Multicap fund - A 36 months close ended equity scheme investing across large cap, midcap and small cap stocks

Multicap fund - A 36 months close ended equity scheme investing across large cap, midcap and small cap stocks

The investment objective of the scheme is

to generate capital appreciation from a

diversified portfolio of equity & equity

related instruments across market

capitalisation and sectors.

There is no assurance or guarantee that

the investment objective of the scheme

will be achieved.

The investment objective of the scheme is

to generate capital appreciation from a

diversified portfolio of equity & equity

related instruments across market

capitalisation and sectors.

There is no assurance or guarantee that

the investment objective of the scheme

will be achieved.

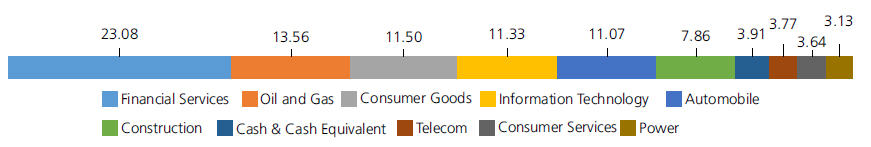

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 22.65 | |

| ICICI Bank Ltd. | 8.88 | |

| State Bank Of India | 5.45 | |

| HDFC Bank Ltd. | 3.34 | |

| Axis Bank Ltd. | 3.25 | |

| Kotak Mahindra Bank Ltd. | 1.73 | |

| Petroleum Products | 13.56 | |

| Reliance Industries Ltd. | 10.48 | |

| Bharat Petroleum Corporation Ltd. | 1.64 | |

| Hindustan Petroleum Corporation Ltd | 1.44 | |

| Software | 11.33 | |

| Persistent Systems Limited | 6.82 | |

| Infosys Ltd. | 1.91 | |

| Firstsource Solutions Ltd. | 1.44 | |

| Tech Mahindra Ltd. | 1.16 | |

| Consumer Durables | 9.55 | |

| Pokarna Ltd. | 4.60 | |

| Century Plyboards (India) Ltd. | 2.91 | |

| Greenply Industries Ltd. | 2.04 | |

| Consumer Non Durables | 6.55 | |

| ITC Ltd. | 2.59 | |

| Emami Ltd. | 2.20 | |

| United Spirits Ltd. | 1.76 | |

| Auto | 5.57 | |

| Maruti Suzuki India Limited | 2.87 | |

| Mahindra & Mahindra Ltd. | 2.70 | |

| Telecom - Services | 3.77 | |

| Bharti Airtel Ltd | 3.65 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.12 | |

| Power | 3.13 | |

| National Thermal Power Corporation Limited | 3.13 | |

| Leisure Services | 3.06 | |

| Barbeque Nation Hospitality Ltd. | 2.04 | |

| Jubilant Foodworks Limited | 1.02 | |

| Construction Project | 2.56 | |

| Larsen And Toubro Ltd. | 2.56 | |

| Auto Ancillaries | 2.18 | |

| Subros Ltd. | 1.43 | |

| Varroc Engineering Ltd. | 0.75 | |

| Cement & Cement Products | 1.36 | |

| JK Cement Ltd. | 1.36 | |

| Entertainment | 1.34 | |

| Zee Entertainment Enterprises Ltd | 1.34 | |

| Aerospace & Defense | 1.23 | |

| Bharat Electronics Ltd. | 1.23 | |

| Construction | 0.71 | |

| PNC Infratech Ltd | 0.71 | |

| Pharmaceuticals | 0.59 | |

| Cadila Healthcare Ltd | 0.59 | |

| Retailing | 0.58 | |

| Zomato Ltd. | 0.58 | |

| Industrial Products | 0.56 | |

| Cummins India Ltd. | 0.56 | |

| Finance | 0.43 | |

| Mahindra & Mahindra Financial Services Ltd. | 0.43 | |

| Equity & Equity related - Total | 90.71 | |

| Futures | ||

| Maruti Suzuki India Limited-MAR2022 | 3.32 | |

| Options | ||

| CNX NIFTY - 14500.000 - Put Option - December 2023 | 2.05 | |

| Options - Total | 2.05 | |

| Triparty Repo | 5.16 | |

| Net Current Assets/(Liabilities) | 2.08 | |

| Grand Total | 100.00 | |

| | ||

Term Deposit as provided above is towards margin for derivatives transactions

Equity Derivative Exposuer is 5.37%

| Reg-Plan-IDCW | Rs18.2600 |

| Dir-Plan-IDCW | Rs18.9430 |

| Growth option | Rs18.2590 |

| Direct Growth option | Rs 19.0740 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW & Growth.

(applicable for all plans)

| Fund Manager | Mr. Devender Singhal* |

| Benchmark | Nifty 200 TRI |

| Allotment date | February 20, 2018 |

| AAUM | Rs88.52 crs |

| AUM | Rs85.31 crs |

| Folio count | 1,738 |

Trustee's Discretion

| Portfolio Turnover | 28.24% |

The scheme is a close ended scheme. The units of the scheme can be traded on the stock exchange.

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil. (applicable for all plans)

Regular:1.28%; Direct: 0.34%

Benchmark

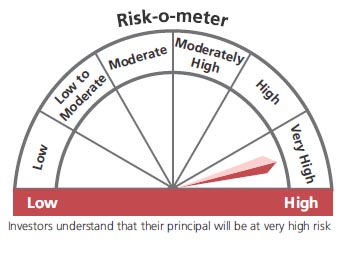

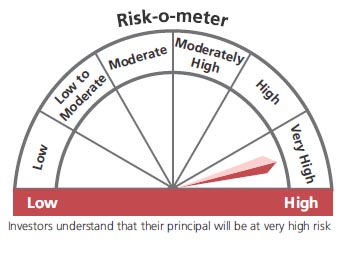

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in equity and equity related securities without any market capitalisation and sector bias.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'