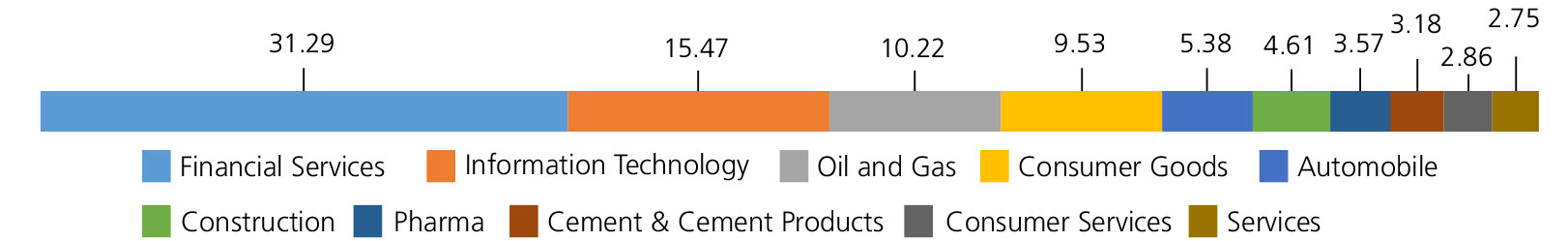

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 22.54 | |

| ICICI Bank Ltd. | 7.28 | |

| HDFC Bank Ltd. | 6.67 | |

| Axis Bank Ltd. | 3.39 | |

| Kotak Mahindra Bank Ltd. | 2.71 | |

| State Bank Of India | 1.93 | |

| AU Small Finance Bank Ltd. | 0.56 | |

| Software | 15.48 | |

| Infosys Ltd. | 6.75 | |

| Tata Consultancy Services Ltd. | 4.12 | |

| Persistent Systems Limited | 2.69 | |

| HCL Technologies Ltd. | 1.46 | |

| Wipro Ltd. | 0.46 | |

| Petroleum Products | 8.43 | |

| Reliance Industries Ltd. | 7.38 | |

| Bharat Petroleum Corporation Ltd. | 1.05 | |

| Finance | 6.48 | |

| HDFC Ltd. | 2.74 | |

| Bajaj Finance Ltd. | 2.51 | |

| SBI Cards & Payment Services Pvt. Ltd. | 1.23 | |

| Consumer Non Durables | 5.98 | |

| Hindustan Unilever Ltd. | 1.93 | |

| ITC Ltd. | 1.52 | |

| Godrej Consumer Products Ltd. | 1.46 | |

| United Breweries Ltd. | 1.07 | |

| Auto | 4.40 | |

| Maruti Suzuki India Limited | 2.74 | |

| Mahindra & Mahindra Ltd. | 0.96 | |

| Eicher Motors Ltd. | 0.70 | |

| Construction Project | 3.60 | |

| Larsen And Toubro Ltd. | 3.60 | |

| Pharmaceuticals | 3.56 | |

| Dr Reddys Laboratories Ltd. | 1.60 | |

| Gland Pharma Limited | 1.18 | |

| Cadila Healthcare Ltd | 0.78 | |

| Consumer Durables | 3.54 | |

| Titan Company Ltd. | 1.47 | |

| Bata India Ltd. | 1.21 | |

| V-Guard Industries Ltd. | 0.86 | |

| Cement & Cement Products | 3.18 | |

| Ultratech Cement Ltd. | 1.82 | |

| Shree Cement Ltd. | 0.90 | |

| The Ramco Cements Ltd | 0.46 | |

| Transportation | 2.75 | |

| Inter Globe Aviation Ltd | 1.45 | |

| Container Corporation of India Ltd. | 1.30 | |

| Industrial Products | 2.29 | |

| Schaeffler India Ltd | 1.19 | |

| Bharat Forge Ltd. | 1.10 | |

| Telecom - Services | 2.27 | |

| Bharti Airtel Ltd | 2.18 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.09 | |

| Insurance | 2.26 | |

| HDFC Life Insurance Company Ltd. | 0.99 | |

| ICICI Lombard General Insurance Company Ltd | 0.76 | |

| Max Financial Services Ltd. | 0.51 | |

| Gas | 1.79 | |

| Indraprastha Gas Ltd. | 1.07 | |

| Gujarat State Petronet Ltd. | 0.72 | |

| Leisure Services | 1.44 | |

| Jubilant Foodworks Limited | 1.44 | |

| Retailing | 1.43 | |

| Avenue Supermarts Ltd. | 0.82 | |

| FSN E-Commerce Ventures Ltd. | 0.55 | |

| Zomato Ltd. | 0.05 | |

| Medplus Health Services Ltd. | 0.01 | |

| Auto Ancillaries | 1.24 | |

| Motherson Sumi Systems Ltd. | 0.98 | |

| Motherson Sumi Wiring India Limited | 0.26 | |

| Construction | 1.01 | |

| Oberoi Realty Ltd | 0.61 | |

| Mahindra Lifespace Developers Ltd | 0.40 | |

| Non - Ferrous Metals | 1.01 | |

| Hindalco Industries Ltd | 1.01 | |

| Chemicals | 0.92 | |

| Solar Industries India Limited | 0.92 | |

| Fertilisers | 0.91 | |

| Coromandel International Ltd. | 0.91 | |

| Financial Technology (Fintech) | 0.02 | |

| PB Fintech Ltd. | 0.02 | |

| Equity & Equity Related - Total | 96.53 | |

| Futures | ||

| CNX BANK INDEX-FEB2022 | 1.01 | |

| Triparty Repo | 4.10 | |

| Net Current Assets/(Liabilities) | -0.63 | |

| Grand Total | 100.00 | |

| | ||

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 81.69%, 14.32%, 1.53% & 2.46.

Term Deposit as provided above is towards margin for derivatives transactions

Equity Derivative Exposuer is 1.01%

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 22,80,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Jan 31, 2022 (Rs) | 1,20,69,730 | 26,29,571 | 14,45,677 | 9,31,601 | 5,14,926 | 1,30,271 |

| Scheme Returns (%) | 15.46 | 14.99 | 15.23 | 17.62 | 24.65 | 16.17 |

| Nifty 100 (TRI) Returns (%) | 14.90 | 15.08 | 15.77 | 17.55 | 24.04 | 17.03 |

| Alpha* | 0.56 | -0.10 | -0.54 | 0.06 | 0.60 | -0.86 |

| Nifty 100 (TRI) (Rs)# | 1,13,04,872 | 26,43,076 | 14,73,935 | 9,30,133 | 5,10,678 | 1,30,802 |

| Nifty 50 (TRI) Returns (%) | 14.50 | 14.91 | 15.98 | 17.96 | 24.12 | 17.19 |

| Alpha* | 0.96 | 0.08 | -0.75 | -0.34 | 0.53 | -1.02 |

| Nifty 50 (TRI) (Rs)# | 1,07,99,065 | 26,18,541 | 14,84,933 | 9,39,388 | 5,11,232 | 1,30,903 |

| S&P BSE SENSEX (TRI) (Rs)^ | 1,09,78,255 | 26,49,362 | 15,00,514 | 9,44,669 | 5,06,374 | 1,30,418 |

| S&P BSE SENSEX (TRI) Returns (%) | 14.64 | 15.13 | 16.27 | 18.19 | 23.43 | 16.41 |

TRI – Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI).

As TRI data is not available since inception of the scheme, benchmark SIP Performance is calculated by taking S&P BSE Sensex PRI values from 29th Dec 1998 to 31st May 2007 and TRI Values since 31st May 2007

*All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of 10,000/- investment made at inception. Source: ICRA MFI Explorer.

*Alpha is difference of scheme return with benchmark return

| Reg-Plan-IDCW | Rs48.1230 |

| Dir-Plan-IDCW | Rs54.3900 |

| Growth option | Rs372.8050 |

| Direct Growth option | Rs411.2520 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Harish Krishnan* |

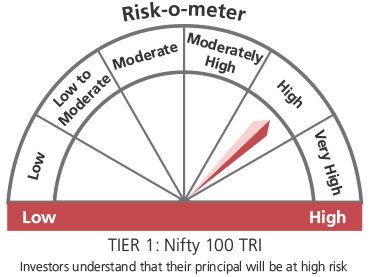

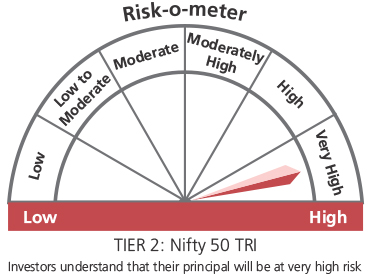

| Benchmark*** | Nifty 100 TRI (Tier 1) Nifty 50 TRI (Tier 2) |

| Allotment date | December 29, 1998 |

| AAUM | Rs3,759.62 crs |

| AUM | Rs3,766.36 crs |

| Folio count | 2,29,404 |

Trustee's Discretion

| Portfolio Turnover | 12.78% |

| $Beta | 0.95 |

| $Sharpe ## | 0.82 |

| $Standard Deviation | 20.44% |

| (P/E) | 38.09 |

| P/BV | 4.36 |

| IDCW Yield | 0.89 |

Initial Investment: Rs1000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in multiples

of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 2.18%; Direct: 0.83%

Benchmark

Benchmark

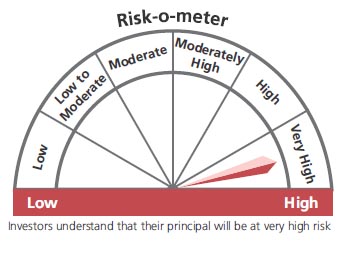

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities of large cap companies

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

***As per SEBI Circular dated 27th October 2021 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 3.40% (FBIL Overnight MIBOR rate as on 31st January 2022).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'