24 Apr 2024

If you are a taxpayer in India, then you might be overwhelmed with the complexities of the tax filing process. However, Tax planning can solve all your problems. Understanding the importance of tax planning using different income tax saving options can help you to save tax and may increase savings. Hence in this article, we will discuss its advantages and top strategies to save taxes.

The importance of planning for tax savings

Tax Planning plays an important role in maximizing the after-tax income and achieving long-term financial goals. Using tax-saving strategies, investors can reduce their overall tax liability preserve more of their income and enhance their portfolio performance over time.

Tax saving strategies for individuals and small business owners

There are different tax-saving schemes that individuals or small business owners can use to save maximum taxes. Some of them are maximizing contributions to retirement funds, taking advantage of deductions and credits, investing in tax saving components and strategically structuring income for optimal tax savings.

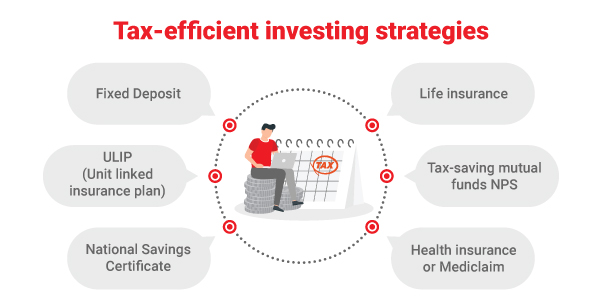

Tax-efficient investing strategies

Tax-efficient investing strategies help investors to minimize tax liability and maximize their returns. Here are 7 tax efficient strategies mentioned below:

1. Fixed Deposit

Fixed Deposits offer guaranteed returns however it is taxed at an individual’s tax slab rate. It might not always offer the highest return as compared to other investment options.

2. ULIP (Unit linked insurance plan)

ULIP combines insurance and investment that offer tax benefits under Section 80C of the income tax Slab. However, there are some charges like premium allocation and fund management charges that one needs to pay.

3. National Savings Certificate

NSCs also provide tax benefits under Section 80C, however, there is a lock-in period of 5 to 10 years and interest earned is taxable.

4. Life insurance

Premiums paid towards life insurance policies are eligible for tax deductions under Section 80C. Additionally, its maturity benefits are also tax-free.

5. Tax-saving mutual funds

There is ELSS tax saver fund or Equity Linked Savings Schemes that offer exposure to equity market and tax benefits under 80C however it has a lock-in period of three years. To calculate your tax savings, you can use ELSS Tax Calculator.

6. NPS

National pension Scheme offers tax benefits under Section 80CCD(1) and Section 80CCD(1B). Additionally, there is also a deduction of up to INR 50k under section 8CCD(1B) for contributing to an NPS tier 1 account.

7. Health insurance or Mediclaim

Health insurance premiums are eligible for tax deduction under Section 80D. It includes a premium paid for individual, family or senior citizens.

Retirement savings plans and tax-advantaged accounts

1. Pension plans

Certain pension plans provide a source of income during retirement. Any contribution towards pension plans is eligible for tax deductions under Section 8CCC of the Income Tax Act, subject to limits mentioned under Section 80CCE.

2. Senior Citizen Savings scheme

The SCSS (Senior Citizen Savings Scheme) is specifically designed for senior citizens over age 60. Contributing to SCSS helps them to save tax under section 80C up to the predetermined limit. However, the interest earned is taxable.

Benefits and Tax Savings for Salaried Employees

1. PPF ( Public Provident Scheme)

For salaried employees, PPF is one of the best tax saving instruments as it offers tax deductions up to a certain limit under Section 80C and all the returns are tax fee and compounded.

2. Tips for creating a successful tax saving plan

For creating a successful tax saving plan it is important to diversify investments and keep yourself up to date with tax laws. Invest in tax-saving instruments like ELSS and PFF. Additionally, you can consult financial advisers to optimize tax efficiency while meeting financial goals.

3. Charitable Giving and Tax Savings

If someone donates or does some charity then that amount can be deducted under Section 80G of the Income Tax. This not only reduces the tax liability but also lets people contribute towards social causes.

Navigating tax law changes and their impact on tax saving strategies

It is quite important to stay informed about the tax law changes to adapt tax saving strategies. Making yourself familiar with the new laws and tax regulations will help you to minimize liabilities, optimize tax efficiency and make informed decisions about financial planning strategies and investments. Person who is choosing ‘new tax regime’, many of the benefits discussed above are not available, hence you need to take informed decision and consult tax advisor before investment.

Common mistakes to avoid when planning for tax saving

While working on tax saving strategies it is necessary to avoid certain pitfalls like not maintaining proper documentation, not adjusting strategies as per new rules and regulations, and not seeking professional advice when needed.

Conclusion

For effective tax savings, it is important to make proper plans and strategies. By investing in tax-saving instruments, staying informed about tax laws can help people optimize their tax-saving strategies and improve overall financial well-being.

FAQ

1. Why is it important to plan for tax savings?

Tax planning aims to maximize savings and minimise tax liabilities by reducing the overall tax burden.

2. How can charitable giving provide tax savings?

Donating to qualified charitable organizations can help individuals to lower their tax liability while supporting the causes they care for.

3. What are some common tax deductions and credits that can help save on taxes?

A few of the common tax deductions include expenses, like mortgage interest, medical expenses, and contributions to retirement accounts.

4. How can tax-efficient investing strategies help save on taxes?

Tax-efficient investing strategies can minimise the taxes on investment gains and maximise the after-tax returns using strategies like tax-loss harvesting.

5. How can I stay up-to-date on tax law changes and their impact on my tax-saving strategies?

Websites like the IRS, financial news outlets and tax professionals can help you stay informed about the new tax laws or any changes in existing laws. Additionally, you can subscribe to newsletters and attend seminars related to tax developments.

Related Blogs:

1. Tax Benefits of SIP Investment

Disclaimer

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY