21 Dec 2023

A demat Account, short for "dematerialized account," is a digital repository for your financial investments, such as stocks, bonds, and mutual funds. It replaces the need for physical certificates by converting these assets into electronic form. This account not only provides a secure and convenient way to hold and manage your investments but also simplifies trading in the stock market by allowing you to buy and sell securities with ease.

What is Dematerialization?

Dematerialization, often referred to as "demat" for short, is the process of converting physical securities, such as paper share certificates, into electronic or digital form. Dematerialization helps enhance security, reduces the risk of loss or fraud associated with physical certificates, and simplifies transactions in today's digital age, where almost everything is stored and traded electronically.

How does a Demat Account work?

A demat account works as a digital vault for your financial investments. When you buy shares or other securities, they are electronically credited to your Demat Account, just like depositing money into a bank account. Conversely, when you sell these investments, they are debited from your Demat Account. Think of it as a smart, digital ledger that records all your investments and allows you to trade them effortlessly.

Features of a Demat account

Here are a few key features of a Demat account:

1. Electronic Record Keeping: Demat accounts replace physical certificates with electronic records, making it easy to manage and track your investments online.

2. Secure and Safe: They offer a relatively high level of security by eliminating the risk of physical certificate theft, loss, or damage.

3. Convenient Trading: Demat accounts make buying and selling securities in the stock market quick and convenient through online trading platforms.

4. Holding multiple Assets: You can hold a variety of financial assets like stocks, bonds, mutual funds, and government securities in a single demat account.

What are the benefits of a Demat account?

Following are the benefits of a Demat account:

1. Easy Online Accessibility:

Demat accounts provide the convenience of 24/7 online access, allowing you to monitor, manage, and trade your investments from the comfort of your home or anywhere with an internet connection.

2. Stores Various Investments:

They serve as a versatile repository, accommodating a wide range of financial instruments, including stocks, bonds, mutual funds, and government securities, all in one place.

3. Fast Transfer of Shares:

Transferring shares between demat accounts is generally a swift and hassle-free process, reducing the time and effort required for transactions compared to physical share certificates.

4. Allows to Add Beneficiaries:

Demat accounts enable you to designate beneficiaries, ensuring a smooth transition of your investments to your loved ones in case of unforeseen circumstances.

5. Eliminates Theft, Forgery, Loss, and Damage of Security Certificates:

By converting physical securities into electronic form, demat accounts help to eliminate the potential risks associated with physical certificates, such as theft, forgery, loss, or damage, providing enhanced security.

6. Facilitates Digitally Secured Storing of Securities:

Demat accounts use advanced security measures to safeguard your digital assets, which helps reducing the chances of unauthorized access or tampering, ensuring the safekeeping of your investments.

What are the Types of Demat Accounts?

Let's explain the different types of demat accounts:

1. Regular Demat Accounts:

A regular demat account is the standard type of demat account available to residents of the country where the account is held. These accounts are primarily used for holding and managing securities within the domestic market.

2. Repatriable Demat Accounts:

A repatriable demat account is designed for Non-Resident Indians (NRIs) and Persons of Indian Origin (PIOs) who wish to invest in the Indian securities market.

3. Non-Repatriable Demat Accounts:

Non-Repatriable demat accounts, like repatriable accounts, are also for NRIs and PIOs, but unlike repatriable accounts, funds and investments held in a non-repatriable demat account cannot be repatriated to foreign accounts. They are meant for local use in the country where the account is held.

Documents needed to open a Demat Account*

To open a demat account in India, you typically need to provide certain documents and meet Know Your Customer (KYC) requirements.

PAN card is a mandatory document for opening a Demat account in India.

Passport Size Photographs

Bank Account Proof:

A cancelled cheque or bank statement with your name and account number may be required for linking your Demat account to your active bank account.

Income Proof (for trading in derivatives and commodities):

If you plan to trade in derivatives (like futures and options) or commodities, you may need to provide income proof documents such as latest salary slips, Income Tax Returns (ITR), or Form 16.

PAN Card of Nominee (if applicable):

If you designate a nominee for your Demat account, you'll need their PAN card and KYC documents.

Steps to open a Demat Account: Opening a demat account in India is a straightforward process. Here are the key steps:

1. Begin, post required research and due diligence by selecting a reputable Depository Participant (“DP”), which could be a bank or a stockbroker. They will facilitate the account-opening process.

2. Fill out the account opening application form provided by your chosen DP. This form will require personal information, financial details, and your preferred account type.

3. Attach copies of the necessary KYC documents, such as proof of identity, proof of address, PAN card, passport-sized photographs, and any other documents requested by the DP.

4. The DP will verify the documents and your information. This step ensures that your application meets regulatory requirements.

5. Sign the required agreements, including the Demat account agreement and terms and conditions as specified by the DP.

6. Once your application is approved, you will receive your unique Demat Account Number (DP ID), and your account will be ready for use.

7. Link your demat account to your active bank account to facilitate smooth fund transfers and settlements.

8. With your demat account becoming active, you can begin trading stocks, bonds, and other securities, all while enjoying the convenience and security of electronic asset management.

The process may slightly vary depending on the DP and the type of account you choose, so it's always a good idea to consult with your chosen DP for specific details and guidance

How do we use a Demat Account?

Using a demat account is simple and efficient. Once you've opened an account, you can start using it to buy, sell, and manage your investments in electronic form. When you buy shares, they are credited to your demat account, and when you sell, they are debited. You can track your holdings, view transaction history, and can even receive dividends directly in your account. Most importantly, you can execute these actions online through a trading platform provided by your broker or Depository Participant, making it incredibly convenient and relatively secure.

You will also need a Demat account to open ETF accounts.

How can you invest in ETFs?

To buy or sell ETFs , you must first open an online demat and trading account to keep your money and facilitate transactions on the exchange. To purchase and sell ETFs, follow the procedures below:

Step 1: Open a Demat account with a broker or a depository participant to hold your ETFs.

Step 2: Open a trading account and link it to your Demat account. Many DPs and brokers give candidates a free trading account.

Kotak Mutual Fund offers various ETFs. Here are the following options for you to choose from:

- Kotak Silver ETF

- Kotak Nifty PSU Bank ETF

- Kotak Nifty 100 Low Volatility 30 ETF

- Kotak Nifty Midcap 50 ETF

- Kotak Nifty IT ETF

- Kotak Nifty Alpha 50 ETF

- Kotak NIFTY India Consumption ETF

- Kotak Nifty MNC ETF

- Kotak Nifty 1D Rate Liquid ETF

- Kotak Nifty Bank ETF

- Kotak Nifty 50 ETF

- Kotak S&P BSE Sensex ETF

- Kotak Nifty 50 Value 20 ETF

- Kotak Gold ETF

Explore our diverse range of products above. Consider to start SIP tailored to your needs.

Conclusion

A demat account is a pivotal tool for anyone looking to participate in the financial markets. It simplifies the process of buying and selling securities, enhances the security of your investments, and offers convenience and flexibility. As you venture into the world of investments, understanding how to open and use a demat account is a crucial step toward achieving your financial goals. So, don't hesitate to consider and explore this powerful tool and start your journey towards building a diverse portfolio.

Demat Account: FAQs

Who needs a Demat account?

A demat account is essential for anyone looking to invest in the stock market or to hold various financial instruments like stocks, bonds, and mutual funds in electronic form. Whether you're an individual investor, trader, or even a long-term saver, a demat account offers the convenience, security, and efficiency needed to participate in financial markets.

What are the disadvantages of Demat account?

One drawback is that some brokerage firms charge annual maintenance fees for demat accounts. Additionally, the digital nature of demat accounts means that you need access to the internet to manage your investments. Another potential disadvantage is that maintaining multiple accounts for different investment purposes can lead to higher administrative work and costs.

Can I buy stocks without a Demat Account?

In India, it's not possible to buy stocks without a Demat account. A Demat account is a mandatory requirement for trading and holding shares in electronic form. It's the primary platform for stock market transactions and provides a relatively secure way to store and manage your investments.

What is the difference between Demat and trading account?

A demat account is like a digital vault that holds your investments in electronic form, while a trading account is used to execute buy and sell orders for stocks, commodities, or other securities. The key difference is that a demat account is for holding assets, while a trading account is for conducting transactions. Both accounts are usually linked for seamless trading and settlement.

Can I withdraw money from my Demat account?

A demat account is primarily for holding and managing securities, so you cannot directly withdraw money from it like a bank account. To access the proceeds from the sale of your investments, you need to transfer them to your linked bank account, which is usually linked to your demat account.

Do we need Demat Account for Mutual Fund holdings?

While it's not mandatory to have a demat account for mutual fund holdings, you can choose to hold mutual fund units in either a demat account or physical (paper) form. However, the majority of investors in India prefer holding mutual funds in a demat account due to the convenience and ease of tracking their investments digitally.

For further queries, go to Investor Services

Disclaimer

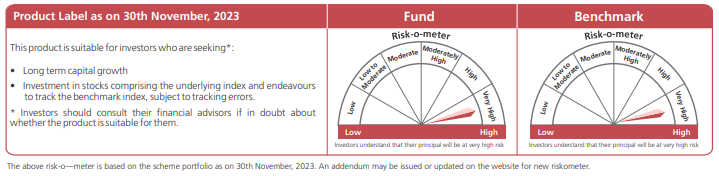

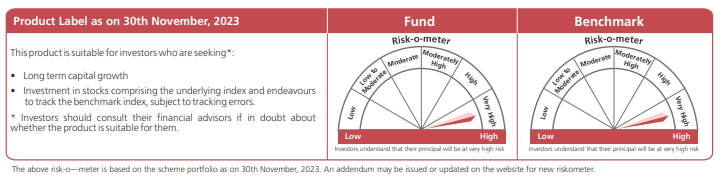

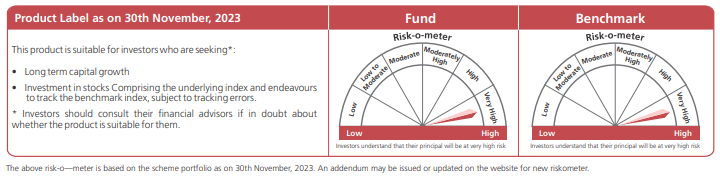

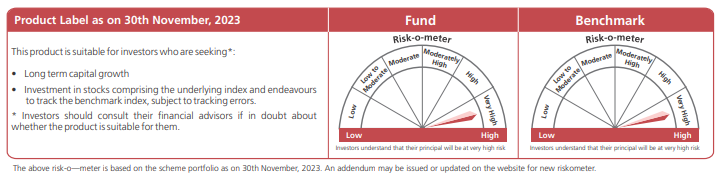

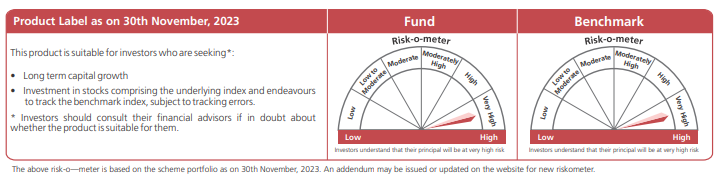

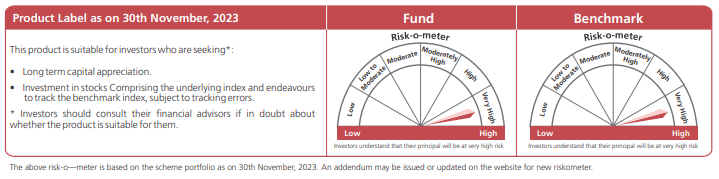

KOTAK NIFTY BANK ETF

An open-ended scheme replicating/ tracking nifty bank index

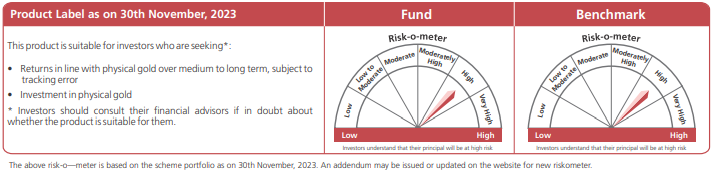

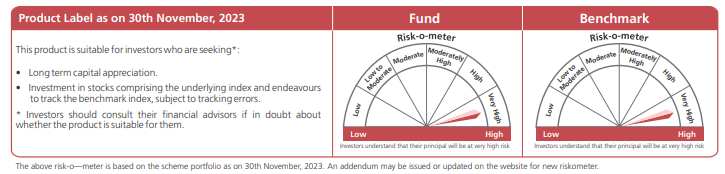

KOTAK GOLD ETF

An open-ended scheme replicating/ tracking physical gold prices

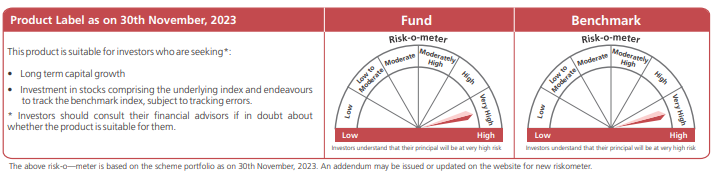

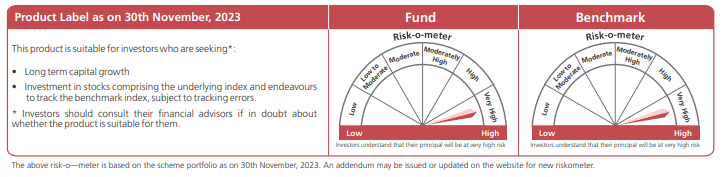

KOTAK NIFTY 50 ETF

An open-ended scheme replicating/ tracking nifty 50 index

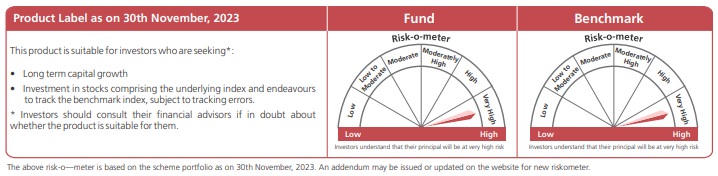

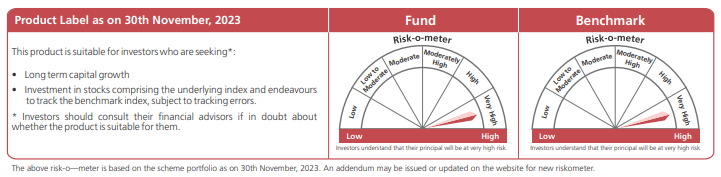

KOTAK NIFTY PSU BANK ETF

An open-ended scheme replicating/ tracking nifty PSU bank index

KOTAK NIFTY IT ETF

An open ended scheme replicating/ tracking NIFTY IT Index

KOTAK NIFTY ALPHA 50 ETF

An open ended scheme replicating/tracking NIFTY Alpha 50 Index

KOTAK NIFTY 50 VALUE 20 ETF

An open-ended scheme replicating/ tracking nifty 50 Value 20 index

KOTAK S&P BSE SENSEX ETF

An open-ended scheme replicating/ tracking S&P BSE Sensex index

KOTAK NIFTY MIDCAP 50 ETF

An open ended scheme replicating/tracking NIFTY Midcap 50 Index

KOTAK NIFTY 100 LOW VOLATILITY 30 ETF

An open ended scheme replicating/tracking NIFTY 100 Low Volatility 30 Index Fund

KOTAK NIFTY INDIA CONSUMPTION ETF

An open ended scheme replicating/tracking NIFTY India Consumption Index

KOTAK NIFTY MNC ETF

An open ended scheme replicating/tracking NIFTY MNC Index

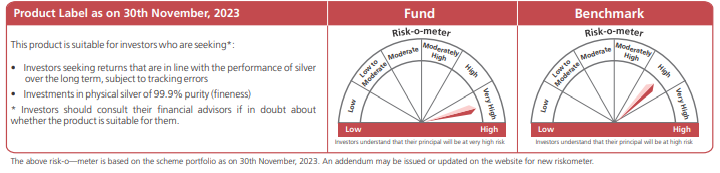

KOTAK SILVER ETF

An open ended Exchange Traded Fund replicating/tracking price of Silver

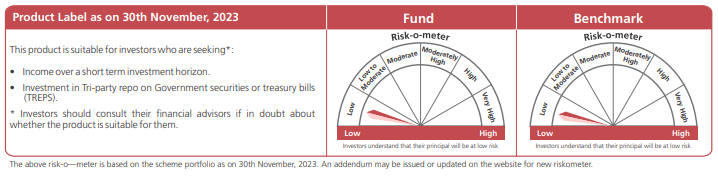

KOTAK NIFTY 1D RATE LIQUID ETF

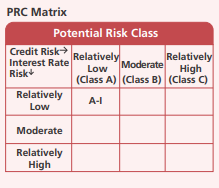

An open ended Exchange Traded Fund replicating/tracking NIFTY 1D Rate Index. A Relatively Low Interest Rate Risk and Relatively Low Credit Risk.

*Please note the list is not an exhaustive list and there may be certain additional documents which can be requested for which shall vary on case to case basis.

These materials are not intended for distribution to or use by any person in any jurisdiction where such distribution would be contrary to local law or regulation. The distribution of this document in certain jurisdictions may be restricted or totally prohibited and accordingly, persons who come into possession of this document are required to inform themselves about, and to observe, any such restrictions. Investors may consult their financial advisor(s) and/or tax advisor(s) before making any investment decisions. Investors should make any investment decision only as per their risk appetite. Investors should read the Scheme information documents carefully before making any investment decision. Investors should read and understand the prevalent laws and regulations that would be applicable before making any decision. Investors should consider the prevalent laws and regulations before/while making any investment decision. Kotak Mahindra Asset Management Company Limited/ Kotak Mutual Fund is not guaranteeing or promising or forecasting any returns/ future performances. The past performance may or may not be sustained in future, and is no guarantee of any future results.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY