An open-ended fund of fund scheme investing in units of SMAM ASIA REIT Sub Trust Fund and/or other similar overseas REIT funds.

An open-ended fund of fund scheme investing in units of SMAM ASIA REIT Sub Trust Fund and/or other similar overseas REIT funds.

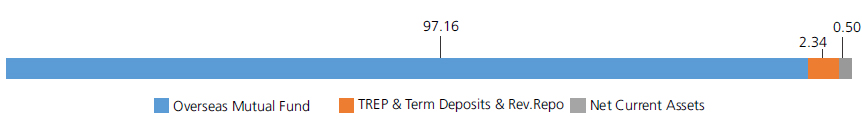

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity Related Mutual Fund Units | ||

| SMAM ASIA REIT Sub Trust | Overseas Mutual Fund | 97.16 |

| Mutual Fund Units - Total | 97.16 | |

| Triparty Repo | 2.34 | |

| Net Current Assets/(Liabilities) | 0.50 | |

| Grand Total | 100.00 | |

Data as on 28th February 2022

| Reg-Plan-IDCW | Rs9.8879 |

| Dir-Plan-IDCW | Rs10.0002 |

| Growth Option | Rs9.8880 |

| Direct Growth Option | Rs10.0004 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

Trustee’s Discretion

| Fund Manager | Mr. Arjun Khanna* |

| Benchmark | S&P Asia Pacific ex Japan REIT Total Return Index. |

| Allotment date | December 29, 2020 |

| AAUM | Rs188.12 crs |

| AUM | Rs184.01 crs |

| Folio count | 10,071 |

Initial Investment: Rs5000 and in multiple of

Rs1 for purchase and of Rs0.01 for switches Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

8% of the units allotted shall be redeemed

without any Exit Load on or before

completion of 1 Year from the date of

allotment of units.

Any redemption in excess of such limit

within 1 Year from the date of allotment

shall be subject to the following Exit Load:

a) If redeemed or switched out on or before

completion of 1 Year from the date of

allotment of units-1.00%

b) If redeemed or switched out after

completion of 1 Year from the date of

allotment of units-NIL

Regular: 1.38%; Direct: 0.49%

Fund

Benchmark

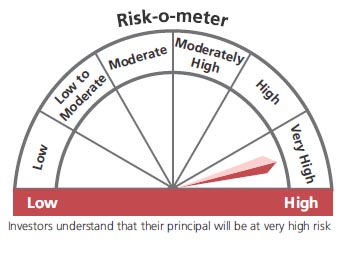

This product is suitable for investors who are seeking*:

- Long term capital growth

- Long term capital appreciation and income by investing in units of SMAM ASIA REIT Sub Trust Fund and/or other similar overseas REIT funds.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'