An open ended equity scheme investing across large cap, mid cap, small cap stocks

An open ended equity scheme investing across large cap, mid cap, small cap stocks

The investment objective of the scheme is

to generate long-term capital appreciation

from a portfolio of equity and equity related

securities across market capitalization.

However, there is no assurance that the

objective of the scheme will be realized.

The investment objective of the scheme is

to generate long-term capital appreciation

from a portfolio of equity and equity related

securities across market capitalization.

However, there is no assurance that the

objective of the scheme will be realized.

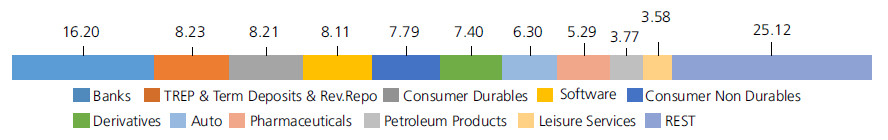

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 16.20 | |

| ICICI Bank Ltd. | 3.84 | |

| State Bank Of India | 3.75 | |

| Federal Bank Ltd. | 2.63 | |

| Indian Bank | 2.20 | |

| City Union Bank Ltd. | 1.63 | |

| Axis Bank Ltd. | 1.35 | |

| Bank Of Baroda | 0.80 | |

| Consumer Durables | 8.21 | |

| Century Plyboards (India) Ltd. | 2.90 | |

| Pokarna Ltd. | 2.28 | |

| Greenply Industries Ltd. | 1.64 | |

| Bata India Ltd. | 0.76 | |

| Amber Enterprises India Ltd. | 0.63 | |

| Software | 8.11 | |

| Persistent Systems Limited | 3.97 | |

| Firstsource Solutions Ltd. | 1.57 | |

| Tech Mahindra Ltd. | 1.54 | |

| HCL Technologies Ltd. | 0.85 | |

| Tata Consultancy Services Ltd. | 0.13 | |

| Infosys Ltd. | 0.05 | |

| Consumer Non Durables | 7.79 | |

| United Breweries Ltd. | 1.89 | |

| United Spirits Ltd. | 1.81 | |

| Emami Ltd. | 1.77 | |

| ITC Ltd. | 1.66 | |

| Heritage Foods Ltd | 0.66 | |

| Auto | 6.30 | |

| Maruti Suzuki India Limited | 3.39 | |

| Tata Motors Ltd - DVR | 1.68 | |

| Mahindra & Mahindra Ltd. | 1.23 | |

| Pharmaceuticals | 5.29 | |

| Sun Pharmaceuticals Industries Ltd. | 1.65 | |

| Alkem Laboratories Ltd. | 1.57 | |

| Eris Lifesciences Ltd. | 1.26 | |

| JB Chemicals & Pharmaceuticals Ltd. | 0.81 | |

| Petroleum Products | 3.77 | |

| Hindustan Petroleum Corporation Ltd | 1.99 | |

| Reliance Industries Ltd. | 1.78 | |

| Leisure Services | 3.58 | |

| Jubilant Foodworks Limited | 1.22 | |

| Sapphire Foods India Ltd. | 1.05 | |

| Westlife Development Ltd. | 0.91 | |

| Barbeque Nation Hospitality Ltd. | 0.40 | |

| Construction | 3.39 | |

| KNR Constructions Ltd. | 1.44 | |

| PNC Infratech Ltd | 1.08 | |

| Mahindra Lifespace Developers Ltd | 0.87 | |

| Power | 3.39 | |

| National Thermal Power Corporation Limited | 1.90 | |

| Kalpataru Power Transmission Ltd. | 1.49 | |

| Auto Ancillaries | 3.07 | |

| Motherson Sumi Systems Ltd. | 1.19 | |

| Rolex Rings Ltd. | 0.76 | |

| Subros Ltd. | 0.73 | |

| Motherson Sumi Wiring India Limited | 0.39 | |

| Telecom - Services | 2.88 | |

| Bharti Airtel Ltd | 2.88 | |

| Finance | 2.86 | |

| Mahindra & Mahindra Financial Services Ltd. | 1.02 | |

| Shriram Transport Finance Co Ltd. | 0.94 | |

| Shriram City Union Finance Ltd. | 0.90 | |

| Industrial Products | 2.33 | |

| Carborundum Universal Ltd. | 1.19 | |

| Cummins India Ltd. | 1.14 | |

| Cement & Cement Products | 2.28 | |

| Ambuja Cements Ltd. | 2.13 | |

| JK Cement Ltd. | 0.15 | |

| Aerospace & Defense | 2.22 | |

| Bharat Electronics Ltd. | 2.07 | |

| Data Patterns (India) Ltd. | 0.15 | |

| Healthcare Services | 2.09 | |

| Max Healthcare Institute Ltd. | 2.09 | |

| Chemicals | 1.98 | |

| Tata Chemicals Ltd | 1.98 | |

| Ferrous Metals | 1.76 | |

| Jindal Steel & Power Ltd. | 1.76 | |

| Retailing | 0.67 | |

| Zomato Ltd. | 0.67 | |

| Fertilisers | 0.39 | |

| Coromandel International Ltd. | 0.39 | |

| Pesticides | 0.23 | |

| Dhanuka Agritech Ltd. | 0.23 | |

| Equity & Equity related - Total | 88.79 | |

| Mutual Fund Units | ||

| Kotak Liquid Scheme Direct Plan Growth | 2.84 | |

| Mutual Fund Units - Total | 2.84 | |

| Futures | ||

| Infosys Ltd.-MAR2022 | 1.87 | |

| Reliance Industries Ltd.-MAR2022 | 1.82 | |

| Maruti Suzuki India Limited-MAR2022 | 1.05 | |

| HCL Technologies Ltd.-MAR2022 | 0.88 | |

| ICICI Bank Ltd.-MAR2022 | 0.86 | |

| Mahindra & Mahindra Ltd.-MAR2022 | 0.77 | |

| Bharti Airtel Ltd-MAR2022 | 0.15 | |

| Triparty Repo | 8.23 | |

| Net Current Assets/(Liabilities) | 0.14 | |

| Grand Total | 100.00 | |

| | ||

Equity Derivative Exposuer is 7.40%

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 42.49, 27.05, 26.65, & 3.81.

| Reg-Plan-IDCW | Rs9.1630 |

| Dir-Plan-IDCW | Rs9.2330 |

| Growth option | Rs9.1630 |

| Direct Growth option | Rs9.2330 |

A) Regular Plan B) Direct Plan

Growth and Income Distribution cum

capital withdrawal (IDCW) (Payout and

Reinvestment) (applicable for all plans)

| Fund Manager | Mr. Harsha Upadhyaya* Mr. Devender Singhal & Mr. Abhishek Bisen |

| Benchmark | Nifty 500 Multicap 50:25:25 TRI |

| Allotment date | September 29, 2021 |

| AAUM | Rs3,694.54 crs |

| AUM | Rs3,575.27 crs |

| Folio count | 1,96,124 |

Trustee's Discretion

| Portfolio Turnover | 9.30% |

Initial Investment: Rs5000 and in multiple ofRs1 for purchase and of Rs0.01 for switches

Additional Investment: Rs1000 & in multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a)For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b)If units redeemed or switched out are

excess of the limit within 1 year from the

date of allotment: 1%

c)If units are redeemed or switched out

or after 1 year from the date of allotment:

NIL

Regular: 2.07%; Direct: 0.23%

Benchmark

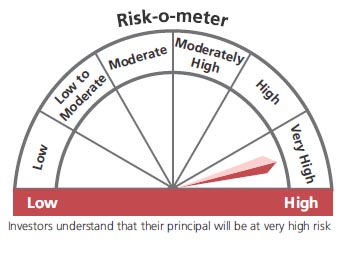

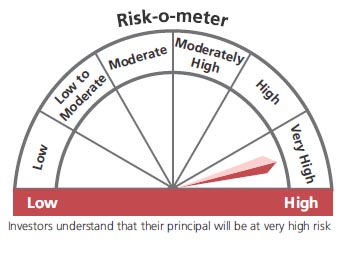

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities across market capitalisation.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'