| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Debt Instruments | ||

| Debentures and Bonds | ||

| Corporate Debt/Financial Institutions | ||

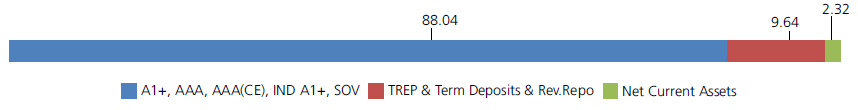

| Reliance Industries Ltd. | CRISIL AAA | 0.95 |

| Larsen and Toubro Ltd. | CRISIL AAA | 0.64 |

| HDFC Ltd. | CRISIL AAA | 0.56 |

| HDB Financial Services Ltd. | CRISIL AAA | 0.45 |

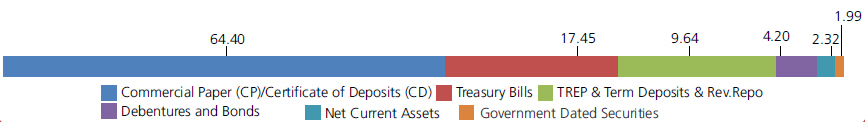

| Corporate Debt/Financial Institutions - Total | 2.60 | |

| Public Sector Undertakings | ||

| Food Corporation of India | CRISIL AAA(CE) | 1.43 |

| Rural Electrification Corporation Ltd. | CRISIL AAA | 0.14 |

| National Highways Authority Of India | CRISIL AAA | 0.03 |

| Public Sector Undertakings - Total | 1.60 | |

| Government Dated Securities | ||

| 8.99% State Government-Madhya Pradesh | SOV | 1.08 |

| 8.95% State Government-Maharashtra | SOV | 0.43 |

| 8.97% State Government-Andhra Pradesh | SOV | 0.32 |

| 8.99% State Government-Bihar | SOV | 0.16 |

| Government Dated Securities - Total | 1.99 | |

| Money Market Instruments | ||

| Commercial Paper(CP)/Certificate of Deposits(CD) | ||

| Corporate Debt/Financial Institutions | ||

| HDFC Ltd. | CRISIL A1+ | 4.89 |

| AXIS Bank Ltd. | CRISIL A1+ | 4.40 |

| Adani Ports and Special Economic Zone Limited | ICRA A1+ | 3.17 |

| Reliance Industries Ltd. | CRISIL A1+ | 3.15 |

| Reliance Jio Infocomm Ltd. | CRISIL A1+ | 3.15 |

| Reliance Retail Ventures Ltd | CRISIL A1+ | 2.38 |

| Ultratech Cement Ltd. | CRISIL A1+ | 1.57 |

| HDFC Bank Ltd. | CARE A1+ | 1.43 |

| HDFC Securities Limited | CRISIL A1+ | 1.26 |

| Birla Group Holding Private Limited | CRISIL A1+ | 0.95 |

| Dalmia Cement (Bharat) Ltd | CRISIL A1+ | 0.95 |

| L & T Finance Ltd. | CRISIL A1+ | 0.79 |

| Can Fin Homes Ltd. | ICRA A1+ | 0.63 |

| ICICI Securities Limited | CRISIL A1+ | 0.63 |

| Motilal Oswal Financial Services Limited | CRISIL A1+ | 0.63 |

| Tata Power Renewable Energy Ltd. | CRISIL A1+ | 0.63 |

| Julius Baer Capital (India) Pvt. Ltd | CRISIL A1+ | 0.48 |

| CESC Ltd. | CRISIL A1+ | 0.47 |

| Hero FinCorp Ltd. | CRISIL A1+ | 0.32 |

| Pilani Investment and Industries Corporation Ltd | CRISIL A1+ | 0.32 |

| Tata Motors Finance Ltd. | ICRA A1+ | 0.32 |

| Aditya Birla Finance Ltd. | ICRA A1+ | 0.31 |

| CESC Ltd. | ICRA A1+ | 0.31 |

| Godrej Industries Ltd | CRISIL A1+ | 0.24 |

| Sundaram Home Finance Ltd | CRISIL A1+ | 0.22 |

| Axis Securities Limited | ICRA A1+ | 0.16 |

| Godrej Housing Finance Ltd | CRISIL A1+ | 0.16 |

| Sharekhan BNP Paribas Financial Services Pvt. Ltd. | ICRA A1+ | 0.16 |

| Sharekhan Limited | CRISIL A1+ | 0.16 |

| Bajaj Financial Securities Limited | CRISIL A1+ | 0.08 |

| Corporate Debt/Financial Institutions - Total | 34.32 | |

| Public Sector Undertakings | ||

| National Bank for Agriculture & Rural Development | ICRA A1+ | 7.72 |

| Canara Bank | CRISIL A1+ | 3.93 |

| National Housing Bank | CRISIL A1+ | 3.17 |

| Bharat Petroleum Corporation Ltd. | CRISIL A1+ | 3.16 |

| National Thermal Power Corporation Ltd. | CRISIL A1+ | 3.16 |

| Small Industries Development Bank Of India | CARE A1+ | 2.53 |

| Indian Oil Corporation Ltd. | ICRA A1+ | 1.58 |

| Bank Of Baroda | FITCH IND A1+ | 1.26 |

| Bharat Oman Refineries Limited | CRISIL A1+ | 0.95 |

| Steel Authority of India Ltd. | CARE A1+ | 0.79 |

| Hindustan Petroleum Corporation Ltd. | CRISIL A1+ | 0.63 |

| Bank Of Baroda | CRISIL A1+ | 0.32 |

| Bharat Heavy Electricals Ltd. | CARE A1+ | 0.32 |

| BOB Financial Solutions Limited | CRISIL A1+ | 0.32 |

| Export-Import Bank of India | CRISIL A1+ | 0.24 |

| Public Sector Undertakings - Total | 30.08 | |

| Treasury Bills | ||

| 91 Days Treasury Bill 03/03/2022 | SOV | 4.29 |

| 91 Days Treasury Bill 17/03/2022 | SOV | 3.82 |

| 91 Days Treasury Bill 26/05/2022 | SOV | 3.15 |

| 364 Days Treasury Bill 13/05/2022 | SOV | 2.88 |

| 91 Days Treasury Bill 31/03/2022 | SOV | 2.74 |

| 91 Days Treasury Bill 24/03/2022 | SOV | 0.41 |

| 364 Days Treasury Bill 03/03/2022 | SOV | 0.16 |

| Treasury Bills - Total | 17.45 | |

| Triparty Repo | 9.64 | |

| Net Current Assets/(Liabilities) | 2.32 | |

| Grand Total | 100.00 | |

| Growth Option | Rs4,265.6783 |

| Direct Growth Option | Rs4,289.2533 |

| Weekly-Reg-Plan-IDCW | Rs1,000.2472 |

| Weekly-Dir-Plan-IDCW | Rs1,005.2114 |

| Daily-Reg-Plan-IDCW | Rs1,222.8100 |

| Daily-Dir-Plan-IDCW | Rs1,222.8100 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Deepak Agrawal* |

| Benchmark | Nifty Liquid Index |

| Allotment date | November 4, 2003 |

| AAUM | Rs34,174.66 crs |

| AUM | Rs27,098.43 crs |

| Folio count | 53,110 |

Daily

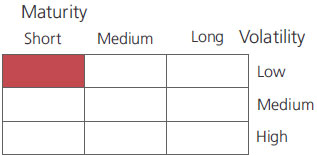

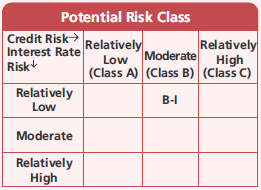

| Portfolio Average Maturity | 0.11 yrs |

| IRS Average Maturity* | - |

| Net Average Maturity | 0.11 yrs |

| Portfolio Modified Duration | 0.11 yrs |

| IRS Modified Duration* | - |

| Net Modified Duration | 0.11 yrs |

| Portfolio Macaulay Duration | 0.11 yrs |

| IRS Macaulay Duration* | - |

| Net Macaulay Duration | 0.11 yrs |

| YTM | 3.77% |

| $Standard Deviation | 0.08% |

*Interest Rate Swap

Source: $ICRAMFI Explorer. Standard Deviation is calculated on Annualised basis using 3 years history of monthly returns.

Initial Investment:Rs500 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs500 & in multiples

of Rs1 or purchases and of Rs0.01

for switches

Ideal Investment Horizon: 7 days to month

Entry Load: Nil. (applicable for all plans)

1. Exit load shall applicable be as per the graded basis as specified below:

| Investor exit upon subscription | Exit load as a % of redemption proceeds |

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 onwards | 0.0000% |

Any exit load charged (net off Goods and Services tax, if

any) shall be credited back to the Scheme. Units issued on

reinvestment of IDCW shall not be subject to entry and

exit load.

2. The revised exit load shall be effective for all fresh investments

3. The revised load structure will be applicable for Insta

Redemption facility as per the applicable circular.

4. Applicability of revised exit load on redemption /switch-out of

units would be done on First in First out Basis ('FIFO').

Regular: 0.32%; Direct: 0.20%

Fund

Benchmark

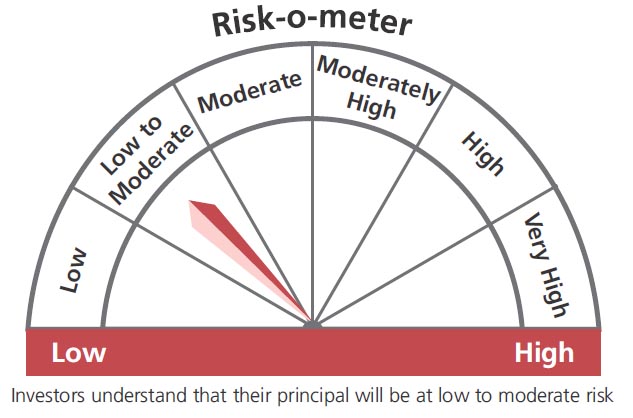

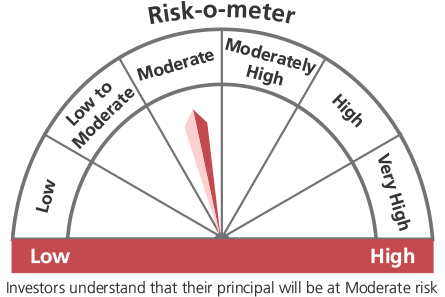

This product is suitable for investors who are seeking*:

- Income over a short term investment horizon

- Investment in debt & money market securities

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'