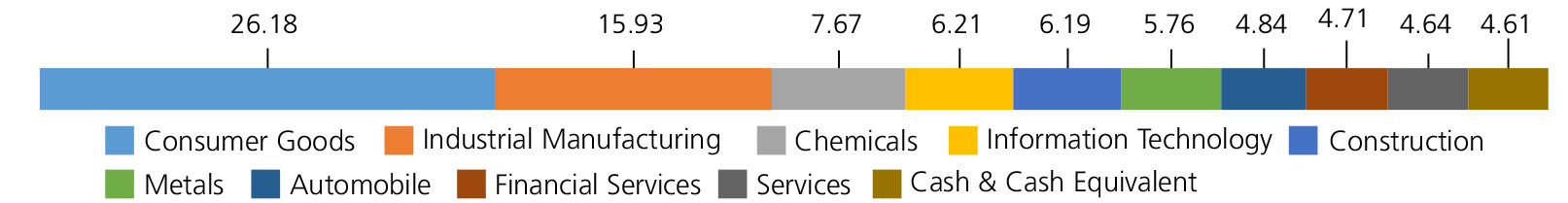

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Consumer Durables | 27.97 | |

| Century Plyboards (India) Ltd. | 5.46 | |

| Sheela Foam Ltd | 4.60 | |

| Somany Ceramics Ltd. | 3.29 | |

| Amber Enterprises India Ltd. | 3.23 | |

| Blue Star Ltd. | 2.51 | |

| V-Guard Industries Ltd. | 2.36 | |

| Orient Electric Ltd. | 2.12 | |

| VIP Industries Ltd. | 1.67 | |

| Kajaria Ceramics Ltd. | 1.57 | |

| Dixon Technologies India Ltd. | 1.16 | |

| Industrial Products | 12.76 | |

| Carborundum Universal Ltd. | 4.14 | |

| Supreme Industries Limited | 3.02 | |

| Nilkamal Ltd | 1.96 | |

| Schaeffler India Ltd | 1.76 | |

| Apollo Pipes Ltd. | 1.11 | |

| WPIL Ltd | 0.45 | |

| Finolex Cables Ltd. | 0.32 | |

| Chemicals | 7.68 | |

| Galaxy Surfactants Ltd. | 3.40 | |

| Solar Industries India Limited | 1.85 | |

| Laxmi Organic Industries Limited | 1.45 | |

| Atul Ltd. | 0.88 | |

| Clean Science and Technology Ltd | 0.10 | |

| Software | 6.21 | |

| Persistent Systems Limited | 3.06 | |

| Cyient Ltd. | 2.82 | |

| Happiest Minds Technologies Limited | 0.33 | |

| Ferrous Metals | 5.77 | |

| Ratnamani Metals & Tubes Ltd. | 2.53 | |

| Shyam Metalics and Energy Ltd | 1.98 | |

| APL Apollo Tubes Ltd. | 1.26 | |

| Auto Ancillaries | 3.45 | |

| Rolex Rings Ltd. | 1.24 | |

| Sandhar Technologies Ltd. | 0.72 | |

| Sansera Engineering Ltd. | 0.57 | |

| Motherson Sumi Systems Ltd. | 0.47 | |

| Varroc Engineering Ltd. | 0.32 | |

| Motherson Sumi Wiring India Limited | 0.13 | |

| Transportation | 3.08 | |

| Blue Dart Express Ltd. | 2.41 | |

| Great Eastern Shipping Company Ltd | 0.67 | |

| Banks | 2.79 | |

| ICICI Bank Ltd. | 1.81 | |

| AU Small Finance Bank Ltd. | 0.98 | |

| Industrial Capital Goods | 2.77 | |

| BEML Ltd. | 1.50 | |

| Thermax Ltd. | 1.27 | |

| Retailing | 2.53 | |

| Medplus Health Services Ltd. | 0.77 | |

| V-Mart Retail Ltd. | 0.76 | |

| Shoppers Stop Ltd. | 0.67 | |

| Go Fashion (India) Ltd. | 0.33 | |

| Cement & Cement Products | 2.43 | |

| JK Cement Ltd. | 1.75 | |

| The Ramco Cements Ltd | 0.68 | |

| Textile Products | 2.25 | |

| Lux Industries Limited | 1.96 | |

| Kewal Kiran Clothing Limited. | 0.29 | |

| Construction | 1.72 | |

| Mahindra Lifespace Developers Ltd | 0.98 | |

| JMC Projects (India) Ltd. | 0.74 | |

| Pesticides | 1.64 | |

| P I Industries Ltd | 0.83 | |

| Dhanuka Agritech Ltd. | 0.81 | |

| Finance | 1.61 | |

| Shriram City Union Finance Ltd. | 0.75 | |

| Aavas Financiers Ltd. | 0.53 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.28 | |

| Anand Rathi Wealth Ltd. | 0.05 | |

| Household Appliances | 1.56 | |

| Hawkins Cooker Ltd | 1.56 | |

| Pharmaceuticals | 1.55 | |

| Torrent Pharmaceuticals Ltd. | 0.80 | |

| Alembic Pharmaceuticals Ltd. | 0.43 | |

| Cadila Healthcare Ltd | 0.32 | |

| Auto | 1.53 | |

| V.S.T Tillers Tractors Ltd | 1.53 | |

| Consumer Non Durables | 1.49 | |

| Prataap Snacks Ltd | 1.06 | |

| Heritage Foods Ltd | 0.43 | |

| Construction Project | 1.18 | |

| Techno Electric & Engineering Company Limited | 1.18 | |

| Textiles - Synthetic | 1.08 | |

| Garware Technical Fibres Ltd. | 1.08 | |

| Fertilisers | 0.76 | |

| Coromandel International Ltd. | 0.76 | |

| Oil | 0.63 | |

| Hindustan Oil Exploration Company Ltd. | 0.63 | |

| Aerospace & Defense | 0.40 | |

| MTAR Technologies Ltd. | 0.40 | |

| Capital Markets | 0.30 | |

| UTI Asset Management Company Ltd | 0.30 | |

| Leisure Services | 0.25 | |

| Barbeque Nation Hospitality Ltd. | 0.25 | |

| Equity & Equity Related - Total | 95.39 | |

| Triparty Repo | 5.03 | |

| Net Current Assets/(Liabilities) | -0.42 | |

| Grand Total | 100.00 | |

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 3.40%, 22.07%, 69.92% & 4.61.

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 20,40,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Jan 31, 2022 (Rs) | 1,17,67,247 | 40,06,509 | 19,56,801 | 12,36,123 | 7,02,326 | 1,42,129 |

| Scheme Returns (%) | 18.26 | 22.79 | 23.74 | 29.37 | 48.55 | 35.78 |

| NIFTY Smallcap 250 (TRI) Returns (%) | NA | 18.26 | 18.60 | 23.26 | 43.38 | 39.82 |

| Alpha* | NA | 4.53 | 5.13 | 6.10 | 5.17 | -4.04 |

| NIFTY Smallcap 250 (TRI) (Rs)# | NA | 31,36,076 | 16,30,597 | 10,68,370 | 6,58,471 | 1,44,513 |

| Nifty Smallcap 100 (TRI) Returns (%) | 12.85 | 15.93 | 16.74 | 20.98 | 40.62 | 34.14 |

| Alpha* | 5.42 | 6.86 | 7.00 | 8.39 | 7.93 | 1.64 |

| Nifty Smallcap 100 (TRI) (Rs)# | 67,96,748 | 27,65,731 | 15,25,798 | 10,10,988 | 6,35,844 | 1,41,157 |

| Nifty 50 (TRI) (Rs)^ | 71,25,653 | 26,17,944 | 14,85,132 | 9,39,897 | 5,11,810 | 1,31,088 |

| Nifty 50 (TRI) Returns (%) | 13.32 | 14.91 | 15.98 | 17.99 | 24.21 | 17.52 |

TRI – Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI).

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of 10,000/- investment made at inception. Source: ICRA MFI Explorer.

*Alpha is difference of scheme return with benchmark return.

| Reg-Plan-IDCW | Rs71.4380 |

| Dir-Plan-IDCW | Rs80.8430 |

| Growth option | Rs163.7480 |

| Direct Growth option | Rs184.0560 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Pankaj Tibrewal* |

| Benchmark*** | NIFTY Smallcap 250

TRI (Tier 1) NIFTY Smallcap 100 TRI (Tier 2) |

| Allotment date | February 24, 2005 |

| AAUM | Rs6,897.30 crs |

| AUM | Rs6,810.75 crs |

| Folio count | 4,22,207 |

Trustee's Discretion

| Portfolio Turnover | 11.06% |

| $Beta | 0.89 |

| $Sharpe ## | 1.13 |

| $Standard Deviation | 27.29% |

| (P/E) | 42.24 |

| P/BV | 5.22 |

| IDCW Yield | 0.60 |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the date

of allotment: 1%

c) If units are redeemed or switched out on or

after 1 year from the date of allotment: NIL

Regular: 1.95%; Direct: 0.49%

Benchmark

Benchmark

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity & equity related securities predominantly in small cap Stocks.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

***As per SEBI Circular dated 27th October 2021 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 3.40% (FBIL Overnight MIBOR rate as on 31st January 2022).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'