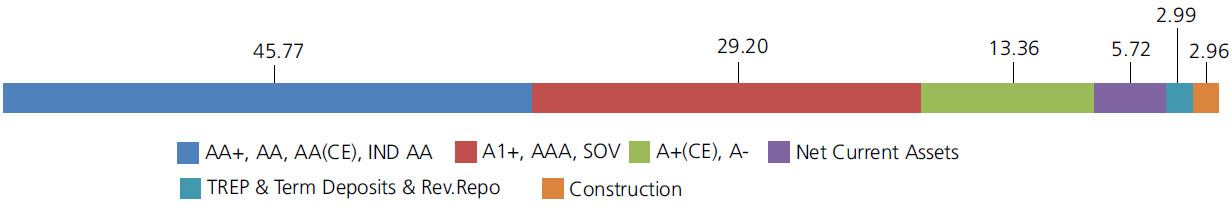

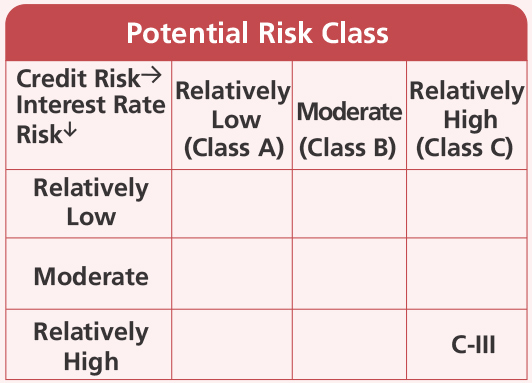

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

A relatively high interest rate risk and relatively high credit risk.

An open ended debt scheme predominantly investing in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds).

A relatively high interest rate risk and relatively high credit risk.

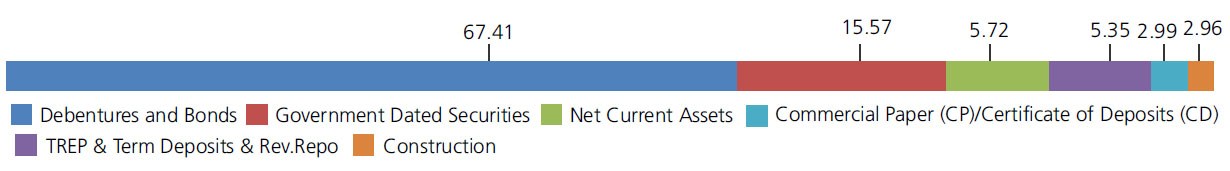

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Mutual Fund Units | ||

| Mutual Fund Units - Total | 2.96 | |

| Embassy Office Parks REIT | Construction | 1.96 |

| Brookfield India Real Estate Trust | Construction | 1.00 |

| Debt Instruments | ||

| Debentures and Bonds | ||

| Government Dated Securities | ||

| 4.62% Central Government | SOV | 4.60 |

| 7.86% State Government-Karnataka | SOV | 2.86 |

| 7.20% State Government-Karnataka | SOV | 2.79 |

| 6.12% State Government-Karnataka | SOV | 2.65 |

| 6.57% State Government-Gujarat | SOV | 1.58 |

| 6.97% State Government-Maharashtra | SOV | 1.09 |

| Government Dated Securities - Total | 15.57 | |

| Public Sector Undertakings | ||

| Punjab & Sind Bank(Basel III TIER I Bonds) | ICRA A- | 6.26 |

| Power Finance Corporation Ltd.(^) | CRISIL AAA | 3.61 |

| Union Bank of India(Basel III TIER I Bonds) | CARE AA | 3.59 |

| U P Power Corporation Ltd ( Guaranteed By UP State Government ) | CRISIL A+(CE) | 2.51 |

| THDC India Ltd. (THDCIL)(^) | CARE AA | 1.39 |

| Punjab National Bank(Basel III TIER II Bonds)(^) | CRISIL AA+ | 0.28 |

| Public Sector Undertakings - Total | 17.64 | |

| Corporate Debt/Financial Institutions | ||

| Coastal Gujarat Power Ltd. ( Guarenteed by TATA Power Co. Ltd ) (^) | CARE AA(CE) | 6.06 |

| Godrej Properties Limited(^) | ICRA AA | 5.53 |

| Aadhar Housing Finance Limited | CARE AA | 5.37 |

| DLF Cyber City Developers Ltd (^) | CRISIL AA | 5.36 |

| Prestige Projects Pvt. Ltd | ICRA A+(CE) | 4.59 |

| Bahadur Chand Investments Private Limited | ICRA AA | 4.08 |

| Bajaj Housing Finance Ltd. | CRISIL AAA | 4.02 |

| Godrej Industries Ltd | CRISIL AA | 3.26 |

| Nuvoco Vistas Corporation Ltd. (^) | CRISIL AA | 2.73 |

| Godrej Industries Ltd | CRISIL AA | 2.46 |

| Muthoot Finance Ltd.(^) | CRISIL AA+ | 2.12 |

| Tata Power Company Ltd. | FITCH IND AA | 1.57 |

| Manappuram Finance Ltd. | CRISIL AA | 1.08 |

| Muthoot Finance Ltd. (^) | CRISIL AA+ | 0.82 |

| Jamnagar Utilities & Power Private Limited ( Mukesh Ambani Group ) (^) | CRISIL AAA | 0.56 |

| Shriram City Union Finance Ltd. | CARE AA | 0.07 |

| HDFC Ltd. | CRISIL AAA | 0.05 |

| LIC Housing Finance Ltd. | CRISIL AAA | 0.04 |

| Corporate Debt/Financial Institutions - Total | 49.77 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Corporate Debt/Financial Institutions | ||

| AXIS Bank Ltd. | CRISIL A1+ | 5.35 |

| Corporate Debt/Financial Institutions - Total | 5.35 | |

| Triparty Repo | 2.99 | |

| Net Current Assets/(Liabilities) | 5.72 | |

| Grand Total | 100.00 | |

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 14,10,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Jan 31, 2022 (Rs) | 22,55,658 | 17,64,681 | 10,73,505 | 7,07,510 | 3,95,437 | 1,23,226 |

| Scheme Returns (%) | 7.69 | 7.48 | 6.89 | 6.52 | 6.19 | 5.01 |

| NIFTY Credit Risk Bond Index Returns (%) | 9.14 | 9.03 | 8.73 | 8.74 | 8.83 | 6.98 |

| Alpha* | -1.46 | -1.55 | -1.84 | -2.22 | -2.64 | -1.97 |

| NIFTY Credit Risk Bond Index (Rs)# | 24,72,528 | 19,14,742 | 11,46,287 | 7,47,911 | 4,11,262 | 1,24,484 |

| CRISIL 10 Year Gilt Index (Rs)^ | 20,93,764 | 16,73,751 | 10,33,010 | 6,86,320 | 3,80,617 | 1,19,543 |

| CRISIL 10 Year Gilt Index (%) | 6.50 | 6.47 | 5.82 | 5.31 | 3.65 | -0.70 |

Alpha is difference of scheme return with benchmark return.

| Growth Option | Rs24.4648 |

| Direct Growth Option | Rs26.6401 |

| Weekly-Reg-Plan-IDCW | Rs10.0846 |

| Weekly-Dir-Plan-IDCW | Rs10.4393 |

| Monthly-Reg-Plan-IDCW | Rs10.9007 |

| Monthly-Dir-Plan-IDCW | Rs10.6242 |

| Quarterly-Reg-Plan-IDCW | Rs11.5359 |

| Quarterly Dir-Plan-IDCW | Rs10.5550 |

| Annual-Reg-Plan-IDCW | Rs10.6394 |

| Annual-Dir-Plan-IDCW | Rs20.0093 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Deepak Agrawal* |

| Benchmark | Nifty Credit Risk Bond Index |

| Allotment date | May 11, 2010 |

| AAUM | Rs1,856.67 crs |

| AUM | Rs1,850.86 crs |

| Folio count | 14,732 |

At discretion of trustees

| Portfolio Average Maturity | 3.73 yrs |

| IRS Average Maturity* | -0.12 yrs |

| Net Average Maturity | 3.61 yrs |

| Portfolio Modified Duration | 2.34 yrs |

| IRS Modified Duration* | -0.12 yrs |

| Net Modified Duration | 2.22 yrs |

| Portfolio Macaulay Duration | 2.50 yrs |

| IRS Macaulay Duration* | -0.12 yrs |

| Net Macaulay Duration | 2.38 yrs |

| YTM | 6.58% |

| $Standard Deviation | 1.25% |

Initial Investment:Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1

Ideal Investments Horizon: 3 year & above

Entry Load: Nil. (applicable for all plans)

Exit Load: a) For redemption / switch out of

upto 6% of the initial investment amount

(limit) purchased or switched in within 1

year from the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.75%; Direct: 0.75%

Fund

Benchmark

This product is suitable for investors who are seeking*:

- Income over a medium term investment horizon

- Investment predominantly in in AA and below rated corporate bonds (Excluding AA+ rated corporate bonds)

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

(^) Fully or Party blocked against Interest Rate Swap (IRS) Hedging Position through Interest Rate Swaps as on 31 Jan 2022 is 16.17% of the net assets.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'