Large & mid cap fund - An open-ended equity scheme investing in both large cap and mid cap stocks

Large & mid cap fund - An open-ended equity scheme investing in both large cap and mid cap stocks

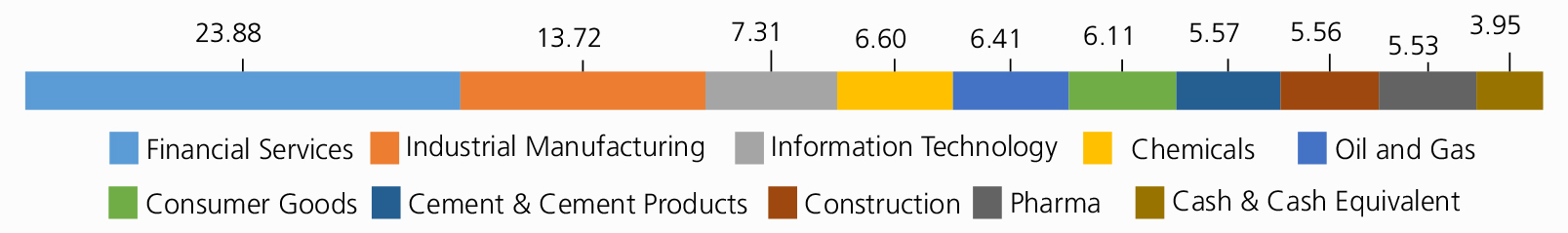

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Equity & Equity related |

||

| Banks | 18.88 | |

| ICICI Bank Ltd. | 5.86 | |

| State Bank Of India | 5.21 | |

| Axis Bank Ltd. | 3.88 | |

| HDFC Bank Ltd. | 2.43 | |

| AU Small Finance Bank Ltd. | 1.50 | |

| Industrial Products | 7.63 | |

| Bharat Forge Ltd. | 2.03 | |

| Cummins India Ltd. | 1.61 | |

| Schaeffler India Ltd | 1.45 | |

| Supreme Industries Limited | 0.87 | |

| AIA Engineering Limited. | 0.85 | |

| Polycab India Ltd. | 0.82 | |

| Software | 7.31 | |

| Infosys Ltd. | 4.48 | |

| Tata Consultancy Services Ltd. | 2.83 | |

| Chemicals | 6.61 | |

| SRF Ltd. | 4.06 | |

| Linde India Ltd. | 2.55 | |

| Cement & Cement Products | 5.57 | |

| Ultratech Cement Ltd. | 1.94 | |

| JK Cement Ltd. | 1.82 | |

| The Ramco Cements Ltd | 0.94 | |

| Shree Cement Ltd. | 0.58 | |

| Dalmia Bharat Limited | 0.29 | |

| Pharmaceuticals | 5.53 | |

| Sun Pharmaceuticals Industries Ltd. | 2.13 | |

| Cipla Ltd. | 1.58 | |

| Ipca Laboratories Ltd. | 1.00 | |

| Gland Pharma Limited | 0.82 | |

| Construction Project | 4.42 | |

| Larsen And Toubro Ltd. | 3.92 | |

| Techno Electric & Engineering Company Limited | 0.50 | |

| Gas | 3.87 | |

| Gujarat State Petronet Ltd. | 2.14 | |

| Indraprastha Gas Ltd. | 0.87 | |

| Petronet LNG Ltd. | 0.86 | |

| Industrial Capital Goods | 3.81 | |

| Thermax Ltd. | 1.75 | |

| ABB India Ltd | 1.53 | |

| BEML Ltd. | 0.53 | |

| Finance | 3.76 | |

| Bajaj Finance Ltd. | 3.30 | |

| Cholamandalam Financial Holdings Ltd. | 0.46 | |

| Consumer Non Durables | 3.28 | |

| ITC Ltd. | 1.72 | |

| United Spirits Ltd. | 1.56 | |

| Consumer Durables | 2.84 | |

| Blue Star Ltd. | 1.40 | |

| Bata India Ltd. | 0.88 | |

| V-Guard Industries Ltd. | 0.56 | |

| Petroleum Products | 2.55 | |

| Reliance Industries Ltd. | 2.55 | |

| Ferrous Metals | 2.51 | |

| Jindal Steel & Power Ltd. | 2.51 | |

| Aerospace & Defense | 2.27 | |

| Bharat Electronics Ltd. | 2.27 | |

| Fertilisers | 2.15 | |

| Coromandel International Ltd. | 2.15 | |

| Telecom - Services | 1.97 | |

| Bharti Airtel Ltd | 1.91 | |

| Bharti Airtel Ltd - Partly Paid Shares | 0.06 | |

| Non - Ferrous Metals | 1.37 | |

| Hindalco Industries Ltd | 1.37 | |

| Healthcare Services | 1.27 | |

| DR.Lal Pathlabs Ltd. | 1.27 | |

| Auto Ancillaries | 1.26 | |

| Balkrishna Industries Ltd. | 1.26 | |

| Textile Products | 1.20 | |

| Page Industries Ltd | 1.20 | |

| Construction | 1.13 | |

| Oberoi Realty Ltd | 1.13 | |

| Insurance | 1.13 | |

| Max Financial Services Ltd. | 1.13 | |

| Retailing | 0.98 | |

| Vedant Fashions Ltd | 0.80 | |

| Zomato Ltd. | 0.18 | |

| Leisure Services | 0.83 | |

| Jubilant Foodworks Limited | 0.83 | |

| Power | 0.71 | |

| Kalpataru Power Transmission Ltd. | 0.71 | |

| Auto | 0.58 | |

| Hero MotoCorp Ltd. | 0.58 | |

| Transportation | 0.51 | |

| Container Corporation of India Ltd. | 0.51 | |

| Equity & Equity related - Total | 95.93 | |

| Mutual Fund Units | ||

| Kotak Liquid Scheme Direct Plan Growth | 0.12 | |

| Mutual Fund Units - Total | 0.12 | |

| Futures | ||

| Max Financial Services Ltd.-MAR2022 | 0.10 | |

| DR.Lal Pathlabs Ltd.-MAR2022 | 0.01 | |

| Futures (Market value represents Notional Value) - Total | 0.11 | |

| Triparty Repo | 3.91 | |

| Net Current Assets/(Liabilities) | -0.07 | |

| Grand Total | 100.00 | |

| | ||

Note: Large Cap, Midcap, Small cap and Debt and Money Market stocks as a % age of Net Assets: 56.05, 35.83, 4.16 & 3.96.

| Monthly SIP of (₹) 10000 | Since Inception | 10 years | 7 years | 5 years | 3 years | 1 year |

| Total amount invested (Rs) | 21,00,000 | 12,00,000 | 8,40,000 | 6,00,000 | 3,60,000 | 1,20,000 |

| Total Value as on Feb 28, 2022 (Rs) | 91,00,883 | 27,31,962 | 14,34,484 | 9,00,055 | 4,97,193 | 1,23,963 |

| Scheme Returns (%) | 15.00 | 15.72 | 15.04 | 16.26 | 22.21 | 6.24 |

| Nifty Large Midcap 250 (TRI) Returns (%) | NA | 16.44 | 16.17 | 17.56 | 25.33 | 6.58 |

| Alpha* | NA | -0.72 | -1.13 | -1.30 | -3.12 | -0.34 |

| Nifty Large Midcap 250 (TRI) (Rs)# | NA | 28,40,471 | 14,93,387 | 9,29,101 | 5,18,900 | 1,24,177 |

| Nifty 200 (TRI) Returns (%) | 13.23 | 14.50 | 14.86 | 16.14 | 22.06 | 7.33 |

| Alpha* (Rs) | 1.77 | 1.22 | 0.18 | 0.12 | 0.15 | -1.09 |

| Nifty 200 (TRI) (Rs)# | 75,68,366 | 25,59,252 | 14,25,361 | 8,97,432 | 4,96,196 | 1,24,644 |

| Nifty 50 (TRI)(Rs)^ | 74,86,155 | 25,13,192 | 14,29,610 | 9,00,928 | 4,90,138 | 1,24,835 |

| Nifty 50 (TRI) Returns (%) | 13.12 | 14.16 | 14.94 | 16.30 | 21.17 | 7.63 |

*Alpha is difference of scheme return with benchmark return.

| Reg-Plan-IDCW | Rs32.7560 |

| Dir-Plan-IDCW | Rs36.5930 |

| Growth option | Rs187.7560 |

| Direct Growth option | Rs207.3740 |

A) Regular Plan B) Direct Plan

Options: Payout of IDCW, Reinvestment of

IDCW & Growth (applicable for all plans)

| Fund Manager | Mr. Harsha Upadhyaya* |

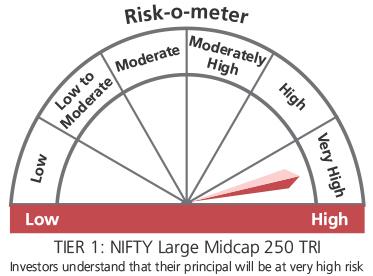

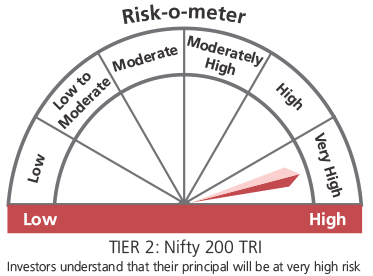

| Benchmark*** | NIFTY Large Midcap 250 TRI (Tier 1) Nifty 200 TRI (Tier 2) |

| Allotment date | September 9, 2004 |

| AAUM | Rs8,927.814 crs |

| AUM | Rs8,802.45 crs |

| Folio count | 3,06,776 |

Trustee's Discretion

| Portfolio Turnover | 11.65% |

| $Beta | 0.88 |

| $Sharpe ## | 0.79 |

| $Standard Deviation | 20.74% |

| (P/E) | 28.13 |

| P/BV | 3.84 |

| IDCW Yield | 0.75 |

Initial Investment:

Rs5000 and in multiple of

Rs1 for purchase and for Rs0.01 for switches

Additional Investment: Rs1000 & in

multiples of Rs1

Ideal Investments Horizon: 5 years & above

Entry Load: Nil. (applicable for all plans)

Exit Load:

a) For redemption / switch out of upto 10%

of the initial investment amount (limit)

purchased or switched in within 1 year from

the date of allotment: Nil.

b) If units redeemed or switched out are in

excess of the limit within 1 year from the

date of allotment: 1%

c) If units are redeemed or switched out on

or after 1 year from the date of allotment:

NIL

Regular: 1.87%; Direct: 0.61%

Benchmark

Benchmark

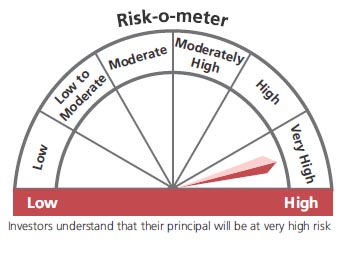

This product is suitable for investors who are seeking*:

- Long term capital growth

- Investment in portfolio of predominantly equity & equity related securities of large & midcap companies.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

***As per SEBI Circular dated 27th October 2021 The first tier benchmark is reflective of the category of the scheme and the second tier benchmark is demonstrative of the investment style / strategy of the Fund Manager within the category.

## Risk rate assumed to be 3.43% (FBIL Overnight MIBOR rate as on 28th February 2022).**Total Expense Ratio includes applicable B30 fee and GST.

* For Fund Manager experience, please refer 'Our Fund Managers'

For last three IDCW, please refer 'Dividend History'.

For scheme performance, please refer 'Scheme Performances'