| KOTAK OVERNIGHT FUND

An open ended debt scheme investing in overnight securities.

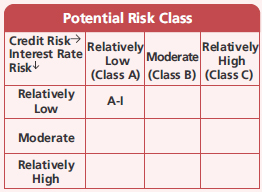

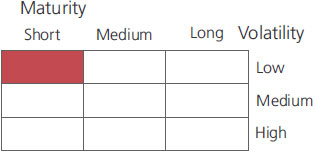

A relatively low interest rate risk and relatively low credit risk.

An open ended debt scheme investing in overnight securities.

A relatively low interest rate risk and relatively low credit risk.

| KOTAK OVERNIGHT FUND

An open ended debt scheme investing in overnight securities.

A relatively low interest rate risk and relatively low credit risk.

*Interest Rate Swap

This product is suitable for investors who are seeking*:

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'

An open ended debt scheme investing in overnight securities.

A relatively low interest rate risk and relatively low credit risk.

Investment Objective

The primary objective of the Scheme is to

generate income through investment in

debt & money market instruments having

maturity of one business day (including

CBLO (Tri-Party Repo), Reverse Repo and

equivalent). However, there is no

assurance or guarantee that the

investment objective of the scheme will be

achieved.

The primary objective of the Scheme is to

generate income through investment in

debt & money market instruments having

maturity of one business day (including

CBLO (Tri-Party Repo), Reverse Repo and

equivalent). However, there is no

assurance or guarantee that the

investment objective of the scheme will be

achieved.

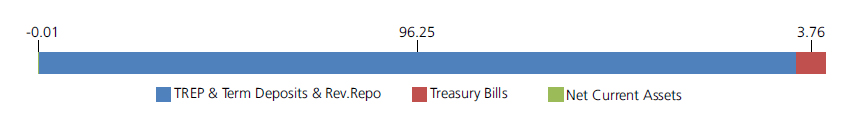

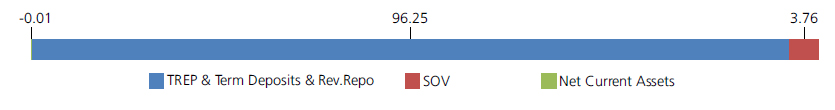

| Issuer/Instrument | Industry/ Rating |

% to Net Assets |

|---|---|---|

| Treasury Bills | ||

| 182 Days Treasury Bill 22/09/2022 | SOV | 1.88 |

| 91 Days Treasury Bill 01/09/2022 | SOV | 0.94 |

| 91 Days Treasury Bill 15/09/2022 | SOV | 0.94 |

| Treasury Bills - Total | 3.76 | |

| Triparty Repo | 96.25 | |

| Net Current Assets/(Liabilities) | -0.01 | |

| Grand Total | 100.00 | |

NAV

| Growth Option | Rs1,151.2236 |

| Direct Growth Option | Rs1,154.8173 |

| Daily-Reg-Plan-IDCW | Rs1,004.7568 |

| Daily-Dir-Plan-IDCW | Rs1,003.6055 |

Available Plans/Options

A)Regular Plan B)Direct Plan

| Fund Manager | Mr. Deepak Agrawal & Mr. Vihag Mishra* ( Dedicated fundmanager for investments in foreign securities) |

| Benchmark | NIFTY 1D Rate index |

| Allotment date | January 15, 2019 |

| AAUM | Rs11,419.19 crs |

| AUM | Rs10,609.43 crs |

| Folio count | 5,098 |

IDCW Frequency

Daily

Ratios

| Portfolio Average Maturity | - |

| IRS Average Maturity* | - |

| Net Average Maturity | - |

| Portfolio Modified Duration | - |

| IRS Modified Duration* | - |

| Net Modified Duration | - |

| Portfolio Macaulay Duration | - |

| IRS Macaulay Duration* | - |

| Net Macaulay Duration | - |

| YTM | 5.47% |

| $Standard Deviation | 0.21% |

*Interest Rate Swap

Minimum Investment Amount

Initial Investment: Rs5000 and in multiple

of Rs1 for purchase and for Rs0.01 for

switches

Additional Investment: Rs1000 & in multiples

of Rs1 for purchase and for Rs0.01

for switches

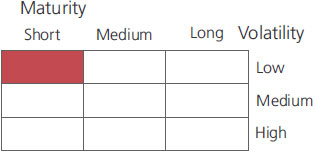

Ideal Investment Horizon: 1 days

Load Structure

Entry Load: Nil. (applicable for all plans)

Exit Load: Nil. (applicable for all plans)

Total Expense Ratio**

Regular: 0.19%; Direct:0.07%

Data as on August 31, 2022

Fund

Benchmark

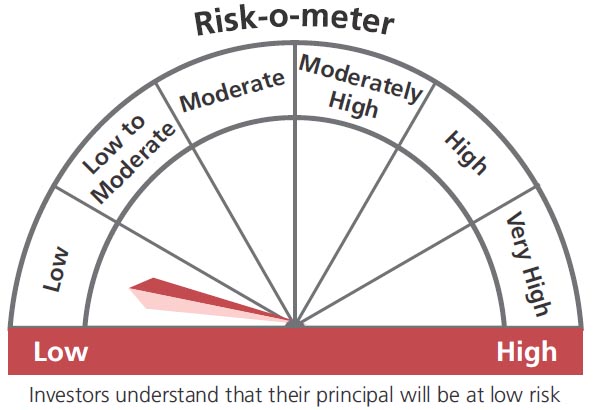

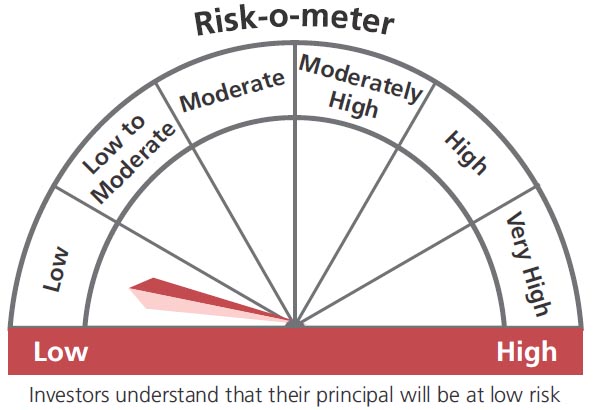

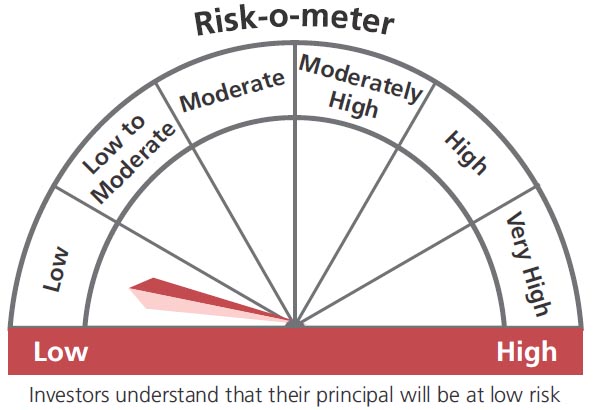

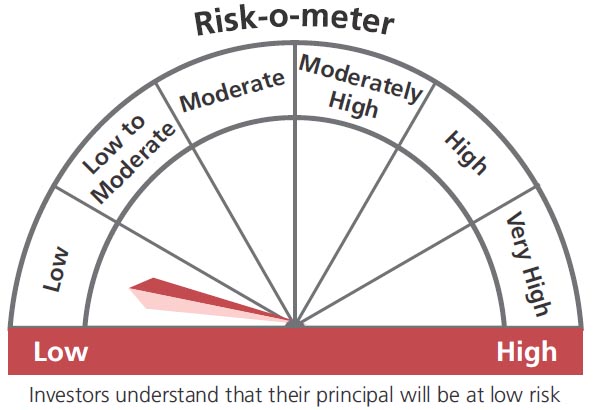

This product is suitable for investors who are seeking*:

- Income over a short term investment horizon

- Investment in debt & money market securities having maturity of one business day.

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

**Total Expense Ratio includes applicable B30 fee and GST

* For Fund Manager experience, please refer 'Our Fund Managers'

For scheme performance, please refer 'Scheme Performances'