7 May 2024

In the realm of investing in ventures and businesses, it is quite crucial to decide for which one to opt equity mutual fund or debt mutual fund. Understanding about these financial processes is quite important to make an informed decision. In this article, we will discuss debt and equity mutual funds, their types, pros, and cons, and help readers understand the complete landscape of investment.

What are Debt Mutual Funds?

Debt mutual funds are investment vehicles where investors invest in scheme, which invests in a portfolio of fixed-income securities like corporate treasury bills, government bonds and different debt instruments. Unlike direct Debt financing, debt mutual funds allow investors to participate in debt instruments indirectly through professionally managed investment portfolios.

Types of Debt Mutual Funds

There are numerous types of debt mutual funds, each type works in its way with different terms to match the investors’ investment preferences and risk preferences.

Here are some common types of debt mutual funds:

1. Liquid Funds: These funds invest in short-term money market instruments with a maturity of up to 91 days. They are known for their high liquidity and low risk, making them suitable for parking surplus funds for the short term.

2. Ultra Short Duration Funds: These funds invest in debt securities with a slightly longer duration than liquid funds, typically between 3 to 6 months. They offer slightly higher returns than liquid funds but with a marginally higher risk.

3. Short Duration Funds: Short duration funds invest in debt securities with a duration ranging from 1 to 3 years. They offer higher returns compared to liquid and ultra-short duration funds but come with slightly higher interest rate risk.

4. Medium Duration Funds: These funds invest in debt securities with a duration of 3 to 4 years. They aim to balance returns with moderate interest rate risk.

5. Long Duration Funds: Long duration funds invest in debt securities with a longer duration, typically over 7 years. They are sensitive to interest rate changes and are suitable for investors with a long-term investment horizon.

6. Dynamic Bond Funds: These funds have the flexibility to invest across various durations based on the interest rate outlook. Fund managers actively manage the portfolio to optimize returns based on market conditions.

7. Credit Risk Funds: Credit risk funds invest in debt securities with lower credit ratings, aiming for higher returns. However, they carry a higher risk of default compared to funds investing in higher-rated securities.

8. Corporate Bond Funds: These funds primarily invest in corporate bonds issued by companies. They offer higher returns compared to government securities but also carry higher credit risk.

9. Gilt Funds: Gilt funds invest in government securities issued by the central and state governments. They are considered to be the safest among debt mutual funds as they carry negligible credit risk.

Each type of debt mutual fund caters to different risk appetites and investment horizons, allowing investors to choose based on their financial goals and risk tolerance. Here are few Tips for Debt Fund Investment

Pros and Cons of Debt Mutual Funds

Pros

- Provides an investment opportunity in a range of different debt instruments while allowing risk diversification.

- A lot of debt funds provide a regular income which makes them the ideal choice for investors looking for steady cashflows.

- Unlike other mutual funds, debt funds have relatively low volatility, relatively high liquidity and reasonable safety.

Cons

- There are fluctuations in the interest rate most of the time which can impact the underlying value of NAVs

- There is a huge credit risk along with the potential of downgrades and defaults affecting the overall fund value.

- Debt mutual funds are subject to market conditions including regulatory changes, geopolitical events and changes in economic conditions.

What are Equity Mutual Funds?

An Equity Mutual Funds are Schemes that invests predominantly in shares/stocks of companies. They are also known as Growth Funds.

In the Indian context, as per current SEBI Mutual Fund Regulations, an equity mutual fund scheme must invest at least 65% of the scheme’s assets in equities and equity related instruments. Equity Funds are either Active or Passive. In an Active Fund, a fund manager conducts research on companies, examines performance and looks for the suitable stocks to invest. In a Passive Fund, the fund manager builds a portfolio that mirrors or tracks market index, say Sensex or Nifty Fifty. Further, it provides an opportunity for investors to profit from the potential growth of stocks while spreading the risk across different sectors and companies. It is quite suitable for investors looking for long-term investment and high-risk tolerance.

Types of Equity Mutual Funds

Each equity mutual fund offers investors a unique investment objective. Some key types of Equity Mutual Funds are:

1. Multi Cap Fund: Invests across large, mid, and small-cap stocks, offering flexibility in portfolio allocation.

2. Flexi Cap Fund: Provides flexibility to invest in stocks across market capitalizations based on market conditions.

3. Large Cap Fund: Primarily invests in top 100 companies by market capitalization, aiming for stability and consistent returns.

4. Large & Mid Cap Fund: Invests in a combination of large and mid-cap stocks, offering diversification across market segments.

5. Mid Cap Fund: Focuses on mid-sized companies, offering potential for higher growth but with higher risk compared to large caps.

6. Small Cap Fund: Invests predominantly in small-sized companies with high growth potential, suitable for investors seeking aggressive returns.

7. Dividend Yield Fund: Invests in stocks with high dividend yields, aiming to provide regular income along with capital appreciation.

8. Value Fund: Seeks stocks that are undervalued relative to their intrinsic worth, following a value investing approach.

9. Contra Fund: Invests against prevailing market trends, aiming to capitalize on opportunities that are currently out of favor.

10. Focused Fund: Concentrates investments in a limited number of stocks, allowing for a focused portfolio strategy.

11. Sectoral/Thematic Fund: Invests in specific sectors or themes, aiming to capitalize on growth opportunities within those sectors.

12. ELSS (Equity Linked Savings Scheme): Offers tax benefits under Section 80C of the Income Tax Act while investing primarily in equity markets, with a lock-in period of 3 years.

Pros and Cons of Equity Mutual Funds

Pros

- Equity mutual funds offer potentially higher returns as compared to traditional investment options over the long term.

- It provides a diversification where investors can spread risk across different stocks and markets.

Cons

- Equity fund are subject to capital gain taxes.

- There is no guaranteed return on investment as compared to fixed-income investments.

- Investors have limited control over choosing when to sell or buy a stock.

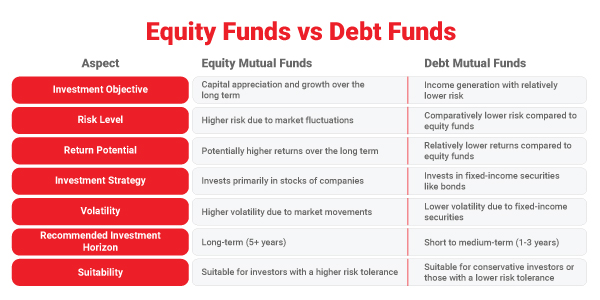

Deciphering the Differences between Debt and Equity Mutual Funds

On analysing the difference between equity and debt mutual funds, each one has its benefits, risks, and factors that influence the overall investment decisions. Debt mutual funds offer relative stability while equity offers potentially better returns on investment.

Choosing Wisely: Equity vs Debt - Making an informed decision

Before deciding which one to opt for debt and equity mutual funds it is important to analyse important factors like risk appetite, growth prospects, and financial health. Informed decisions can help one to have suitable growth and profitability.

Decoding the Debt to Equity Ratio: A Crystal Financial Indicator

The debt-to-equity ratio helps to calculate the company’s financial leverage and health. Further, it allows investors to evaluate solvency and risk profiles.

Conclusion

Debt and equity mutual funds are among the investment options available. Understanding their differences and making informed decisions can help you navigate the financial markets confidently.

FAQs

1. Is FD a debt instrument?

Yes, a fixed deposit is a kind of debt instrument offered by banks.

2. What is a Debt mutual fund?

Debt mutual fund scheme invests in different asset classes that include money market instruments, bonds, etc.

3. What is the formula for debt to equity?

The formula for the Debt to Equity Ratio is Total Debt divided by Shareholders’ equity.

Investors may consult their Financial Advisors and/or Tax advisors before making any investment decision.

The material is not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY