21 Sep 2023

What is Nifty 50?

Nifty, abbreviation for National Stock Exchange Fifty and popularly recognised as the Nifty 50, is a stock market index of the National Stock Exchange (NSE), one of the largest stock exchanges in India. It is composed of the top 50 companies traded on the NSE which are selected based on their free-float market capitalization, which refers to the shares available for public purchase and sell.

The Nifty 50 index is a well-diversified 50 companies index reflecting overall market conditions. Nifty 50 Index is computed using free float market capitalization method.

Nifty 50 can be used for a variety of purposes such as benchmarking fund portfolios, launching of index funds, ETFs and structured products.

Nifty was launched in 1996 and managed by NSE Indices Limited. It is one of the most widely followed index to evaluate the performance of the equity markets. Typically, if the Nifty 50 shows upward movement it means that the nation’s equity markets are on a positive trend.

NSE Indices Limited (formerly known as India Index Services & Products Limited), or NSE Indices, are used as benchmarks for products traded on NSEAs on June 30, 2023. NIFTY indices served as the benchmark index for 122 ETFs listed in India and 12 ETFs listed abroad. Derivatives benchmarked to NIFTY indices are also available for trading on NSE and NSE International Exchange IFSC Limited (NSE IX) as of July 03, 2023.

(Source: The National Stock Exchange)

The constituent companies of the Nifty 50 are top renowned Indian corporates. Some examples include TCS, Asian Paints, Maruti Suzuki India Ltd, HDFC Bank, and RIL. Additionally, the Nifty comprises various sub-indices, such as Nifty Next 50 Index Fund, Nifty Auto Index, Nifty Bank Index, Nifty IT Index, and Nifty FMCG Index, each representing specific sectors within the market.

Eligibility Criteria for Companies to get selected in NIFTY 50

- Market impact cost is the best measure of the liquidity of a stock. It accurately reflects the costs faced when actually trading an index. For a stock to qualify for possible inclusion into the Nifty50, have traded at an average impact cost of 0.50% or less during the last six months for 90% of the observations, for the basket size of Rs. 100 Million.

- The company should have a listing history of 6 months.

- Companies that are allowed to trade in F&O segment are only eligible to be constituent of the index.

- A company which comes out with an IPO will be eligible for inclusion in the index, if it fulfills the normal eligibility criteria for the index for a 3 month period instead of a 6 month period.

(Source: The National Stock Exchange; Methodology Document for Equity Indices, July 2023)

The composition of the Nifty 50 is reviewed every six months. Companies which do not meet the criteria are removed, and replacements are added from companies that meet the NSE's criteria.

The NSE provides public notice of these changes at least four weeks in advance. This is crucial because financial products and portfolios are built around owning Nifty 50 stocks, and it allows sufficient time for portfolio adjustments.

How to invest in NIFTY 50 Index?

If the investors do not have the time and proper knowledge of the stock market and yet they aspire to trade in the stocks of Nifty 50 index, then, they might consider investing in Nifty 50 Index Mutual Fund schemes which invest in stocks forming part of the Nifty 50 index and endeavours to track the performance of Nifty 50 Index.

An investor investing in Index Mutual Fund schemes need to be aware of the tracking error/difference which means the extent to which the NAV of the fund moves in a manner inconsistent with the movements of the benchmark index on any given day or over any given period of time.

How is Nifty calculated?

The determination of companies' market capitalization involves the calculation of the Nifty. This calculation is performed by multiplying the company's share price by its equity, resulting in the market capitalization. Additionally, to calculate the free-float market capitalization, the equity capital is multiplied by the share price and then further multiplied by the Investable Weight Factor (IWF), which represents the share proportions traded by investors in the stock market.

To calculate the Nifty index, a base value of 1,000 is used. The market value is divided by the product of the base market capital and the base value of 1,000 to determine the daily index value of the Nifty.

Nifty calculation formula is as follows:

Market Capitalization = Equity Capital * Share Price

Free Float Market Capitalization = Share Price * Equity Capital * Investable Weight Factor (IWF)

Index Value = Current Market Value / (1000 * Base Market Capital)

How does Nifty vary from Sensex?

Sensex and Nifty are two most prominent and primary indices within the Indian stock market. They serve as benchmarks against which other indices and stocks assess their performance. As discussed, while Nifty tracks the behaviour of the top 50 blue-chip companies as per market capitalization that are traded on the National Stock Exchange (NSE). Sensex comprises of 30 of the largest and most actively traded stocks on Bombay Stock Exchange (BSE). which is also a major stock exchange of the country.

What are the potential benefits of investing in the Nifty 50 Index?

The main benefits of the Nifty 50 Index are:

- SIPs: Nifty 50 Index funds help investors who want to participate in the equity market and invest in Nifty 50 stocks but do not have the required knowledge about stock market to invest in these stocks by way of systematic investment plans (SIPs).. With as low as Rs. 500 per month investors can start investing in NIFTY 50 stocks by way of SIPs.

- Flexibility: Investing in NIFTY 50 through index funds offers flexibility in terms of amount invested. The frequency of SIPs can be increased or reduced as per the wish of investors. The investors can also stop the SIP as per their wish.

- Lower Expenses: Since Nifty 50 index funds mirror the movement of the Nifty 50 index on NSE, this eliminates the Fund Manager’s discretion in managing the fund to some extent. As a result, the expenses associated with managing these funds are low, leading to lower fees for investors.

- No requirement of rebalancing by investors: When investing in a NIFTY 50 index fund the fund manager maintains investment in the same proportion as the NIFTY 50 index, making adjustments to stock weightage as necessary.

- Reduction in Biasness: Nifty 50 Index Funds track and mirror the performance of Nifty 50 index, as a result of which Fund Managers (FMs) invest in the stocks forming part of the Nifty 50 Index which in turn eliminates Fund Manager’s bias with respect to investing corpus in the stocks of their choice. This leads to reduction in FMs bias and makes index investing a discipline and rule-based investment approach.

Nifty Index Fund from Kotak Mutual Fund

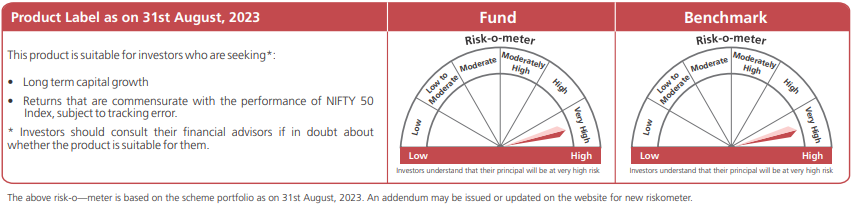

Kotak Mutual Fund offers you the option to invest in Nifty 50 Index through its Kotak Nifty 50 Index Fund.

The investment objective of Kotak Nifty 50 Index Fund is to replicate the composition of the Nifty 50 and to generate returns that are commensurate with the performance of the NIFTY 50 Index, subject to tracking errors. However, there is no assurance that the objective of the scheme will be realized.

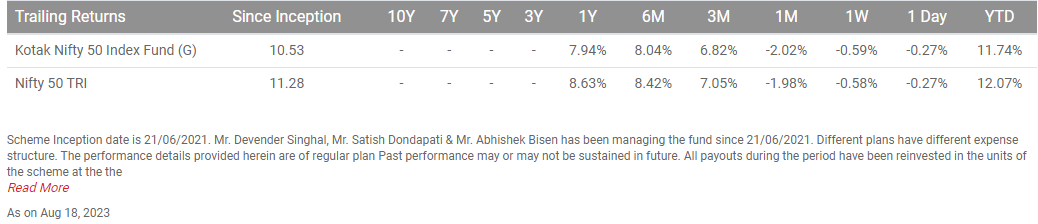

In the past one year, the scheme has delivered a return if 7.94% almost as much as the Nifty 50 index which has delivered return of 8.63%.

Scheme Inception date is 21/06/2021. Mr. Devender Singhal, Mr. Satish Dondapati & Mr. Abhishek Bisen has been managing the fund since 21/06/2021. Different plans have different expense structure. The performance details provided herein are of regular plan. Past performance may or may not be sustained in future. All payouts during the period have been reinvested in the units of the scheme at the then prevailing NAV. Returns >= 1 year: CAGR (Compounded Annualised Growth Rate). N.A stands for data not available. Note: Point to Point (PTP) Returns in INR shows the value of 10,000/- investment made at inception. Source: ICRA MFI Explorer. # Name of Scheme Benchmark. ## Name of Additional Benchmark. TRI - Total Return Index, In terms of SEBI circular dated January 4, 2018, the performance of the scheme is benchmarked to the Total Return variant (TRI) of the Benchmark Index instead of Price Return Variant (PRI). Alpha is difference of scheme return with benchmark return. Data as on August 18, 2023.

For performance details in SEBI format please refer the disclaimers given below.

Conclusion

One of the main benchmark indices under Nifty is the Nifty 50 index. As understood above this index is an important indicator and essential tool for evaluating the stock market movements. Investors can invest in mutual fund schemes and receive mutual fund updates by https://www.kotakmf.com/fund-detailsvisiting the websites of the mutual fund or the Association of Mutual Funds of India (AMFI).

FAQ

What is the risk involved in investing in NIFTY index?

The Nifty index funds are affected by market volatility such as geopolitical tensions, pandemics like Covid-19, global economic recession, they also carry the risk of tracking difference/error which can affect the deliverables of the scheme.

What is the taxation on investing in NIFTY?

A short-term capital gains tax of 15% is levied for investments held for a period of less than a year while a long term capital gains tax of 10% is levied for investment income above rupees 1 lakh, if the units are held for a period of more than one year. However, investors should consult their tax advisors before investing.

Kotak Nifty 50 Index Fund

Performance link of the other Schemes managed by the FMs: https://www.kotakmf.com/documents/Funds-Managed-by-Fund-Managers-Regular-Plan

The document is not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

The document includes statements/opinions which contain words or phrases such as "will", "believe", "expect" and similar expressions or variations of such expressions, that are forward looking statements. Actual results may differ materially from those suggested by the forward looking statements due to risk or uncertainties associated with the statements mentioned with respect to but not limited to exposure to market risks, general and exposure to market risks, general economic and political conditions in India and other countries globally, which may have an impact on services and/or investments, the monetary and interest policies of India, inflation, deflation, unanticipated turbulence in interest rates, foreign exchange rates, equity prices or other rates or prices etc.

Past performance may or may not be sustained in future. For detailed portfolio and related disclosures for the schemes please refer our website https://www.kotakmf.com/Information/forms-and-downloads. The portfolio and its composition is subject to change and the same position may or may not be sustained in future. The fund manager may make the changes, as per different market conditions and in the best interest of the investors.

Investors may consult their financial advisors and /or tax advisors before making any investment decisions.

NSE Indices Limited (formerly known as India Index Services & Products Ltd. - IISL), a subsidiary of NSE, provides a variety of indices and index related services for the capital markets. The company focuses on the index as a core product. The company owns and manages a portfolio of indices under the NIFTY brand of NSE, including the flagship index, the NIFTY 50. NIFTY equity indices comprises of broad based benchmark indices, sectoral indices, strategy indices, thematic indices and customised indices. NSE Indices Limited also maintains fixed income indices based on Government of India securities, corporate bonds, money market instruments and hybrid indices. Many investment products based on NIFTY indices have been developed within India and abroad. These include index based derivatives traded on NSE, NSE IFSC and Singapore Exchange Ltd. (SGX) and a number of index funds and exchange traded funds. The flagship 'NIFTY 50' index is widely tracked and traded as the benchmark for Indian Capital Markets. For more information, please visit: www.niftyindices.com

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY