KEY CREDIT BRIEF

A brief on credit rationales and analysis of less known credit papers in our portfolio.

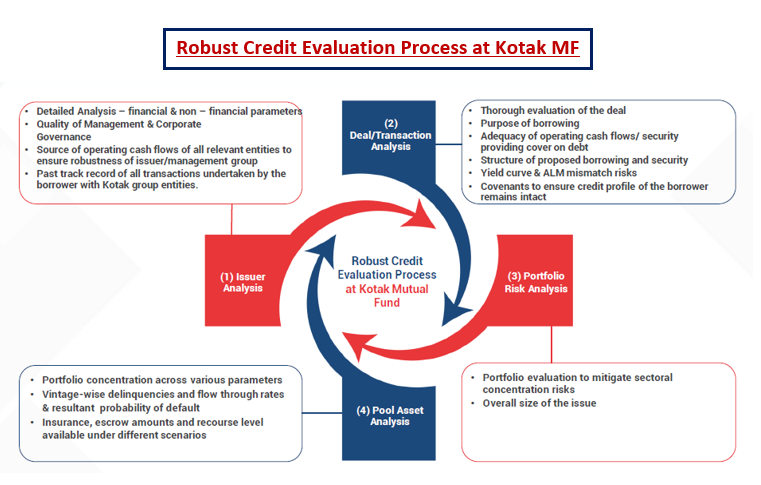

Kotak Credit Process - Mitigating Risk Through Robust Practices

Select Statement Of Holdings In Our Fixed Income Funds As On

| Credit Papers | Kotak Banking and PSU Debt Fund | Kotak Bond Fund | Kotak Bond Short Term Fund | Kotak Corporate Bond Fund | Kotak Credit Risk Fund | Kotak Dynamic Bond Fund | Kotak Low Duration Fund | Kotak Liquid Fund | Kotak Medium Term Fund | Kotak Money Market Fund | Kotak Savings Fund | Kotak Floating Rate Fund | Kotak Debt Hybrid Fund |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Aadhar Housing Finance Limited |  |  |  | ||||||||||

Aditya Birla Real Estate Limited (Formerly known as Century Textiles and Industries Limited) |  |  | |||||||||||

Aseem Infrastructure Finance Limited (AIFL) |  | ||||||||||||

Bahadur Chand Investments Private Limited |  |  |  |  | |||||||||

Bharti Telecom Ltd. |  |  |  |  |  | ||||||||

Cholamandalam Investment and Finance Company Ltd. |  |  | |||||||||||

Dhruva Trust XXIII (Originated by Five-Star Business Finance Limited) |  |  |  |  | |||||||||

DME Development Limited |  |  |  |  | |||||||||

Embassy Office Parks REIT |  |  |  |  | |||||||||

First Business Receivables Trust |  |  | |||||||||||

Future Lifestyle Fashions Ltd. |  | ||||||||||||

Godrej Properties Limited |  |  |  | ||||||||||

HDB Financial Services Ltd. |  |  |  |  |  |  | |||||||

India Grid Trust |  |  |  |  | |||||||||

India Universal Trust AL1 (Originated by HDFC Bank Limited) |  |  |  |  | |||||||||

Indinfravit Trust |  | ||||||||||||

IndoStar Capital Finance Limited |  |  | |||||||||||

IOT Utkal Energy Services Ltd. |  | ||||||||||||

Jamnagar Utilities & Power Private Limited |  |  |  | ||||||||||

JM Financial Asset Reconstruction Co. Pvt. Ltd |  | ||||||||||||

JM Financial Credit Solutions Ltd. |  |  | |||||||||||

John Deere Financial India Private Limited |  | ||||||||||||

Julius Baer Capital (India) Pvt. Ltd (JBCIL) |  |  | |||||||||||

Mindspace Business Parks REIT – NCDs |  |  | |||||||||||

Motilal Oswal Financial Services Limited |  |  | |||||||||||

Muthoot Finance Ltd. |  |  |  |  |  |  |  | ||||||

Nexus Select Trust REIT |  | ||||||||||||

Nirma Limited |  |  | |||||||||||

Nuvama Wealth and Investment Limited |  | ||||||||||||

ONGC Petro Additions Ltd. |  | ||||||||||||

Panatone Finvest Ltd |  |  |  | ||||||||||

Piramal Capital & Housing Finance Limited |  |  | |||||||||||

Prestige Projects Private Limited |  |  | |||||||||||

Punjab National Bank |  |  |  |  |  |  | |||||||

Sansar Aug 2024 V Trust |  |  |  |  | |||||||||

Sansar June 2024 Trust |  |  |  |  |  | ||||||||

Sansar Trust July 2023 |  | ||||||||||||

Sansar Trust Nov 2023 IV (Originator Shriram Finance Ltd) |  |  |  | ||||||||||

Sansar Trust Sep 2023 IX (Originator Shriram Finance Ltd) |  |  | |||||||||||

Sharekhan Limited |  |  | |||||||||||

SMFG India Credit Company Ltd |  |  | |||||||||||

SMFG India Home Finance Company (SMHFC) |  | ||||||||||||

Tata Steel Ltd. |  |  | |||||||||||

Telangana State Industrial Infrastructure Corporation Ltd |  | ||||||||||||

U P Power Corporation Ltd |  |  |  | ||||||||||

Vajra Trust 008 (Originated by Veritas Finance Private Limited) |  |  | |||||||||||

Vedanta Ltd |  |  |  |  |

Credit Papers

Aadhar Housing Finance Limited(ICRA AA)(ICRA Rationale Link)

- Aadhar Housing Finance Limited (AHFL) is a housing finance company (HFC) engaged in providing affordable housing finance

- Blackstone through its fund BCP TOPCO VII Pte. Ltd. holds majority stake in the company

- As on Sep'24, the company had assets under management (AUM) of ~Rs. 22,817 crore.

- The loan book is quite granular with average ticket size of around Rs. 10 lakh

- The company is present across major state and union territories

Aditya Birla Real Estate Limited (Formerly known as Century Textiles and Industries Limited)(CRISIL AA)(CRISIL Rationale Link)

- Incorporated in 1897, the company is promoted by Late Mr BK Birla and is a part of the Aditya Birla Group.

- Following equity infusion in March and December 2015, the Aditya Birla group is a significant stakeholder in the company.

- Company operated a cotton textile mill until 1951. Since then, it has progressively expanded into diverse fields by setting up manufacturing units in rayon, cement and pulp and paper segments.

- The company also ventured into the real estate business. In FY18, the company incorporated a wholly owned subsidiary, Birla Estate Pvt Ltd to focus on the residential real estate business.

- It manufactures a variety of paper products (including multi-layer packaging board and tissue paper) with total installed capacity of 4.81 lakh tonne per annum.

- The company had a net gearing ratio of 0.60x as on Mar’24 on consolidated basis.

Aseem Infrastructure Finance Limited (AIFL)(IND A1+,CARE A1+)(IND Rationale Link)

- AIFL is a non-banking infrastructure finance company (NBFC-IFC) registered with the RBI. The company commenced operation from August 2020, and it primarily funds infrastructure projects.

- The company is promoted by National Investment and Infrastructure Fund Limited through Strategic opportunities fund (a fund promoted by Govt. of India (GOI)) which holds 59% stake in the company; further GOI direct shareholding in the company is ~31% and Sumitomo Mitsui Banking Corporation (SMBC) holds balance 10%.

- The company has exhibited strong growth in AUM since inception (i.e. August 2020) reaching a loan book of ~Rs. 13,000 crore as of Mar’24.

- Asset quality of the company remains robust with Nil NPA as on Mar'24

- The company remains adequately capitalised with CRAR of 20.64% and above average leverage with Debt/Equity ratio of 3.85x as of Mar’24

Bahadur Chand Investments Private Limited(ICRA A1+,ICRA AA)(ICRA Rationale Link)

- Bahadur Chand Investments Private Limited and its parent, Brijmohan Lal Om Prakash’s (BMOP), are the principal holding companies of Hero MotoCorp Limited (HMCL).

- BCIPL has strong financial flexibility emanating from the market value of its investment in HMCL. It holds ~20% stake in HMCL as on Dec'24.

- BCIPL and BMOP also hold equity and preference stake in a large number of group companies viz. Hero FinCorp Limited, Hero Future Energies Private Limited etc

Bharti Telecom Ltd.(CRISIL A1+,CRISIL AA+)(CRISIL Rationale Link)

-

Bharti Telecom Ltd. (BTL) is promoted by Bharti group and Singtel, Singapore.

-

BTL holds 40.31% shareholding of Bharti Airtel Limited (BAL) (Dec'24).

-

Market value of BTL’s holding in BAL is more than INR 3 lakh crore which provides financial flexibility to the Company.

Cholamandalam Investment and Finance Company Ltd.(ICRA AA+,CRISIL A1+)(CRISIL Rationale Link)

- Cholamandalam Investment and Finance Company Ltd (CIFCL), a non-banking finance company, is a part of the Chennai-based Murugappa Group of companies.

- The company’s core business segments include vehicle finance, LAP and home loans. The company has recently launched new business verticals (i.e. Personal Loan, consumer and small enterprise loan and SME loan)

- The company had an AUM of ~Rs. 1,64,642 crore and gearing of ~7.3x as of Sep'24

Dhruva Trust XXIII (Originated by Five-Star Business Finance Limited)(ICRA AAA(SO))(ICRA Rationale Link)

- Securitisation of pool of small business loan (SBL) receivables originated by Five-Star Business Finance Limited

- The pool is well diversified with low obligor concentration, weighted average seasoning of 17.38 months and weighted average LTV of 39.12% as of cut-off date.

- The pool has an external credit enhancement of 5% of initial pool principal in the form of fixed deposits. Further credit support is available in form of Excess Interest Spread (EIS) and subordination by way of equity tranche.

- The pool is rated as AAA (SO) by ICRA.

DME Development Limited(CRISIL AAA)(CRISIL Rationale Link)

- DME Development Limited (“DME” or “the company”), is a Special Purpose vehicle (SPV) formed by National Highway Authority of India (“NHAI” or “the authority”) with 100% shareholding

- DME was incorporated to undertake development of approximate 1,312 km-long expressway between Delhi and Mumbai on a greenfield alignment. This would be an eight-lane expressway with a provision to expand to 12 lanes.

- The project is having concession period of 20 years including construction period of 3 years

- DME has further entered into an implementation agreement with NHAI for construction and maintenance of the project, there by transferring the risk of construction and maintenance of the project to NHAI

- NHAI has nominated its senior and experienced personnel to DME’s board including representation of one senior official from Ministry of Road Transport and Highways

Embassy Office Parks REIT(CRISIL AAA,CRISIL A1+)(CRISIL Rationale Link)

- Embassy REIT is registered as an irrevocable trust under the Indian Trust Act, 1882, and as a real estate investment trust (REIT) with SEBI’s Real Estate Investment Trust Regulations.

- It is sponsored by Embassy Property Development Pvt. Ltd (part of the Embassy group). Investment is in NCD issued by REIT, it gets stable cash flow primarily from rental of commercial assets

- It has a portfolio of assets which include 14 commercial assets (office parks and city centric offices), 1,614 hotel keys (including under construction) and 100 MW solar power plant as of Sep'24.

- The commercial assets enjoy robust occupancy of around 87% and have upside potential for rentals, given the good asset and service quality.

- The projects are located in prime areas of Mumbai, Pune, Bengaluru, and National Capital Region.

- The net debt to total assets ratio was 0.31 times as on Sep’24.

First Business Receivables Trust(CRISIL AAA(SO))(CRISIL Rationale Link)

- It is a securitization where loan given by Reliance Industries Limited (RIL) to Reliance Corporate IT Park Ltd (RCIPTL) has been assigned to PTC Holder. The same will be serviced from service receivable from Reliance Industries Limited, Reliance Retail Limited (RRL) and Reliance Jio Infocomm Limited (RJIL).

- Reliance Corporate IT Park Ltd (RCITPL) provides infrastructure, IT and IT enabled services across India including from its office complex in Ghansoli, Navi Mumbai to RIL, RJIL and RRL, for which it has entered into ’Business Service Agreements’ (BSA) for a period of 13 years.

- The same is rated as AAA(SO) by CRISIL as the primary risk is predicated on RIL,RJIL,RRL which are rated as AAA.

Future Lifestyle Fashions Ltd.(CRISIL D)(CRISIL Rationale Link)

- Future Lifestyle Fashions Ltd. (FLF) operates in fashion retail and distribution. FLF operates retail outlets in 3 broad formats – Central (big-box fashion retailer), Brand Factory (fashion discount chain) and Exclusive Brand Outlets.

- Lockdown/Covid-19 has impacted fashion/retail industry significantly, also impacting financial and operating performance of FLF.

- Above resulted in multiple downgrade of external rating of company. The rating was downgraded to below investment grade in Oct’20.

- We had exercised put option on NCDs issued by FLF, by virtue of which the maturity shifted to 9th Nov'20 from 9th Nov'22. The Company failed to make the repayment including interest payment on due date which resulted in downgrade of external rating to D.

- In May’23, Hon’ble National Company Law Tribunal has allowed the admission of insolvency petition under insolvency and bankruptcy code. NCLT has appointed Interim Resolution Professional (IRP). Subsequently Committee of Creditors (CoC) has appointed it to Resolution Professional (RP). RP has asked for expression of interest from Prospective Resolution Applicants (PRAs). 2 plans was received. One of the plan has been put for voting by CoC. The PRA vide letter dated 25th September 2024, intimated that they are withdrawing the plan. RP along with Committee of Creditors is contesting the same in NCLT.

- Due to uncertainties created by the withdrawal of plan, the exposure has been markerd down to zero.

Godrej Properties Limited(ICRA AA+)(ICRA Rationale Link)

- Godrej Properties Ltd (hereinafter, GPL) is currently developing residential, commercial and township projects spread across 10 cities with total saleable area of ~237 million sq. ft. as on Sep'24.

- GPL is a part of the Godrej Group which is amongst India’s most diversified conglomerates.

- The Godrej Group was established in 1897 and comprises of a varied business portfolio that includes real estate development, fast moving consumer goods, advanced engineering, home appliances, furniture, security, and agri-care.

- It is one of India’s only national developers with a strong presence across the country’s leading real estate markets.

- The net debt-equity ratio was 0.70x as on Sep'24.

HDB Financial Services Ltd.(CRISIL AAA)(CRISIL Rationale Link)

- HDB Financial Services Limited (HDB Finance) was set up as an non-banking finance company by HDFC Bank. HDFC Bank owns majority of equity shares in HDB Finance.

- Apart from the lending business, HDB Finance is also engaged in the distribution of general and life insurance products for HDFC Ergo General Insurance Company and HDFC Standard Life Insurance Company, respectively. The company also runs BPO services that undertake collection services, back office and sales support functions under a contract with HDFC Bank.

- HDB Finance receives support from HDFC Bank in terms of operational and managerial support with regard to formulation of credit policies, portfolio monitoring and collection practices and also receives regular funding support.

- The company complements the parent's product portfolio and distribution network, and supports collection activities for the retail portfolio.

- It has a consolidated gearing of 5.93x as on Sep'24.

India Grid Trust(CRISIL AAA,IND AAA)(CRISIL Rationale Link)

- India Grid Trust (IndiGrid) was set up on October 21, 2016, as an irrevocable trust under the provisions of the Indian Trusts Act, 1882, and was registered with SEBI as an Infrastructure Investment Trust (InvIT)

- IndiGrid operates in power transmission and generation sector and its portfolio primarily consists of power transmission and renewable energy assets

- All SPVs (except one) under IndiGrid are interstate transmission system (ISTS) licensees and comes under the point of connection pool mechanism, where Power Grid Corporation of India, as the central transmission utility, collects monthly transmission charges from all designated customers on behalf of the licensees

- It has an AUM of Rs. 29,700 crore and Net /Debt to AUM of 58.7% as on Sep'24.

India Universal Trust AL1 (Originated by HDFC Bank Limited)(IND AAA (SO))(IND Rationale Link)

- Securitisation of pool of new car loans receivables originated by HDFC Bank Limited.

- The pool is well diversified with low obligor concentration, weighted average seasoning of 15.2 months and weighted average LTV of 84.7% as of cut-off date.

- The pool has an external credit enhancement of 6% of initial pool principal in the form of an unconditional and irrevocable credit collateral guarantee. Further credit support is available in form of Excess Interest Spread (EIS).

- The pool is rated as AAA (SO) by India Ratings.

Indinfravit Trust(ICRA AAA)(ICRA Rationale Link)

- Indinfravit Trust is an Infrastructure Investment Trust under SEBI regulations, sponsored by L&T IDPL and backed by marquee investors such as CPPIB, Omers and Allianz Capital.

- Till Mar 2023, trust had 13 road assets. It has acquired 4 road assets from Brookfield in Jun 2023. Hence the total size of portfolio has increased to 17 road projects.

- The portfolio consists of 14 toll road assets and 3 annuity assets. The assets have an average operational track record of 10 years. The portfolio is well diversified and is spread across 7 states.

- ~95% of revenue is under concession from NHAI indicating low counterparty risk.

- Indinfravit has comfortable credit metrics with Total Debt/Equity of 2.0x and Net debt/EBITDA of 5.5x in Mar 2024.

IndoStar Capital Finance Limited(CRISIL AA-)(CRISIL Rationale Link)

- IndoStar Capital Finance Limited (“IndoStar” or “the company”) is a systemically important NBFC with consolidated AUM of Rs. 10,112 crores as on Sep'24. On an overall basis, Commercial Vehicle (CV) finance book constituted ~69% of the total AUM as on Sep'24, Home finance book at 25%, SME finance book at 4% and corporate book at 2%. Retail loan book accounted for 98% of the consolidated AUM as on Sep'24.

- Going ahead, the Company intends to focus primarily on used CV financing and affordable housing finance.

- The standalone capitalisation profile stood comfortable with CRAR of 25.86% as on Sep'24.

- Brookfield Asset Management (Brookfield) is the largest shareholder and co-promoter of the company with 56.2% stake, followed by the Everstone group at 17.4% as on Sep'24.

IOT Utkal Energy Services Ltd.(CRISIL AAA)(CRISIL Rationale Link)

- IOT Utkal Energy Services Ltd. (IOTUL) is a SPV which has set up crude and product storage tanks on Build-Own-Operate-Transfer (BOOT) basis for Indian Oil Corporation’s (IOC) Paradip refinery in Orissa.

- IOTUL achieved successful completion and deemed commissioning of crude oil tankages in October 2013. The total project cost incurred for the construction of the facility was Rs.3,553 crore and the BOOT period is 15 years from COD (up to October 2028).

- IOTUL’s crude and product storage tanks facility plays a critical role in the operations of IOC’s Paradip refinery. IOTUL also benefits from the fixed cash flows arising from its contractual agreement with IOC.

- The NCDs of IOT Utkal are backed by an annuity based contract executed with its sole counterparty, Indian Oil Corporation Ltd.

Jamnagar Utilities & Power Private Limited(CRISIL AAA)(CRISIL Rationale Link)

- Jamnagar Utilities & Power Private Limited (“JUPL”) is owned by promoters of Reliance Industries Ltd. (RIL)

- It is primarily engaged in the business of setting up, operating and maintaining captive power plants at various manufacturing locations of Reliance Industries Limited (RIL).

- JUPL has set-up power plants at various locations viz Dahej, Hazira and Jamnagar with aggregate capacity to generate over 2300 megawatt (MW) of power and over 10000 tonne per hour (tph) of steam.

- Its power plants in Jamnagar, Hazira, and Dahej are captive to the existing petrochemicals and refining business of RIL and caters to most of its power requirement.

JM Financial Asset Reconstruction Co. Pvt. Ltd(CRISIL AA-)(CRISIL Rationale Link)

- JM Financial Asset Reconstruction Company Limited is an Asset Reconstruction Company, registered with RBI and it is one of the leading ARCs in India. JM Financial Ltd is the holding company of JMARC.

- The company invests in acquiring good quality assets at the right price and limiting the downside by ensuring sufficient underlying security value.

- The AUM of JMARC is Rs 13,701 crores as of Sep’24 which is fairly diversified with presence across multiple sectors.

- The company has low leverage in balance sheet with total CRAR of 21.2% as of Sep'24.

JM Financial Credit Solutions Ltd.(ICRA AA)(ICRA Rationale Link)

- JM Financial Credit Solutions Limited (JMCSL) is a non-banking financial company and is jointly promoted by the JM Financial Group and global fund led by Mr. Vikram Pandit, ex-Chief Executive Officer (CEO) of Citigroup. JM Financial Ltd is the holding company of JMCSL.

- The company is engaged in secured wholesale lending, largely catering to the residential real estate sector through product offerings such as construction finance, loan against property, loan against land, loans for early-stage projects and loan against securities.

- The company has profitable operations with low leverage in balance sheet with total CRAR of 40.70% as of Sep'24.

- JMCSL has comfortable ALM profile.

John Deere Financial India Private Limited(CRISIL AAA)(CRISIL Rationale Link)

- John Deere Financial India Private Limited (JDFIPL), incorporated in October 2011, is a systemically important non-deposit taking non-banking financial company (NBFC) registered with the Reserve Bank of India (RBI).

- It is a wholly-owned subsidiary of John Deere India Private Limited (JDIPL), which, in turn, is indirectly wholly owned by Deere & Company (Deere; through John Deere Asia (Singapore) Pte Limited), USA.

- JDFIPL was incorporated with the aim to support sales of JDIPL vehicles in India.

- It primarily offers retail finance for the purchase of farm equipment manufactured and sold by JDIPL and for the construction equipment manufactured and sold by Wirtgen India Private Limited (which was also acquired by Deere & Company in Dec’17).

- The gearing ratio for the company is 3.26x as on Sep’24.

- Deere & Co, headquartered in US, is a world leader in farm and farm equipment manufacturing with a global presence. The company operates through three business segments: agriculture and turf, construction and forestry, and financial services.

Julius Baer Capital (India) Pvt. Ltd (JBCIL)(CRISIL A1+)(CRISIL Rationale Link)

- JBCIL is a non-banking financial company that is mainly engaged in lending against securities to wealth clients of Julius Baer group.

- JBCIL is a wholly owned subsidiary of Julius Baer Wealth Advisors (india) Pvt Ltd. (JBWA) which is a leading entity in Wealth Management and Private Banking Business in India. It is part of Julius Baer Group which manages ~Rs 40 lac crores AUM as of Dec’23. India business represents ~5% of AUM.

- JBCIL has a loan book of Rs 4,878 crores as of Sep’24.

- The company is profitable with Return on Asset (RoA) of 1.6% as on Sep'24.

- Balance sheet is well capitalised with capital adequacy ratio of 19.69% as on Sep'24.

- It has strong asset quality with NIL NPA as on Sep'24.

- The company is rated A1+ by ICRA and AA+(Stable)/A1+ by CRISIL.

Mindspace Business Parks REIT – NCDs(CRISIL AAA)(CRISIL Rationale Link)

- Mindspace REIT is registered as an irrevocable trust under the Indian Trust Act, 1882, and as a Real Estate Investment Trust (REIT) with SEBI’s REIT Regulations, 2014. Mindspace REIT’s portfolio assets are held through the asset SPVs.

- The real estate investment trust (REIT) owns eight special purpose vehicles (asset SPVs) comprising 10 commercial offices, information technology (IT) parks and special economic zone (SEZ) assets, and houses the facility management division.

- The net debt to total assets was 22.80% as on Sep'24.

Motilal Oswal Financial Services Limited(ICRA A1+)(ICRA Rationale Link)

- Motilal Oswal Financial Services Limited (MOFSL) is among India’s leading provider of capital market related services.

- Motilal Oswal group is majorly present in fee-based businesses like broking, asset & wealth management and investment banking

- MOFSL ranks among the top ten equity brokers by active number of active clients in the broking industry.

- MOFSL had a debt-equity ratio of 1.40 times on consolidated basis as on Sep'24.

Muthoot Finance Ltd.(CRISIL AA+,CRISIL A1+)(CRISIL Rationale Link)

- Muthoot Finance Ltd. (MFL) was incorporated in 1997 and is India’s largest gold loan focused NBFC with consolidated AUM of ~Rs 1,04,149 crs on Sep'24 and a net worth of ~Rs 27,273 crore (consolidated) on Sep'24.

- Muthoot Finance Limited (MFL) is the flagship company of the Kerala-based business house, The Muthoot Group, which has diversified operations in financial services, healthcare, real estate, education, hospitality, power generation and entertainment.

- It had a consolidated debt-equity ratio of 3.0 times as on Sep'24.

Nexus Select Trust REIT(CRISIL AAA)(CRISIL Rationale Link)

- Nexus Select Trust REIT is registered as an irrevocable trust under the Indian Trust Act, 1882, and as a real estate investment trust (REIT) with SEBI’s Real Estate Investment Trust Regulations.

- The REIT is sponsored by Wynford Investments Limited, an affiliate of Blackstone Inc (Blackstone).

- The REIT owns 17 urban consumption centres (90.5% of GAV), three office spaces (5.9% of GAV), two hotels (3.1% of GAV) and one renewable energy plant (0.5% of GAV) across the country in Sep’24.

- The projects are located in key urban cities and has well diversified portfolio across North (42.8%), West (27.5%), South (25.7%) and East (4%).

- The urban consumption centres which represents over 90.5% of total assets enjoy robust occupancy of around 97.4% and have upside potential for rentals, given the good asset and service quality.

Nirma Limited(CRISIL AA)(CRISIL Rationale Link)

- Nirma set up Dr. Karsanbhai K Patel in 1980 to manufacture detergents, expanded its operations to soaps, chemicals and processing of minerals. The company is the largest soda ash manufacturer in India.

- It has one plant in USA and 4 in India (all situated in the State of Gujarat).

- The revenue profile is well diversified across product profile i.e. soda ash, detergent, soaps, caustic soda, linear alkyl benzene, salt etc.

- The company has done certain large acquisition in past, recently Nirma completed acquisition of 75% stake in Glenmark Life Science Ltd. Even after this acquisition, the leverage profile of the company remains acceptable.

- The company is rated AA/A1+ by CRISIL with stable outlook.

Nuvama Wealth and Investment Limited(CRISIL A1+)(CRISIL Rationale Link)

- Nuvama Wealth and Investment Ltd (NWIL) is broking arm of Nuvama Wealth Management Ltd (NWML). The wealth group NWML is listed on stock exchanges and has market cap of more than Rs 23,000 crs.

- PAG which is a global alternative investment fund with AUM of USD 50-Bn is major shareholder of NWML and holds ~55.81% in the group.

- NWIL is a trading member of National Stock Exchange (NSE), Bombay Stock Exchange (BSE), Multi Commodity Exchange of India Ltd (MCX) and National Commodity and Derivatives Exchange Ltd (NCDEX). It provides broking services to its clients. The company is also registered as depository participant with National and Central Securities Depository providing depository services to its clients. NWIL acts in the capacity of distributor of various financial products such as mutual funds, bonds, PMS, structured products and AIFs.

- The operations of NWIL continue to be profitable.

- NWIL has well capitalised balance sheet with gross gearing of 4.12x in Sep’24.

ONGC Petro Additions Ltd.(ICRA AAA(CE))(ICRA Rationale Link)

- ONGC Petro additions Limited is a Joint Venture incorporated in 2006, promoted by Oil and Natural Gas Corporation Limited (ONGC) and GAIL (India) Limited (GAIL) and co-promoted by Gujarat State Petroleum Corporation Ltd. (GSPC) with stake of 49.36%, 49.21% and 1.43% .

- OPaL has setup a 1.1 MMTPA (million metric tonnes per annum) Greenfield petrochemicals complex at Dahej SEZ in Gujarat. The principal business of OPaL is to produce, purchase, treat, market, distribute, import, export and trade petrochemicals products and its by-products.

- There are strong linkages with ONGC as OPAL remains strategically important to ONGC and ONGC has also infused capital in the form of warrants and has provided backstopping support for CCDs. OPaLs project is a part of forward integration plans of ONGC. Entire feedstock for OPaL is currently sourced from ONGC.

- The bonds have letter of comfort from ONGC

Panatone Finvest Ltd(CRISIL A1+)(CRISIL Rationale Link)

- Panatone Finvest Ltd (PFL) is principal telecom & media holding company of Tata Group and is held ~100% by Tata Sons.

- The Company is registered as Core Investment Company (CIC) with Reserve Bank of India

- PFL currently holds significant stake in Tata communications Ltd (TCL) and Tejas Networks Ltd (TNL).

- The market value of its investment in group companies is significantly higher than debt outstanding

Piramal Capital & Housing Finance Limited(CRISIL A1+)(CRISIL Rationale Link)

- Piramal Capital and Housing Finance Limited (“PCHFL”) is a housing finance company (HFC), wholly owned by Piramal Enterprises Limited (“PEL”).

- PCHFL’s loan book stood at Rs. 51,749 crore as on Sep 30, 2024.

- The headline asset quality indicators have witnessed an improvement with gross NPA/net NPA improving to 3.4%/1.7% respectively as on Sep 30, 2024 from 3.5%/1.9% respectively as on Mar 31, 2023.

- The capitalisation profile for PCHFL stood comfortable with CRAR at 21.6% as on Mar 31, 2024 and gearing at 3.22x as on Sep 30, 2024.

Prestige Projects Private Limited(ICRA A)(ICRA Rationale Link)

- Prestige Projects Private Limited (PPPL), is part of Prestige Estates Projects Limited (PEPL). At present, PEPL holds a 60% stake in the company and the remaining 40% is held by Pinnacle Investments (a firm owned by promoters of PEPL).

- PPPL has launched various residential project in cities such as Bangalore Hyderabad etc

- The two of its townships projects viz Prestige City, Banglaore and Prestige City, Hyderabad has got very good response.

- The NCDs are secured by immovable property with a security cover of minimum 1.50 times.

Punjab National Bank(CARE A1+,CRISIL AAA,CRISIL A1+,IND A1+)(CRISIL Rationale Link)

- Punjab National Bank is the second largest Public Sector Bank in India

- Govt. of India (GOI) owns 70.08% as on Sep'24.

- As on Sep'24, PNB had total capitalization of 16.38% with Tier-1 of 13.63%.

Sansar Aug 2024 V Trust(CRISIL AAA(SO))(CRISIL Rationale Link)

- Securitisation of pool of vehicle loans receivables originated by Shriram Finance Limited.

- The pool is well diversified with low obligor concentration and a weighted average net seasoning of ~7.8 months as of cut-off date.

- The pool has external credit enhancement in the form of 11.25% of initial pool principal as cash collateral. Further credit support is available in form of Excess Interest Spread (EIS).

- The pool is rated as AAA (SO) by CRISIL.

Sansar June 2024 Trust(CRISIL AAA(SO))(CRISIL Rationale Link)

- Securitisation of pool of vehicle loans receivables originated by Shriram Finance Limited.

- The pool is well diversified with low obligor concentration and a weighted average seasoning of ~8.2 months as of cut-off date.

- The pool has external credit enhancement in the form of 12.75% of initial pool principal as cash collateral. Further credit support is available in form of Excess Interest Spread (EIS).

- The pool is rated as AAA (SO) by CRISIL.

Sansar Trust July 2023(CRISIL AAA(SO))(CRISIL Rationale Link)

- Securitisation of pool of vehicle loans receivables originated by Shriram Finance Limited.

- The pool is well diversified with low obligor concentration and a weighted average seasoning of 6.3 months as of cut-off date.

- The pool has external credit enhancement in the form of 5.5% of initial pool principal as cash collateral. Further credit support of 24.9% of initial pool principal is available in form of Excess Interest Spread (EIS) and subordination.

- The pool is rated as AAA (SO) by CRISIL.

Sansar Trust Nov 2023 IV (Originator Shriram Finance Ltd)(CRISIL AAA(SO))(CRISIL Rationale Link)

- Securitisation of pool of vehicle loans originated by Shriram Finance Limited.

- The pool is well diversified with low obligor concentration and a weighted average seasoning of 9.5 months as of cut-off date.

- The pool has credit enhancement in the form of 12.75% of pool principal as cash collateral. Further credit support is available in form of Excess Interest Spread (EIS).

- The pool is rated as AAA (SO) by CRISIL.

Sansar Trust Sep 2023 IX (Originator Shriram Finance Ltd)(ICRA AAA(SO))( ICRA Rationale Link)

- Securitisation of pool of vehicle loans originated by Shriram Finance Limited.

- The pool is well diversified with low obligor concentration and a weighted average seasoning of 7.8 months as of cut-off date.

- The pool has credit enhancement in the form of 6% of pool principal and cash collateral of 6%. Further credit support is available in form of Excess Interest Spread (EIS).

- The pool is rated as AAA (SO) by ICRA.

Sharekhan Limited(CRISIL A1+,ICRA A1+)(CRISIL Rationale Link)

- Sharekhan Limited (“Sharekhan” or “the company”) is a security broking service provider, registered with the Securities and Exchange Board of India (SEBI). The company is owned by Mirae Group of South Korea.

- The company is one of the leading broking house in India with presence since 2007 and also has international presence through its branch in UAE. The company is having sizeable presence in western and north-western parts of the country

- Sharekhan’s main business activity includes share broking (primarily in the retail segment) and the distribution of mutual fund products. It also has a small presence in portfolio management services

- Apart from broking business, the company through its wholly owned subsidiary provides financing solution to retail clients of the Group through various capital market products

- The consolidated gearing of company stands at 1.63x as of Sep'2024.

SMFG India Credit Company Ltd(ICRA AAA)(ICRA Rationale Link)

- SMFG India Credit Company Ltd (SMICC) has been operating in India since 2005. SMICC is wholly owned by SMFG which is a Japanese group with ~USD 2 trillion of assets.

- SMICC has strong operational and financial linkages with SMFG group. SMFG group supports SMICC with equity and debt capital whenever required.

- SMICC’s secured lending portfolio consists of mortgage loans to retail customers and small and medium enterprises (SMEs), commercial vehicle (CV) loans and secured rural loans such as two-wheeler loans, CV and mortgage loans. The unsecured portfolio comprises personal loans to salaried and self-employed individuals in urban segment and group and individual loans in the rural space

- SMICC has profitable operations. Standalone AUM as of Mar’24 was ~Rs 36,800 crores. Balance sheet is well capitalised with capital adequacy of 17.3% in Mar’24

- Asset quality continues to be acceptable with Net NPA of 1.3% in Mar’24.

- SMICC is rated AAA (Stable) / A1+ by rating agencies.

SMFG India Home Finance Company (SMHFC)(CRISIL AAA)(CRISIL Rationale Link)

- SMFG India Home Finance Company (SMHFC) has been operating since 2016 and primarily offers home loan and loan against property (LAP) in the affordable segment to salaried and self-employed professionals.

- It has pan India presence across 15 states and union territories and operates through 171 branches.

- SMHFC is 100% subsidiary of SMFG India Credit Company Ltd (SMICC). Both SMICC and SMHFC are part of Japanese group SMFG which has ~USD 2 trillion of assets. SMHFC has strong operational and financial linkages with SMFG group. SMFG group supports both SMICC and SMHFC with equity and debt capital whenever required.

- SMHFC has profitable operations. Balance sheet is well capitalised with capital adequacy of 19.4% in Mar’24,

- Asset quality continues to be acceptable with Net NPA of 1.6% in Mar’24.

- SMHFC is rated AAA (Stable) / A1+ by rating agencies.

Tata Steel Ltd.(CARE AA+)(CARE Rationale Link)

- Tata Steel Limited was established as India’s first integrated steel company in 1907.

- The company has presence across the entire value chain of steel manufacturing from mining and processing iron ore and coal to producing and distributing finished products.

- The company offers a broad range of steel products such as hot rolled, cold rolled, coated steel, rebars, wire rods, tubes and wires.

- Tata steel has an annual crude steel production capacity of 38 million tonnes per annum globally

- The company is one of the most geographically diversified steel producers, with operations in various countries and commercial presence in more than 50 countries across the globe

- Tata Steel is one of the leading company of the Tata Group

- The net debt equity ratio is 0.97 times as on Sep’24 on consolidated basis.

Telangana State Industrial Infrastructure Corporation Ltd(IND AA(CE))(IND Rationale Link)

- Telangana State Industrial Infrastructure Corporation Ltd. (“TSIIC or “the Corporation) is owned by Government of Telangana

- TSIIC is primarily engaged in development of industrial parks and SEZs, land allotment, providing infrastructure facilities and other services for the promotion of industries in Telangana and manage, control and operate these parks.

- The NCDs issued by TSIIC has unconditional and irrevocable guarantee from Govt. of Telangana

- The NCD also has provisions for direct debit mechanism from the consolidated fund of the state maintained with the Reserve Bank of India (RBI).

- TSIIC has created Debt Service Reserve Account (DSRA) equivalent to two peak quarterly servicing of interest plus principal of the outstanding bonds

U P Power Corporation Ltd(CRISIL A+ (CE) )(CRISIL Rationale Link)

- U P Power Corporation Limited (“UPPCL” or “the Company”) is a power distribution company wholly owned by the UP Government (GoUP). The Company has issued bonds, to fund its operations, under the provisions of the UDAY (Ujwal DSICOM Assurance Yojana) agreement.

- The bonds are secured by charge on receivables of UPPCL. It will be further supported by fund infusion from GoUP on quarterly basis through budgetary allocation i.e. debt servicing by GoUP. These are further secured by an unconditional and irrevocable guarantee from Govt. of Uttar Pradesh.

- The structure has escrow mechanism wherein daily collections are deposited into escrow a/c which gets used for servicing of bonds.

Vajra Trust 008 (Originated by Veritas Finance Private Limited)(ICRA AAA(SO))(ICRA Rationale Link)

- Securitisation of pool of small business loan (SBL) and home construction loan (HCL) receivables originated by Veritas Finance Private Ltd.

- The pool is well diversified with low obligor concentration, weighted average seasoning of 16.75 months and weighted average LTV of 35.59% as of cut-off date.

- The pool has an external credit enhancement of 5% of initial pool principal in the form of fixed deposits. Further credit support is available in form of Excess Interest Spread (EIS) and subordination by way of equity tranche.

- The pool is rated as AAA (SO) by ICRA.

Vedanta Ltd(ICRA AA)(ICRA Rationale Link)

- Vedanta Ltd (VEDL) is a diversified mining company, with a vast majority of its resource base and production located in India. It produces aluminium, copper, zinc, lead, silver, iron ore, steel and crude oil. It also has a small power business.

- The company has healthy market share in the domestic aluminium and zinc businesses and the cost-efficient operations in the domestic zinc, aluminium and oil and gas segments.

- VEDL continues to be profitable on consolidated basis with EBITDA margins of 27.4% in 9MFY25.

- The company has low net leverage with Net Debt/EBITDA of 1.8x in Dec’24.

Disclaimers: The above disclosure on credit quality of the debt instruments is based on the information provided by rating agencies/respective companies. Few schemes of Kotak Mutual Fund have taken exposure in the debt instruments issued by above companies. In future, the Fund Manager at their discretion may or may not invest in the Debt instruments issued by above companies.

| Name of the Scheme | Type of Scheme | This product is suitable for investors who are seeking* | Riskometer | PRC Matrix |

|---|